The "Mobile Imaging Services - Global Market Trajectory & Analytics" report has been added to ResearchAndMarkets.com's offering.

Global Mobile Imaging Services Market to Reach $2.2 Billion by 2026

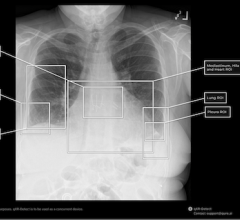

Mobile radiology represents a transforming concept that is evolving rapidly in line with notable advancements in the point-of-care (POC) testing arena. By wrapping digital X-ray capability into a mobile cart or portable system, the concept allows medical professionals to perform imaging examinations almost anywhere, including at patient bedside. The functionality incorporated into a mobile and compact footprint facilitates seamless examinations and accelerates the imaging turnaround to ensure faster diagnosis and treatment-related decision. The increasing acceptance of these mobile radiology units in clinical and other settings is anticipated to empower people and help healthcare providers in monitoring and managing patient health in an efficient manner. The mobile radiology trend is anticipated to receive a considerable push from increasing focus on point-of-care testing and ongoing advances in this direction. The concept is expected to play an important role in complementing traditional imaging practices and enabling users to perform a large number of radiology examinations in an effective way.

Amid the COVID-19 crisis, the global market for Mobile Imaging Services estimated at $1.7 Billion in the year 2020, is projected to reach a revised size of $2.2 Billion by 2026, growing at a CAGR of 4.5% over the analysis period. X-ray, one of the segments analyzed in the report, is projected to grow at a 4.1% CAGR to reach US$783.6 Million by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Ultrasound segment is readjusted to a revised 4.3% CAGR for the next 7-year period. This segment currently accounts for a 22.6% share of the global Mobile Imaging Services market.

The increasing acceptance of these mobile radiology units in clinical and other settings is anticipated to empower people and help healthcare providers in monitoring and managing patient health in an efficient manner.

The mobile radiology trend is anticipated to receive a considerable push from increasing focus on point-of-care testing and ongoing advances in this direction. The concept is expected to play an important role in complementing traditional imaging practices and enabling users to perform a large number of radiology examinations in an effective way.

X-ray, one of the segments analyzed in the report, is projected to grow at a 4.1% CAGR to reach $783.6 Million by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Ultrasound segment is readjusted to a revised 4.3% CAGR for the next 7-year period. This segment currently accounts for a 22.6% share of the global Mobile Imaging Services market.

The U.S. Market is Estimated at $542 Million in 2021, While China is Forecast to Reach $260.8 Million by 2026

The Mobile Imaging Services market in the U.S. is estimated at $542 Million in the year 2021. The country currently accounts for a 30.63% share in the global market. China, the world second largest economy, is forecast to reach an estimated market size of US$260.8 Million in the year 2026 trailing a CAGR of 5.8% through the analysis period.

Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 3.8% and 4.3% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 3.3% CAGR while Rest of European market (as defined in the study) will reach $276.9 Million by the end of the analysis period.

Continuously and rapidly evolving changes in global healthcare are helping mobile imaging services worldwide to become more popular and in their increased adoption throughout the global healthcare industry. The principal reason behind this is that mobile imaging seeks to provide comprehensive EKG, ultrasound, and X-Ray services to medical facilities, businesses, and homes directly.

Moreover, they are faster and generally cheaper when compared to third-party alternatives and take the excessive workload off overburdened in-house units for imaging. Furthermore, such mobile services can be seamlessly integrated into all existing services without any additional overhead cost. All leading players in the market for mobile diagnostic imaging have started developing mobile versions of all imaging modalities, be it X-ray, ultrasound, CT, PET, or MRI.

Such devices are hugely helpful in the emergency rooms of hospitals, as they allow immediate examination without having to remove a patient, thereby saving considerable time, especially in critical cases. Smaller hospitals too, stand to benefit from them in their ICUs ad because of lower throughput.

CT Segment to Reach $363.1 Million by 2026

In the global CT segment, USA, Canada, Japan, China and Europe will drive the 4.3% CAGR estimated for this segment. These regional markets accounting for a combined market size of $232.1 Million in the year 2020 will reach a projected size of $310.8 Million by the close of the analysis period.

China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach $33.1 Million by the year 2026.

For more information: https://www.researchandmarkets.com/reports/5140639

March 06, 2026

March 06, 2026