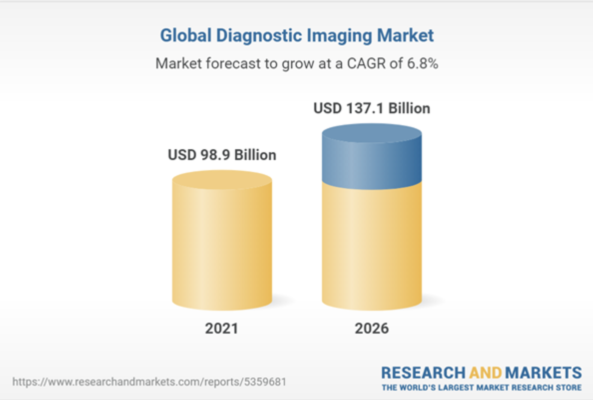

February 21, 2022 — The global diagnostic imaging market is projected to reach $35 billion by 2026 from $26.6 billion in 2020, at a CAGR of 5.7% from 2021 to 2026.

The growth of this market is primarily driven by the increasing demand for early disease diagnosis and widening scope of clinical applications, rapidly growing geriatric population and the subsequent increase in the prevalence of associated diseases, technological advancements in the diagnostic imaging industry, and increasing investments, funds, and grants by public-private organizations.

However, the high cost of diagnostic imaging systems, technological limitations associated with standalone systems, declining reimbursements and increasing regulatory burden in the US and the shortage of helium availability are expected to limit market growth to a certain extent.

The CT Scanners market segment accounted for the largest share of the global diagnostic imaging market in 2020

Based on product, the diagnostic imaging market is broadly segmented into six segments - X-ray imaging systems, CT scanners, ultrasound imaging systems, MRI systems, nuclear imaging systems, and mammography systems. The CT scanners segment held the largest share of the global diagnostic imaging market in 2020.

The high growth of this product segment can be attributed to the growing demand for early and accurate diagnosis, high adoption of CT Scanners by hospitals and diagnostic centers across the globe. There has been a steady increase in the demand for CT scanners ever since the COVID-19 pandemic started.

CT of the chest plays an important role in diagnosing COVID-19; almost every patient needs a CT scan to monitor disease progression. Consequently, the rising demand for disease treatment has favored the CT scanners market, even with the deferred procedures.

The general radiography application of X-ray systems accounted to be the fastest market during the forecast period

Based on application, the diagnostic imaging market is segmented into the respective modalities viz., MRI systems, ultrasound systems, X-ray imaging systems, CT scanners, nuclear imaging systems, and mammography systems, and their respective applications.

Among the applications, the largest share in 2020 was accounted by cardiology under CT scanners, and brain & neurological MRI under MRI systems; radiology/general imaging under ultrasound systems; General radiography applications under X-ray imaging systems; and oncology under nuclear imaging systems.

General radiography applications under X-ray imaging systems application accounted for the largest market share among all application segments of the diagnostic imaging market in 2020.

Asia Pacific region expected to register the highest CAGR during the forecast period

The diagnostic imaging market is segmented into five major regions, namely North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific region is expected to register the highest CAGR during the forecast period. The increasing incidence of chronic diseases, growing awareness about the benefits of early disease diagnosis, improvements in healthcare systems, the flourishing medical tourism market in APAC countries, increasing government initiatives for modernizing the healthcare infrastructure, and the growing number of ongoing research activities related to the development of advanced diagnostic imaging modalities are some of the major factors driving market growth in this region.

For more information: www.researchandmarkets.com

February 17, 2026

February 17, 2026