March 11, 2014 — Countries across the globe are struggling to combat issues such as escalating healthcare costs, poor or inconsistent quality of healthcare, rapid expansion in healthcare insurance and changing healthcare reform mandates. Growing consumerism, globalization, changing demographics and lifestyles, and growing incidences of diseases that are expensive to treat further exacerbate these. Resolving these issues is a daunting task faced by healthcare stakeholders, highlighting the need for proactive, collaborative and systemic models. Several initiatives and healthcare reforms have been developed in order to support the adoption and implementation of clinical decision support software (CDSS) solutions.

An integrated electronic health record (EHR) solution with CDSS and computerized physician order entry (CPOE) is estimated to be a high growth segment over the next five years. Growing demand for integrated CDSS with EHR and CPOE is attributed to its ability to meet the needs of clinicians, from retrieving patient data to triggering alerts and reminders. Furthermore, the system helps to reduce the number of cases of medication errors.

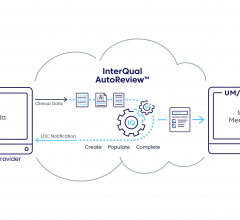

For the healthcare industry, cloud computing has emerged as an efficient model to deliver various IT solutions. It enables the management and migration of huge amounts of data, helps in saving costs, offers anytime access from multiple mobile devices, provides large backup data storage capability and offers ease-of-use. In terms of security, public cloud computing services are preferred in the healthcare industry, to meet HIPAA compliance. The growth in popularity and benefits offered by cloud computing have encouraged healthcare stakeholders to invest in this model for the delivery CDSS solutions. Owing to these factors, this segment is expected to be a major revenue pocket for the CDSS market in the coming years.

Countries such as China, India, Singapore, and Australia will also offer potential growth opportunities to CDSS stakeholders. Saudi Arabia and Brazil will also emerge as lucrative markets for CDSS vendors. In Saudi Arabia, various favorable government initiatives are focusing on strengthening healthcare services such as the e-Health program. The e-Health projects are aligned with the predefined goals of the Ministry of Health, which has made it mandatory to implement information communication technology (ICT) in the country's healthcare system. Similarly, the Brazilian government has launched a series of initiatives such as Prosoft, and Lei-de-Informatica and Renuncia Fiscal, to foster and promote clinical IT solutions. Improving financial support from government, coupled with various initiatives, is a significant factor providing impetus to the CDSS market growth.

Meditech dominates the global clinical decision support system market, followed by Zynx Health, Cerner Corp., McKesson Corp. and Epic.

From an insight perspective, this research report focuses on the qualitative data, market size, share, and growth of various segments and sub-segments, competitive landscape and company profiles. The qualitative data covers various levels of industry analysis, such as market dynamics (drivers, restraints, opportunities and threats), porter's five forces analysis and market share analysis based on cumulative installation, globally. The report also offers market shares, sizes and related growth of various segments in the industry. It also focuses on the emerging and high-growth segments of CDSS (integrated CDSS solutions and knowledge-based CDSS solutions), high-growth regions, countries and the initiatives of their respective governments.

The grey area while estimating the market size is the complex structure of CDSS solutions as it is composed of three parts. Of the three parts, a few parts are offered by third-party vendors, which increase the difficulty level while understanding the structure of CDSS solutions.

The competitive landscape covers the growth strategies adopted by industry players in the last three years. The company profiles comprise the basic views on the key players in the CDSS market and the product portfolios, developments, and strategies adopted by market players to maintain and increase their market shares in the near future. The above-mentioned market research data, current market size and forecast of future trends will help the key players and new entrants to make the necessary decisions regarding product offerings, geographic focus, change in strategic approach, R&D investments for innovations in products and technologies and levels of output in order to remain successful.

For more information: www.reportlinker.com

May 22, 2024

May 22, 2024