Greg Freiherr has reported on developments in radiology since 1983. He runs the consulting service, The Freiherr Group.

Mid-tier Innovation: Flash in the Pan or Wave of the Future

Radiology may have happened upon a new kind of pragmatism, one coming from the ground up.

New imaging products with innovative technologies made to satisfy specific needs are being developed — and they are being introduced at the mid-tier. This is a marked change from the old school approach whereby cutting-edge technologies, introduced at the highest end of the product line, were ported over time to lower — and less expensive — tiers.

This is not to say that “trickle down” no longer feeds product portfolios. It most certainly does. Technologies once found just at the premium or super premium end of a vendor portfolio are appearing at lower tiers, just as they have for decades.

It’s just that R&D has become more ... open minded. The reason may be the acute need for solutions that only sophisticated technologies can satisfy, a need created by a confluence of value-based medicine and provider consolidation.

Lightning Strikes

It is akin to the debate about whether lightning travels from the sky to the ground or from the ground up. The answer: It does both. Which one depends on environmental conditions of the moment.

Radiology’s focus on practical considerations has led vendors to do much the same — migrate technologies from the top down, as has long been the case, and innovate at the mid-tiers.

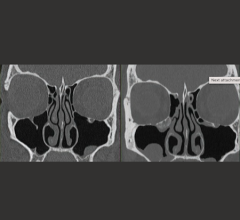

Product families commonly have members with distinctly different capabilities, even when those capabilities address a similar goal. Take GE’s Revolution computed tomography (CT) family. Low-dose scanning is possible with each member. But the algorithms for its achievement vary considerably. GE, which years ago pioneered iterative reconstruction, once offered it only at the premium end. But it now appears throughout the Revolution CT family. Yet, true to the “trickle-down philosophy,” the premium end still benefits from the most powerful algorithm, as different family members sport algorithms of varying complexity and horsepower.

Putting a twist on the old school approach is Toshiba’s Aquilion One, a family of scanners built at the premium end of the spectrum. Volumetric scanning once found only at the top of the product hierarchy has trickled throughout the three versions of this family. Aquilion One 320 delivers 320 slices per rotation, the low end of volumetric scanning. The other two family members deliver 640 slices. (At the high end, the ViSION offers faster rotation and a more powerful generator than the Aquilion One 640.)

Typifying the markedly different “bottom up” R&D is Siemens’ Somatom go family. Rather than start at the top and work its way down, Siemens has introduced mid-tier CT products — the 32-slice Somatom go.Now and 64-slice Somatom go.Up. FDA-cleared since April, the two scanners feature miniaturized hardware otherwise sited in the control room and built it into the scanner gantry. Including a shielded niche as part of the installation, Somatom go can make the control room passé. This frees up space. (The technologist operates the CT with a gantry-mounted computer tablet that can be carried about.) Standardized — and automated — workflows built into the tablet promise results and increased reproducibility among exams that are quicker and more efficient exams.

A Future Unlike The Past?

The underlying R&D approach bucks tradition. Only time will tell if it catches on. But it bears watching.

CT is being buffeted by a number of different and conflicting technological and economical issues. The number of slices once defined performance — and, therefore, the appeal — of a scanner. But radiology has come to recognize that more than 64 slices is needed for mainstream applications.

Mid-tier scanners, optimized for efficiency and cost-effectiveness, therefore, seem perfectly suited to the needs of value-based medicine, defined as “safe, appropriate and effective care with enduring results, at reasonable cost” care that accounts for patient “wishes and preferences.” Siemens’ two new CTs appear to serve both cost control and increased patient satisfaction. They promise to satisfy the mainstream needs of a radiology department and make patient handling more efficient.

Installed wisely, their increased efficiency promise to make patients happier by reducing wait times in the near- and long-term. The ability to handle more patients each day cuts delays in scheduling, as it boosts revenue.

Innovation at what has come to be considered mid-tier (32 to 64 slices), therefore, may be what radiology most needs in a value-based world. Determining whether this is so or not may be a trend that has had a major impact on healthcare in the U.S. — the consolidation of providers.

IHN Revolution

Provider consolidation has bred integrated health networks (IHNs), which today own or are affiliated with most U.S. hospitals and group practices. Regardless of whether mid-tier products appear due to trickle-down engineering or as the vanguards of a new family, the potential value for IHNs is the same. Like ripples traveling outward, each new product can benefit IHNs, if the low-cost, high-efficiency products are used strategically and tactically. While mid-tier CTs might not establish the credentials for a provider to handle the most difficult cases, they can deliver high-quality images for routine procedures performed at high-traffic departments and centers.

If the unique R&D approach exemplified by Somatom go catches on, might it spur similar ones? Possibly in other modalities? Or is it peculiar to the unique circumstances of CT? Thinking outside the box might radically change equipment R&D and with it, the way technology is dispersed and used.

February 06, 2026

February 06, 2026