Meyersdale Medical Center purchased Siemens SOMATOM Emotion 16-Slice CT scanner this year. The systems small footprint allowed it fit into the centers imaging room without any expansions the scanner accommodates patients that weigh up 440 pounds, incre

With the election of a new president and Congress, not to mention a tumultuous economy, medical imaging, just like many other medical sectors, faces uncertain times going in to 2009.

Recent reports released from IMV Medical Information Division Inc., a market research consulting firm specializing in medical imaging, points to decreased growth in the magnetic resonance imaging (MRI) market and a decrease in the computed tomography (CT) market in 2008. Yet, 2009 should see an improved MRI and CT market among smaller, rural hospitals.

Tough times

While clinicians utilize CT scans more than ever in terms of volume, this didn’t translate to increased spending to replace older CT systems in 2008.

A March 2008 report released by IMV showed the proportion of CT sites having zero dollars budgeted for CT scanners increased from 51 to 83 percent from 2000 to 2008, despite the fact that 68.7 million CT scans were performed in 2007, an increase from 50.1 million in 2003. This represents an annual growth rate of around 8 percent per year.

The procedure rate for MRI increased only 3 percent per year from 2003 (24.2 million scans) to 2007 (27.5 million scans) said a June 2008 IMV report, down from 1999-2003, when the average annual growth rate of MRI scans was around 15 percent. The precertification requirements from health insurers and the advent of the Deficit Reduction Act (DRA) of 2005 were the primary causes for the drop in growth rate.

“The imaging market is not the ‘go-go’ market now,” said Lorna Young, senior director, market research at IMV. “Both the government and the insurance companies try to reduce their healthcare payments, which is causing constriction on the market.”

The DRA essentially lowered reimbursement rates for stand-alone imaging centers starting in 2007 by capping the outpatient prospective payment system (OPPS), which ultimately reduced fees for several imaging tests, according to a September 2008 Government Accountability Office (GAO) report. The GAO report found that nearly all CT and MRI tests were paid at the lower OPPS rates.

While the DRA didn’t affect hospitals, over 1,100 independent imaging centers closed, according to some estimates.

“The DRA did reduce growth opportunities for the imaging manufactures,” Young said. According to a July 2008 IMV report, just 4 percent of hospitals with over 400 beds plan to acquire 1.5T MRI scanners in 2009, while 13 percent plan on purchasing 64-slice (or higher) CT systems. No hospital over 400 beds planned on purchasing 16-slice CT systems in 2009. “The average expenditures for 2009, when you pull it all together, are going to be less than 2008 for all hospitals,” Young said.

Shining star

While large hospitals’ capital budgets are tight, rural hospitals are looking to ramp up capital spending going into the new year. It may sound counter-intuitive that rural hospitals would be looking to increase capital spending in a tough economy, in addition to inherent financial issues associated with smaller hospitals, but IMV projects more spending on MRI and CT from smaller hospitals in 2009.

Seventeen percent of hospitals with under 100 beds plan on purchasing a 1.5T MRI system in 2009, according to the July IMV report. The percentage looking to purchase 1.5T MRI in 2009 increased to 22 percent for hospitals from 100-199 beds. These are 11 and 17 percent increases from 2008, respectively.

Fifteen percent of hospitals with under 100 beds are looking to purchase 64-slice (and over) CT scanners, according to the July IMV report, while 25 percent of hospitals from 100-199 beds and 30 percent of hospitals from 200-399 beds are looking to purchase a CT 64-slice. Twelve percent of hospitals under 100 beds are looking to purchase 16-slice CT systems.

“Rural hospitals are always facing financial challenges,” said Alan Morgan, CEO, National Rural Health Association. “That’s just part of the environment. But, with the enhancements in the Medicare program for these hospitals, across the board, they are doing okay right now. It seems like the hospitals are looking to expand the services they offer their communities and improve the quality of services they’re giving.”

One of the primary reasons, according to Morgan, is that Critical Access Hospitals (CAH) — defined by Medicare as hospitals with 25 or less beds in a rural area located at least 35 miles from the next closest hospital, among other criteria — serve disproportionate numbers of patients covered under Medicare and Medicaid. CAHs get high reimbursement rates from Medicare because they are a critical resource in the communities they are serving, according to Young. They are also exempt from the Present on Admission (POA), a new way in which hospitals must claim payments, according to the Centers for Medicare and Medicaid Services (CMS). Starting Oct. 1, 2008, CMS implemented payment reductions for select complications that occurred during the patient stay.

According to Morgan, these hospitals are making it a priority to keep local residents from finding new healthcare facilities.

“They want to keep their patients there locally,” Morgan said. “They ask ‘how do we keep our patient base in our local community?’ Being able to add [a new CT or MRI system] gives that additional leverage to make sure that rural hometown health is being delivered locally and that they are able to capture and contain their market.”

Even with a sluggish economy, Morgan hasn’t seen many indications that rural hospitals are being negatively affected. “It certainly does not appear there is a slowdown in improving their facilities or the services they offer,” Morgan said. “I’ve not seen an impact. We’ve had significant time to have the high gas prices, the food prices and everything else that would impact healthcare facilities and it hasn’t taken a toll yet on rural hospitals.”

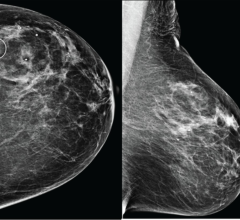

One example of a CAH adding a CT system to better serve its area is Meyersdale Medical Center in Meyersdale, PA.. The center, located in southwestern Pennsylvania, purchased a Siemens SOMATOM Emotion 16-Slice CT scanner this year as an upgrade from their single-slice CT. The SOMATOM Emotion has allowed Meyersdale to perform more complex CT exams, notably CT angiography and pulmonary embolism chest scans, allowing the center to treat local residents who may have been forced to travel up to 40 miles away for those scans before, said Siemens Medical Solutions. Meyersdale is now performing 20 more CT scans per month, resulting in an increased referral pattern and a 35 percent increase in gross charges.

Morgan believes any Medicare cuts made by a new Congress wouldn’t effect rural hospitals in 2009. “Anything Congress might do won’t impact the market until 2010,” Morgan said. “My perception is [rural hospitals] are looking to upgrade now.”

February 09, 2026

February 09, 2026