Getty Images

The MarkeTech Group and The Association for Medical Imaging Management (AHRA) collaborated on the creation of the Medical Imaging Confidence Index (MICI) based on the belief that measuring the confidence of U.S. medical imaging administrators on a regular basis would provide a valuable index for those having an interest in this industry. The MICI panel consists of a select group of imagePRO panel members from around the U.S. representing different hospital sizes and geographic locations to capture a true “industry outlook”: how imaging administrators see the future of medical imaging in regard to revenues, costs, purchasing, and growth.

A group of 161 imaging directors/managers of hospitals completed a 3-minute web survey regarding their perception of medical imaging trends for the third quarter of 2020. They were asked to rate their level of confidence on several industry topics, on a range between 0 to 200.

The score interpretation is as follows:

- Below 50 is extremely low confidence

- 50 to 69 is very low confidence

- 70 to 89 is low confidence

- 90 to 110 reflect an ambivalent score (Neutral)

- 111 to 130 is high confidence

- 131 to 150 is very high confidence

- Anything above 150 is extremely high confidence

Confidence Remains High in Growth as Profit Center

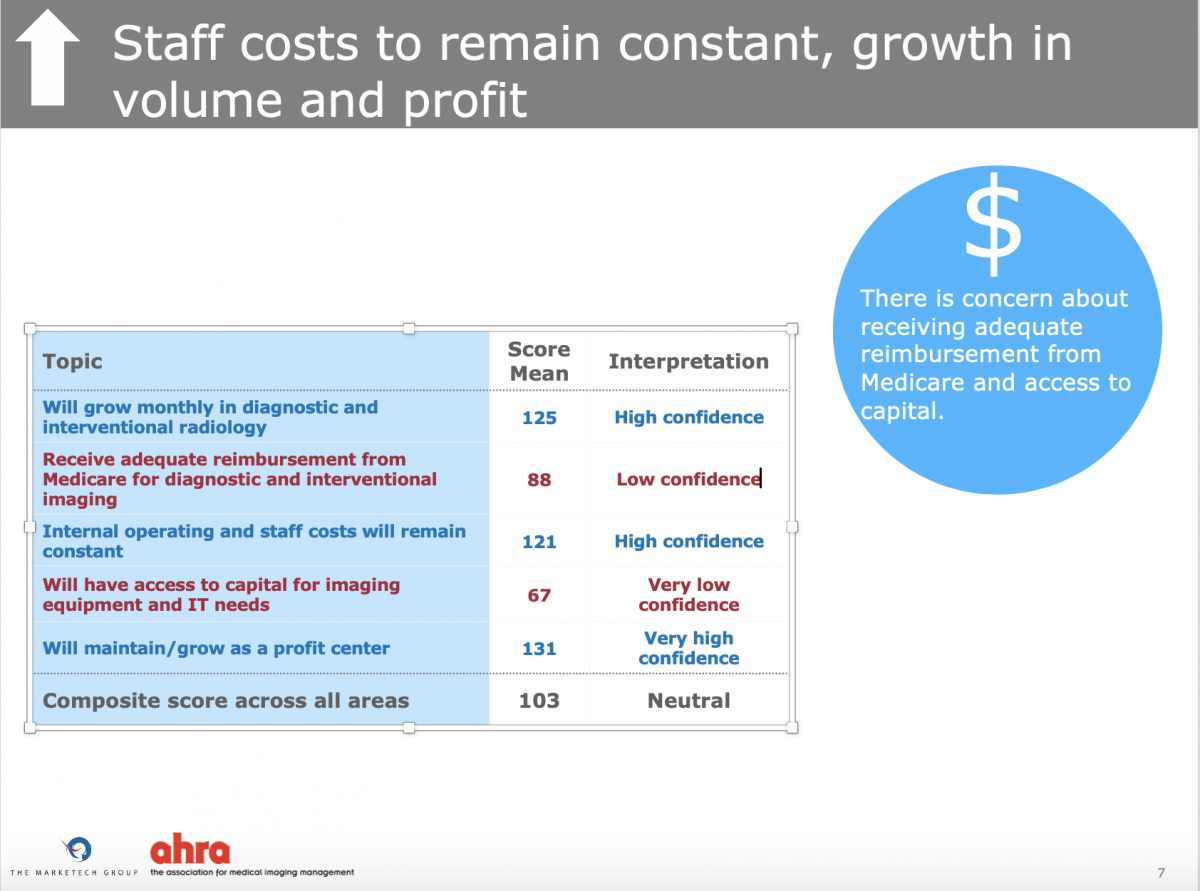

There is concern about receiving adequate reimbursement from Medicare and access to capital. When asked if staff costs will remain constant, as well as growth in volume and profit, the majority of respondents had a neutral response. See Figure 1.

Figure 1.

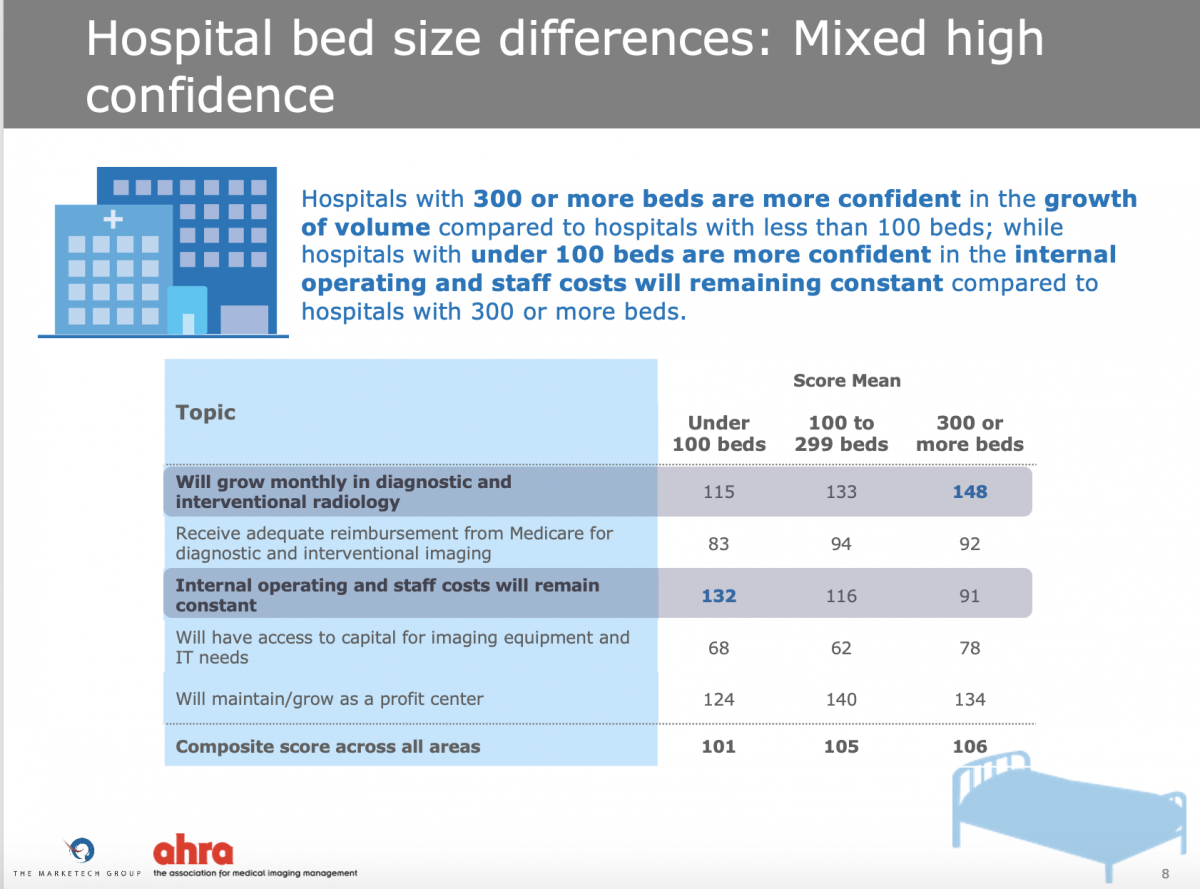

Hospitals with 300 or more beds are more confident in the growth of volume compared to hospitals with less than 100 beds; while hospitals with under 100 beds are more confident in the internal operating and staff costs will remaining constant compared to hospitals with 300 or more beds. See Figure 2.

Figure 2.

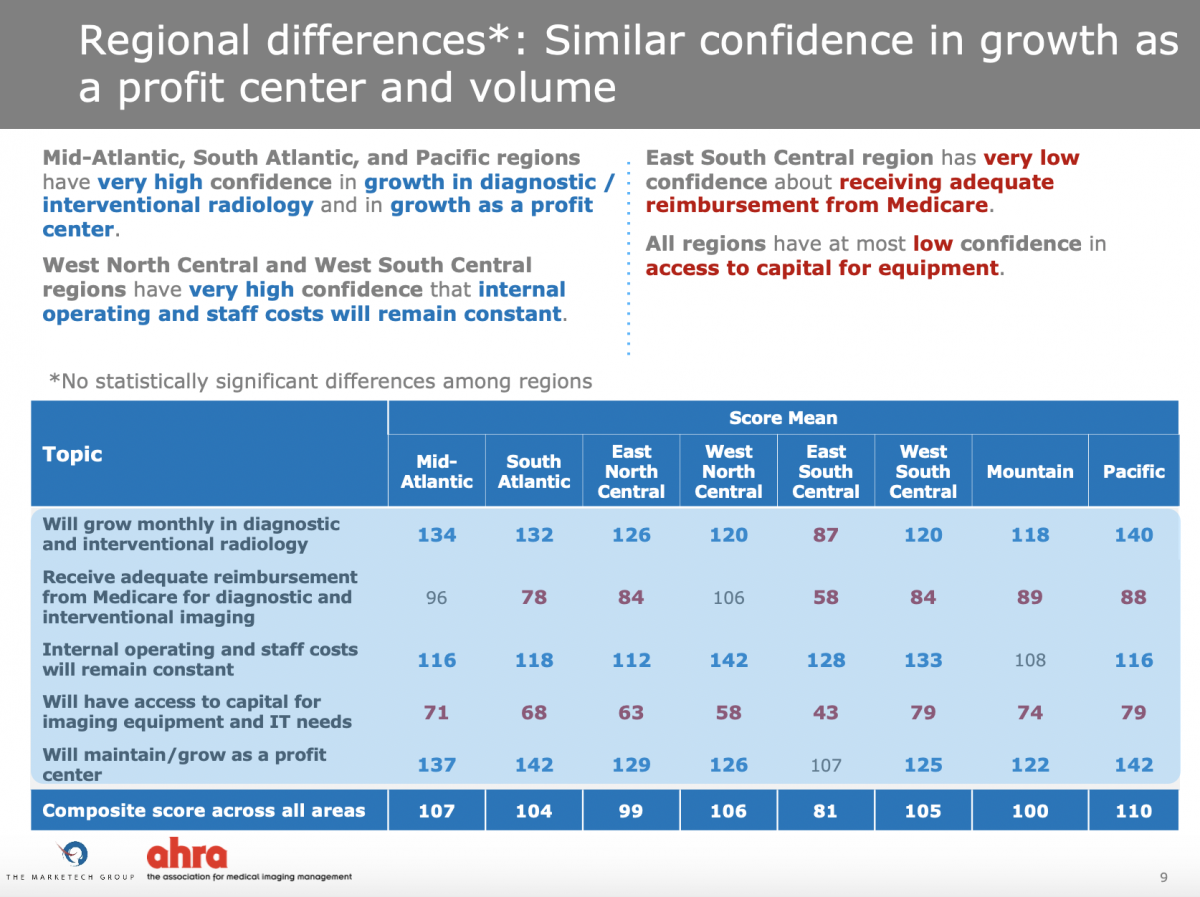

The four geographic regions have similar confidence in growth as a profit center and volume. Mid-Atlantic, South Atlantic and Pacific regions have very high confidence in growth in diagnostic/interventional radiology and in growth as a profit center.

West North Central and West South Central regions have very high confidence that internal operating and staff costs will remain constant. East South Central region has very low confidence about receiving adequate reimbursement from Medicare. All regions have at most low confidence in access to capital for equipment. See Figure 3.

Figure 3.

A Mix of Confidence and Concern

In summary, there is very high confidence in the facility growing as a profit center; and high confidence in the growth of diagnostic and interventional radiology and staff costs remaining constant. There is concern about receiving adequate reimbursement from Medicare and having access to capital.

Hospitals with 300 or more beds are more confident in growth of diagnostic/interventional radiology than hospitals with less than 100 beds. Hospitals with less than 100 beds are more confident in internal operating and staff costs will remaining constant than hospitals with 300 or more beds.

The Mid-Atlantic, South Atlantic and Pacific regions have very high confidence in growth as a profit center and in volume. West North Central and West South Central regions have very high confidence that staff costs will remain constant. All regions have at most low confidence in access to capital for equipment. East South Central region has very low confidence about receiving adequate reimbursement from Medicare.

Related Industry Trends Content:

Imaging Volumes Continue to Improve Post COVID-19 Closures

March 09, 2026

March 09, 2026