Fast, easily accessible patient images are crucial in this day and age, as imaging and medical records take on a new meaning during the COVID-19 pandemic. This has put a spotlight on picture archiving and communication systems (PACS), securing its growth and sustainability in this industry.

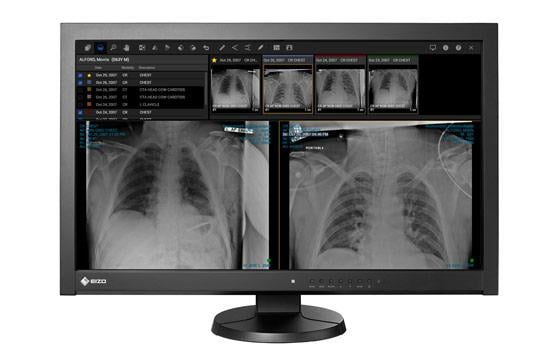

PACS imaging technology provides storage and easy access to images from various modalities such as ultrasound, X-ray, magnetic resonance imaging (MRI), nuclear medicine and computed tomography (CT), and allows hospitals, medical centers and clinics to easily capture, view, store and share images both externally and internally.

The research firm Technavio has been monitoring the picture archiving and communication system market, and stated in its most recent report, Global Picture Archiving and Communication System Market 2020-2024,¹ that it is poised to grow by $1.17 billion during 2020-2024, progressing at a compound annual growth rate (CAGR) of almost 6 percent during the forecast period. The analysts expect the market to grow by a CAGR of 5.75 percent through 2024.

The report also states that the increasing demand for mobile PACS — now more than ever — will offer immense growth opportunities as healthcare providers around the world try to navigate through this unprecedented time in history. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments while maintaining their positions in the slow-growing segments. This study identifies the increasing adoption of PACS by small hospitals and imaging centers as one of the primary reasons driving PACS market growth during the next several years.

Currently, the market is segmented based on geography as well as product. According to Technavio analysts, this includes sub-segments such as mini-PACS, mid-end PACS and enterprise PACS. The report states that the emergence of cloud-based PACS will be one of the key driving forces in the market through 2024, and is expected to have a major impact on this market.

Utilizing PACS Technology to Fight COVID-19

In March, PACS provider Image Information Systems launched a diagnostic imaging learning platform for coronavirus cases. Studies have shown that COVID-19 can be detected by chest computed tomography (CT) scans even before the first symptoms begin to show. CT scans are important to monitor the disease and to help predict the outcome. However, this requires a certain level of experience and training that is rarely seen when dealing with a novel virus. A newly created website, www.disAIblecorona.com, helps fill this void by providing the radiology community with scientific medical imaging facts about COVID-19 and the latest in coronavirus-related information. It includes a dedicated learning area with full cases, offering the radiology community a forum to build and share anonymous coronavirus cases from around the world.

Quick capture of POCUS images. Hyland Healthcare recently launched PACSgear Enterprise — the latest version of the PACSgear server software, which supports the advanced capture and connectivity modules of the PACSgear platform. Accessible through a web-based, thin-client user interface, PACSgear Enterprise supports multiple servers and provides a single platform for all enterprise imaging capture activities, allowing clinicians to quickly capture point-of-care images from anywhere and automatically link them to a patient’s electronic medical record (EMR).

A timely application of PACSgear is the use of PACSgear Image Link and Encounter Workflow. With this module, clinicians can quickly capture point-of-care ultrasound images in the emergency department or other care locations — including temporary locations — as long as there is system connectivity. The images are automatically sent to the PACS or vendor neutral archive (VNA) and linked to the patient’s record in the EMR. This gives radiologists the ability to review the image remotely from the PACS or VNA with an enterprise viewer.

Mobile diagnostic image review. In April, the U.S. Food and Drug Administration (FDA) cleared Intelerad’s InteleConnect EV solution for diagnostic image review on a range of mobile devices. This comes at a critical time for healthcare systems and ensures that radiologists are able to collaborate and leverage resources in more creative ways, even when workstation access is not available. It also is approved for mobile diagnostic image review, and can immediately be used on various iPad and iPhone models, with additional devices on the horizon.

The ability to review images and collaborate with clinical staff through diagnostic radiology is key, epecially during this current crisis, to ensuring the best possible patient outcomes with easy transmission of data. With mobile access to diagnostic quality images, radiologists now have the flexibility to collaborate anywhere at any time.

Reference:

1. Picture Archiving and Communication System Market 2020-2024, Technavio Research. www.businesswire.com/news/home/20200506005628/en/COVID-19-Impact-Recovery-Analysis-Picture-Archiving-Communication. Accessed May 11, 2020.

February 24, 2026

February 24, 2026