Getty Images

One of the components of Signify Research’s Machine Learning in Medical Imaging service is the Product Developments and Technology Trends report which considers some of the most impactful currents in medical imaging AI. The trends discussed in the report are set to shape the future of the AI market for the coming years, particularly as the use of machine learning in medical learning is at a pivotal point. While still a young sector, it is growing rapidly, with both technology maturing and use cases and clinical implementations becoming clearer. Medical imaging AI is becoming a higher priority for both providers and vendors alike, which is enabling some AI outfits to strike increasingly large deals and establish leadership positions. Facilitating these changes are several key aspects of medical imaging AI development.

The Transition Away from Point Solutions

In its current nascent state, the medical imaging AI market is characterized by its fragmentation. It is made up of a host of unproven start-ups, which have tended towards developing narrow AI tools which address a specific problem. However, radiologists still need to review an image to identify other potential findings, limiting the benefits offered by point solutions, and we have started to see these narrow AI algorithms evolving to comprehensive solutions, end-to-end solutions and AI suites. However, there remains a significant market opportunity for narrow AI solutions addressing high value use cases, for example, fractional flow reserve computed tomography (FFR-CT), breast lesion detection or C-spine fracture detection. Most notable of these exceptions is FFR-CT, where a solitary measurement is all that is required. The specificity of its use is irrelevant given its ability to improve a patient’s care pathway and spare them from an invasive catheterization procedure.

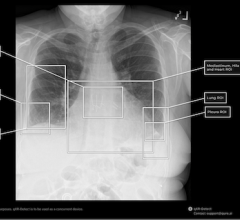

Comprehensive solutions, which detect greater numbers of findings for a given body area, aim to pick up incidental or secondary findings, reducing the likelihood of missed diagnoses. They can also identify other non-pathological findings (such as tube placements or anatomical positioning), removing the need for repetitive, multiple scans in certain instances. Comprehensive solutions are targeted at a given body area, and package together multiple native algorithms into a single solution, for example, chest X-ray solutions from Annalise.ai, Oxipit, Qure.ai and Lunit.

In parallel, we expect to see more end-to-end solutions, which address the scope of the clinical pathway beyond image analysis for specific conditions, such as oncology. For example, Aidence has added reporting capabilities to its nodule detection and quantification tools for lung cancer. End-to-end solutions aim to reduce the turnaround time for diagnosis to improve patient outcomes, such as stroke solutions that incorporate tools beyond ICH and LVO detection, including perfusion analysis, a mobile viewer application and a HIPPA-compliant secure messaging system to coordinate care teams to treat stroke patients.

AI suites are centered around a given use case, packaging together all the tools, including those beyond image analysis, that a radiologist would require to diagnose a particular condition or to prepare for a specific procedure. Imaging IT vendors are central to this, incorporating third-party AI image analysis tools alongside their native capabilities such as workflow tools, advanced visualization tools and radiology reporting tools.

As the medical imaging AI market matures, the distinction between these solutions (comprehensive solutions, end-to-end solutions and AI suites) will increasingly blur, and those that add the greatest value will emerge as leaders, whether they have been developed natively, or through partnerships with other vendors.

The Rise of Risk-based Screening

Risk-based screening is set to become more widely utilized in the coming years. At present, screening programs are often an effective, albeit relatively blunt tool. Risk-based screening programs will allow those most likely to be affected by a particular condition to be targeted and observed more closely. Those at a lower risk, on the other hand, will be spared unnecessary exams, allowing them to avoid additional radiation exposure, as well as other negative consequences, such as unneeded biopsies, for example. This stratified approach to screening will also save providers money, allowing them to focus their resources on those patients most likely to require them.

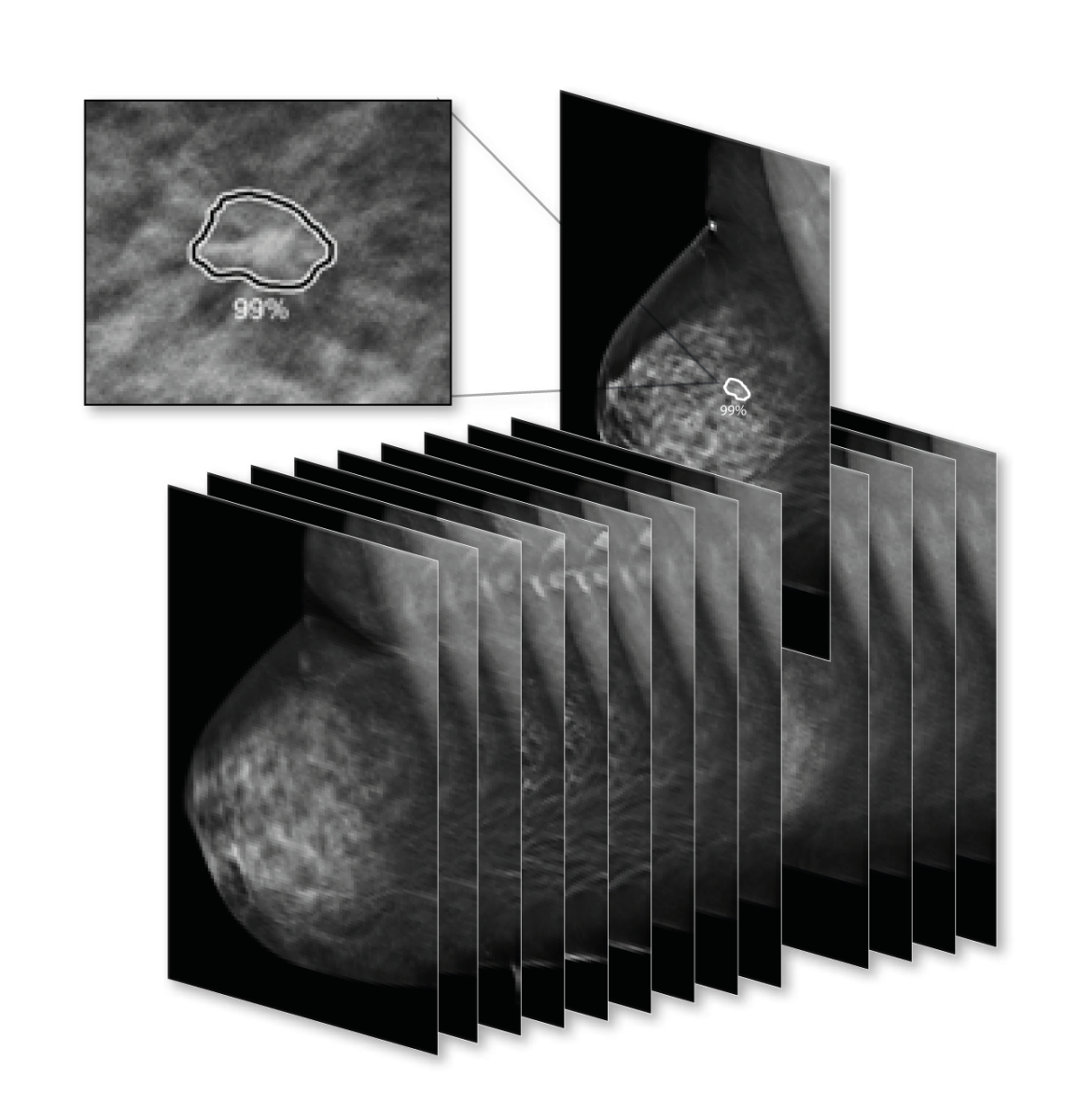

ProFound AI for DBT is a high-performance, deep-learning workflow solution trained to detect malignant soft tissue densities and calcifications. It became the first 3-D tomosynthesis software using artificial intelligence (AI) to be FDA cleared in December 2018.

Unsurprisingly given the prevalence of breast cancer screening, that is the area that has seen the most progress toward the adoption of risk-based screening programs. Breast imaging AI vendor iCAD was one of the first to develop an AI risk-based screening tool for breast cancer imaging. Its ProFound AI Risk solution takes into account breast density analysis and detection of subtle mammographic features, along with a patient’s age, to determine her risk of developing breast cancer. In the future the product is set to evolve and include an increasing number of risk factors in the tool’s calculation, such as demographic factors and genetic factors such as BRCA1 gene mutation. Risk-based screening tools for other areas of oncology, for example lung cancer, are likely to follow, tailoring these screening programs to high-risk populations.

As detailed in a previous Signify Premium Insight (Cleerly Scoops Millions for its Heart Health Solution), risk stratification is also set to become more widely adopted in other clinical areas, such as in cardiology. Presently, the lack of established screening programs in other areas hinders the utility of AI stratification tools outside of mammography, but longer-term it could be a lucrative direction for AI developers. To stand vendors in best stead for the future, partnerships with EHR vendors, which would enable them to utilize key patient data in their risk-prediction models, look sensible. In cardiology, this wealth of data, alongside quantification and characterization tools such as those offered by Cleerly, Artrya and Caristo Diagnostics, for example, will allow AI solutions to deliver great value to both clinician and patient.

AI Marketplaces are Becoming Platform-oriented

One of the barriers to increased AI adoption in medical imaging are the last mile challenges that healthcare providers face in implementing solutions into the workflow. These include factors like the selection and purchasing of applications, as well as deployment, integration and workflow orchestration. AI marketplaces coupled with AI platforms have addressed these challenges.

AI marketplaces grant providers easy access to a whole host of algorithms from a wide range of vendors (selection and purchase of AI solutions), with billing and contracting for all algorithms typically managed by the marketplace. While primarily focused on diagnostic tools, these marketplaces’ offerings have been evolving to better match the needs of providers, with several vendors expanding their marketplaces to include operational and analytics tools alongside their image analysis solutions.

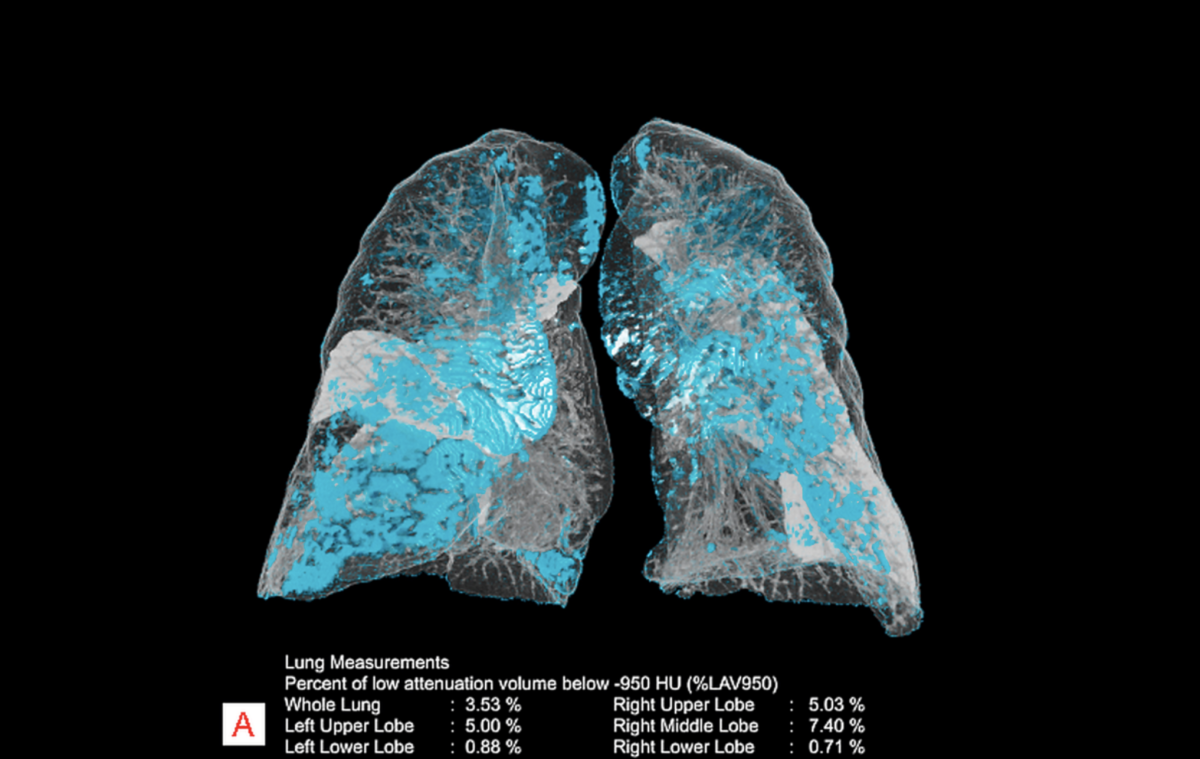

AI-Rad Companion Chest CT from Siemens Healthineers helps radiologists interpret CT images of the thorax faster and more precisely, and to document the findings in less time with the help of automatic measurements.

AI platforms deploy AI applications into the picture archiving and communication system (PACS) by one of two means: A docker platform to package and deliver container-based application services, for example Siemens Healthineers AI-Rad Companion; or a workflow engine, with dedicated servers or virtual machines for each application, for example, Agfa HealthCare’s RUBEE for AI platform. Once deployed, the AI applications are integrated (front-end) into the PACS user interface either by a custom integration or more loosely by using the algorithm/application vendor’s user interface. Some informatics vendors also provide a results viewer with their AI platform to interact with the AI results (to edit and/or accept or reject the AI findings).

AI platforms are central to the orchestration of AI algorithms and influence the performance and utilization of these algorithms, alongside the management of DICOM interface. They route images to the AI applications based on the study DICOM header, but some AI platforms may also use AI-detected features in addition to the DICOM header. Some platform vendors even provide metrics to show how the AI algorithms are utilized and how they perform on local imaging datasets.

As AI becomes more ubiquitous in radiology, it will be these AI platforms (and marketplaces) that truly enable it to scale.

A Strong Structure to Build On

Key to machine learning’s success in any discipline is the data that tools have at their disposal. In medical imaging AI, this foundational data will benefit from the rising prominence of structured reporting. The ability to convert AI findings and free-text reports into a structured report containing both data and information on the findings of interest will be key to maximizing the utility of medical imaging AI data. We have started to see structured reporting tools enter the market (for example, Smart Reporting and Nuance), but these offerings are somewhat limited and remain at the early stages of development. AI developers may consider releasing products themselves, although given the level of expertise and the required resource, their time may be better spent developing their core analysis products. Instead, partnership with a structured reporting specialist may prove to be a better strategy long term.

Before the potential of structured reporting can be realized, the technology will pass through several distinct stages. First, solutions will look to standardize medical imaging reports. This ‘the means of streamlining content of a radiological report’ uses grading systems as well as specific lexicons to improve the accuracy and generalizability of reports. Secondly, tools to facilitate this standardization, with IT-guided content generation, such as dropdown menus, pick lists and gap filling, being hallmarks of the change. As the market advances, true structured reporting, ‘the use of an IT-based means of importing and arranging medical content in the radiological report,’ will emerge.

This shift from standardized to true, structured reporting will be gradual, and is reliant on the development of more sophisticated tools, using technologies such as AI. Although such tools are available in some countries, overcoming the barriers such as radiologist culture and the lack of national or global standards for radiology reporting terminology, are necessary to standardize this. The rewards of such a transition are significant, however. True structured reporting solutions, which can assimilate data from multiple sources such as RIS, PACS, AV measurements, and even the output of AI solutions, and seamlessly, without intervention input data into the radiologist’s report could have a significant impact. Such tools will enable healthcare providers to utilize vast amounts of AI-detected radiographic features that may otherwise go unheeded.

Product Developments

Product developments are influencing the growth and evolution of the medical imaging AI market, and several key areas have been highlighted above. Narrow AI algorithms that address high value use cases (for example, FFR-CT) will remain viable offerings, but vendors with AI algorithms should consider evolving their products to comprehensive or end-to-end solutions, depending on the use case. Imaging IT vendors may also look to package native capabilities alongside third-party algorithms as AI suites or workflow packages.

Other areas where product developments will influence market growth are the development of risk-based screening tools (for example, for breast cancer screening), improving patient care. AI marketplace are increasingly being packaged together with AI platforms, which look to address the last-mile challenges of selecting, purchasing, deploying, integrating and orchestrating AI.

Finally, one of the more significant technology trends that will impact the medical imaging AI market in the coming years will be structured reporting. By automatically populating radiology reports with AI findings, as well as other key information in a structured manner without intervention from the radiologist, will significantly improving radiologists’ efficiencies, and ‘complete-the-loop’ in terms of reporting AI findings.

Sanjay M Parekh, Ph.D., is a senior market analyst for Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry.

March 06, 2026

March 06, 2026