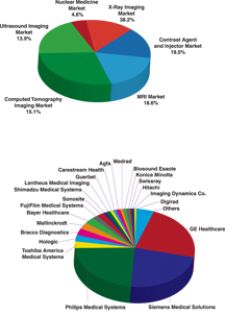

Medical Imaging Market by Segment, U.S., 2008.

Despite the current decline triggered by the Deficit Reduction Act (DRA), the U.S. medical imaging market is expected to recover by 2010. In 2008, the medical imaging market was valued at over $9.2 billion, growing at an associated CAGR of 4.2 percent by 2015. While this market is suffering from both a significant decline in reimbursement and the effects of an economic recession, technological advancements and new clinical applications continue to help drive the sales of medical imaging equipment.

X-Ray imaging

The U.S. X-ray market, including general analog, CR, DR, cardiovascular, fluoroscopy and mammography systems, was valued at over $2.6 billion in 2008. Digital technology is the main driving force behind this market. Within general X-ray, the analog market is declining the most, the digital radiography market is experiencing the highest growth and the computed radiography market is expected to remain flat. The digital mammography market is estimated to exhibit the highest growth in 2008 and the cardiovascular X-ray market is set to grow at a steady CAGR of 3.2 percent over the forecast period. While the use of fluoroscopy systems is increasing, the value of the market is being offset by a decline in price, causing it to remain flat. All segments aside from cardiovascular systems are expected to exhibit price declines throughout the forecast period. This downward price pressure is due to intensified competition and the high cost of the systems.

Magnetic resonance imaging

The overall MRI system market was valued at over $1.7 billion in the U.S in 2008. The MRI market was one of the most heavily affected by the DRA. This covers low-, mid- and high-field MRI systems, as well as open and intra-operative systems. As a result of the DRA, all markets, with the exception of intra-operative MRI, are expected to exhibit a decline in growth from 2007 to the end of 2009, as well as continuous declines in pricing throughout the forecast period. The reason why the intra-operative MRI market has avoided these pressures is that it is a niche market still in its early stages of growth. While the mid-field segment is by far the largest MRI market, there is a definite trend toward high-field systems. The low field market is forecasted to decline through to 2015 at a CAGR of -10.7 percent, the mid-field and open MRI markets are expected to remain flat, and the high field market is expected to almost double by 2015 to over $814 million.

Ultrasound imaging

The U.S. ultrasound imaging market is expected to reach $1.6 billion by 2015. This market is broken down into three traditional segments: cardiology, radiology, and OB/GYN, as well as a specialty segment, which includes markets such as vascular, urology and breast dedicated ultrasound. The hand-carried ultrasound market is, however, expected to experience the fastest growth in the entire medical imaging market at an impressive CAGR of over 20.7 percent. Both the cardiology and radiology markets have reached maturity and will remain flat over the forecast period. The OB/GYN ultrasound market is still exhibiting moderate growth and is expected to reach over $291 million by 2015. Some of the smaller specialty markets are also in their growth phases and are forecasted to become significant market segments by 2015.

Computed tomography imaging

In 2008, the overall computed tomography (CT) system market was valued at almost $1.4 billion in the U.S., representing a 2.4 percent increase over 2007. The market for CT systems includes the 16-slice, 32/40-slice, 64-slice and ultra-premium (over 64-slice) markets. This market was also one of the most heavily affected by the implementation of the DRA. Despite the temporary decline it has caused, all markets are expected to exhibit a modest positive growth by 2015. There is a clear trend in this market toward higher slice systems as they produce more accurate images, as can be understood by the higher growth of the 64-slice segment. Due to this trend, the premium market (systems with a slice count of over 64) was initially expected to experience the same level of growth, however, that did not occur due to the current state of the economy and the very high average selling prices of these systems.

Nuclear medicine imaging

This market includes PET/CT, SPECT and SPECT/CT systems. The growth of the overall market is a result of the trend toward hybrid systems, which allow physicians to better pinpoint abnormalities in the body by combining the functional information provided by the PET or SPECT aspect with the anatomical information given in a CT scan. As a result, the PET/CT has completely eclipsed the PET market. The SPECT/CT market, exhibiting a CAGR of 9.4 percent, is expected to cannibalize the SPECT market, which is estimated to experience a continuous decline through the end of the forecast period. While the nuclear medicine imaging market suffered a sharp decline in 2007, and is still struggling, the hybrid markets are expected to recover and resume positive growth by 2010.

Contrast agents and contrast injectors

In 2008, the contrast agent market was valued at over $1.7 billion and the contrast agent injector market was valued at over $70 million. All segments in this market are expected to exhibit a steady growth in value throughout the forecast period, despite a continuous decline in prices. The ultrasound contrast agent market is growing the fastest and is estimated to more than double by 2015. The MRI contrast agent market grew 5.5 percent this year over 2007, and is forecasted to grow at an even faster rate by 2015. The X-ray/CT contrast agent market is growing the slowest of the agents, as it is the most mature market and has far more products available than the other two. The contrast injector market, which is mainly driven by replacements, is expected to reach almost $100 million by 2015.

Competitive analysis

In 2008, GE Healthcare was the dominant player in the medical imaging equipment market in the U.S. They are the only company that participates in every segment, and have managed to successfully penetrate every market and retain their customers. With the exception of nuclear medicine, they hold the most share in every segment. Their strong focus on innovation and dedication to providing reliable service has enabled them to stay ahead in the imaging market. Siemens Medical Solutions was the second leading competitor in the market in 2008. They have products in every market except for the contrast agents and injector market. They are the leading competitor in the nuclear medicine market, which is a relatively small but significant imaging segment. While they have a wide variety of systems, Siemens has been successful in offering top of the line products.

Philips Medical Systems was very close behind Siemens in the imaging market in 2008. They also offer products in every segment except for the contrast agent and injector market. Philips has done particularly well in the X-ray and ultrasound markets, where their award-winning high performance cardiovascular imaging systems have been very well-received.

Source: The information contained in this article is an excerpt from the report on U.S. Markets for Diagnostic, Interventional & Contrast Imaging 2009, which is available for purchase from iData Research Inc., (866) 964-3282 or [email protected]. Sarah Chapdelaine, BBA, is with iData Research Inc. in Vancouver, BC, Canada. She has disclosed that she holds no financial interest in any product or manufacturer mentioned herein. Ms. Chapdelaine may be reached (604) 266-6933, ext. 210. Kamran Zamanian, Ph.D., is with iData Research Inc. in Vancouver, BC, Canada. He has disclosed that he holds no financial interest in any product or manufacturer mentioned herein. Mr. Zamanian may be reached (604) 266-6933, ext. 202.

February 09, 2026

February 09, 2026