May 16, 2012 — David Fisher, vice president for healthcare policy and strategy at Siemens Healthcare, testified on behalf of the Medical Imaging & Technology Alliance (MITA) today at the Internal Revenue Service (IRS) Hearing on Proposed Medical Device Excise Tax Regulations [REG-113770-10] to voice the industry’s concerns about implementation of the tax imposed by the Affordable Care Act. MITA has submitted comments to the IRS on the proposed regulations, slated to go into effect in 2013, requesting clarification surrounding how and when the new tax will be put into practice.

“The medical device excise tax creates strong headwinds against an important sector of the U.S. economy,” said Gail Rodriguez, executive director of MITA. “However, in light of the complexity and necessary lead time for implementation of the tax, MITA is requesting that the IRS provide clarifications and revisions to several critical implementation issues as well as offering appropriate transition relief. We appreciate the efforts of Treasury and the IRS to provide the industry with the necessary regulatory guidance and look forward to working constructively with all parties to resolve these concerns.”

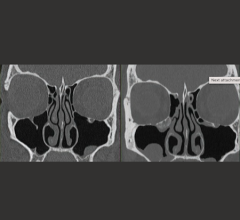

The 2.3 percent tax will be levied on the sale of medical devices, including innovative medical imaging technologies that are fundamental to the practice of medicine by diagnosing and treating disease, often reducing the need for costly medical services and invasive surgical procedures. The medical device tax poses significant challenges for manufacturers of these technologies, particularly those global companies with production and distribution facilities located in the United States and overseas to serve markets around the world.

In a comment letter submitted to the IRS on May 7, MITA offered the following key recommendations:

- Clarify the taxable manufacturer

- Option for a single reporting entity for the U.S. corporate group

- Streamline registration for intra-group exempt sales

- Clarify that service contracts and replacement components are not taxable

- Clarify that software upgrades are not taxable

- Clarify that refurbished products are not taxable

- Ensure that the tax is prospective as Congress intended and would apply only to sales and leases entered into after December 31, 2012

- Transition relief for the first three quarters of 2013, due to the extensive administrative challenges faced by medical device manufacturers to prepare for implementation of the new tax

For more information: www.medicalimaging.org.

February 20, 2026

February 20, 2026