The smallest ultrasound system on the market, the GE Vscan, is designed to be easy to use.

With the advent of handheld ultrasound systems like GE Healthcare’s Vscan, the idea of a doctor in the emergency department (ED) with an ultrasound clipped to his keyboard is not too far-fetched. We are not there yet, but competition is growing in the market. While there are signs the market has begun to mature, there also are signs it could expand into new territory.

The portable ultrasound market has flourished over the past decade, and with Fujifilm’s acquisition of Sonosite (the firm credited with opening the market up) in December 2011, the trend seems set to continue. Now that there are systems the size of iPhones, the point-to-care market penetrated by Sonosite’s exclusively portable machines is more important than ever as other companies try to find their own avenue into it. Among them are GE, Hitachi, Fukuda, Mindray, Toshiba, Philips, Samsung and Siemens, which all offer their own models. The question now is, are there new ways to sell it?

Point-to-care is any area where a physician is in direct contact with the patient. Several markets are emerging with potential for the use of a portable ultrasound system. One market expert, Harvey Klein, Ph.D., has been involved in the ultrasound industry since 1975, and set up his own consulting firm, Klein Biomedical Consultants (KBC), in 1980. Klein has published a long series of reports on the subject and delivered numerous talks, including for the American Society of Echocardiography (ASE), as well as a presentation entitled, “Portable Ultrasound Devices: Threat or Opportunity?” at the Radiological Society of North America (RSNA) annual meeting in 2005, just as the market began to explode.

“The markets which saw the beginning of ultrasound many years ago were radiology, OB/GYN and cardiology. These are the three major traditional markets,” said Klein. “When you use the term point-to-care market, we refer to several emerging markets — emergency medicine, anesthesiology, critical care medicine and MSK [musculoskeletal].” While the traditional three were largely responsible for the growth of the ultrasound market until five to seven years ago, the emerging markets are driving it now with the arrival and penetration of portable systems.

Three Types of Portables

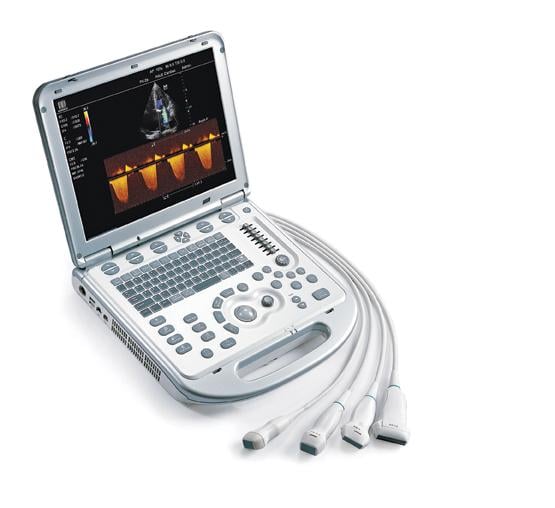

Portable, or compact, ultrasound devices can be broadly split into three categories. First, there is the laptop, often brought to a patient’s bedside. Like almost all laptops, they weigh between 10 and 14 pounds. Secondly, there are hand-carried systems, weighing between five and eight pounds. This is where Sonosite carved itself an effective niche with, for example, the Sonosite Edge. These systems can be taken out as necessary. Third are the handheld or hand-operated systems that weigh less than a pound. They can accompany the physician anywhere.

The appeal of portable ultrasound lies in the possibility of using the technology anywhere to get a fast and accurate read on a patient’s condition. It is this benefit that helped Sonosite become the sole supplier to the U.S. Army, which equips medics with the devices to triage battlefield injuries.

The emerging markets, such as MSK, are good examples of the convenience of using portable ultrasound to do a quick scan, said Klein, especially in non-serious situations, when having a huge machine brought over from an ultrasound department would be unnecessary.

Portable systems are not designed for high performance. Ultrasound technology has made big advances over the years, but portable systems need only to deliver the basics to fulfill the requirements of MSK and other emerging markets, said Klein. However, the speed of portable ultrasound can be extremely important in addressing very serious situations. For example, using a portable device would cut out time needed to set up a traditional scan and allow a physician to identify something like a sudden and life-threatening hemorrhage in a patient much more quickly.

Future Possibilities for Portables

Today, the point-to-care market is well penetrated, and the portable ultrasound market as a whole continues to show double-digit growth, between 15 and 20 percent annually. That growth is expected to continue for a few more years, until the market fully matures. According to Klein, the question now is whether new potential markets can be penetrated successfully to stimulate a second wind of growth.

One major potential market Klein pinpoints is primary care, specifically for small handheld systems. This market will grow if handheld ultrasounds become incorporated into the standard-of-care — as commonplace as a stethoscope. The basic obstacle to this happening is price — current devices are simply too expensive for most practitioners. The Siemens Acuson P10, for instance, can cost nearly $8,500. However, competition naturally drives prices down, and it is only a matter of time before a new face with nothing to lose enters the market, said Klein.

Another possible growth market is pre-hospital. It is easy to envision paramedics making use of a handheld system to beam images ahead to the hospital. Ambulances already are full of equipment, and a space-saving device like a handheld ultrasound would make a lot of sense. This is another individual market within primary care that has huge potential though it, too, may be difficult to penetrate.

Training Key to Future Growth

“The real issue,” said Klein, “is whether a company wants to spend money on educating users, because that can be fairly costly. Companies don’t want to put a little handheld system in everyone’s pocket without their being adequately trained. The issue is, what is adequate training? That’s the $64,000 question.”

The price issue could be resolved, but proliferation may still come to naught if there are a number of physicians who are not trained. And if they are trained but inexperienced, there is a good chance that they could fail to identify something obvious and refer a patient to the ultrasound department, and they might just send them on to radiology, to something they understand better. “If you’re always doing [the scans] with normal patients, you’re not going to learn a darn thing,” Klein added.

Training is not a new challenge, however. “Sonosite was able to invest the money in education and really did a very good job,” Klein said. “They were responsible, really, for the growth in the emerging markets.” Other vendors followed, and with “more feet on the street,” competition drove further growth.

While training may have provided an earlier breakthrough, for now it can be a lower priority. “The focus should be on trying to get the price down,” said Klein. “I think the price can be cut and vendors can still maintain a decent profit margin.”

SIDEBAR:

A Range of Portable Models Available

The portable ultrasound market continues to grow, with several players offering systems. Here are a few of the products currently on the market:

• SonoSite, which was recently purchased by Fujifilm, offers several models of laptop and handheld ultrasound systems. The Edge is a laptop unit featuring a solid aluminum core and a splash-resistant silicone keyboard. It has SonoHD2, adaptive image clarity that provides a new series of algorithms to reduce speckle noise and image artifacts; SonoADAPT tissue optimization; SonoMB multi-beam imaging; advanced needle visualization and ColorHD technology.

• VScan from GE Healthcare is a pocket-size visualization tool providing black and white anatomic and color-coded blood flow images in real-time. It is optimized for physicians to obtain a quick inspection of the heart, abdominal organs and urinary bladder and will provide insights into areas of OB/GYN, pleural fluid and motion detection and pediatrics.

• The Siemens Acuson P10 is a 1.6-pound unit for point-of-care in an array of applications from cardiology to emergency medicine. It features an intuitive PDA-style user-interface and instant power-up. It features high-quality fundamental and harmonic 2-D images.

• Viamo, from Toshiba America Medical Systems, is a lighweight laptop device that mounts to a cart stand, wall, boom arm or can be carried anywhere. Some of the imaging features include: Advanced Dynamic Flow (ADF) for high-resolution color flow imaging; ApliPure to reduce speckle noise and increase contrast resolution; pulse subtraction for quality in 2-D applications and Quick Scan.

• Mindray’s M7 is a lightweight laptop that features the System On Chip (SOC) design, enabling complex technologies to be built into the compact chassis. Octal-beam imaging technology provides good temporal resolution. The M7 also features iClear speckle suppression technology, iBeam spatial compounding, iScape panoramic imaging and tissue Doppler imaging.

• Fukuda Denshi USA recently introduced its new UF-760AG in the United States. The color portable unit provides imaging quality in a compact system and includes both 3-D and 4-D imaging. Three modes of Doppler are available (continuous wave, pulsed wave and color), plus stress echo, spatial compounding, speckle reduction, tissue harmonic and tissue specific imaging.

• Hitachi offers the Aloka ProSound C3CV portable system that leverages the power of the Fusion processor and a high-performance laptop computer. It runs as a Windows application on a standard laptop computer for ease of use. Wireless and Ethernet connectivity are built in. It supports a variety of transducers and exam types and has internal storage for more than 50,000 images.

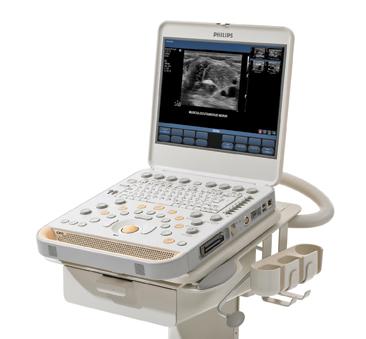

• The Philips Healthcare CX50 CompactXtreme system is designed to provide premium image quality throughout the emergency department (ED). Features include the company’s PureWave crystal technology to improve image quality even on technically difficult patients, plus SonoCT and XRES imaging, and iSCAN automated image optimization. It also features QLAB, automated and objective methods for quantifying ultrasound data to improve workflow.

February 16, 2026

February 16, 2026