Getty Images

Last year was a record year for the global teleradiology reading services market, with revenues rising by 9 percent to $1.2 billion. The market is on course for solid growth over the next five years, tipping the market past $2 billion in 2024.

Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry, defines teleradiology as the electronic transmission of radiological patient images from a scanning organization to a different reading organization for the purposes of diagnostic interpretation and reporting.

By 2024, it is estimated that 5.5 billion diagnostic imaging examinations will be performed globally (including in-house, using radiology groups and using teleradiology reading service providers), of which teleradiology reading will account for 2 percent of these reads.

Several drivers will contribute to the substantial growth of the teleradiology market (in terms of penetration, revenue and read volumes) over the next five years. These include the following.

1 Shortage of Radiologists in Certain Countries/Regions

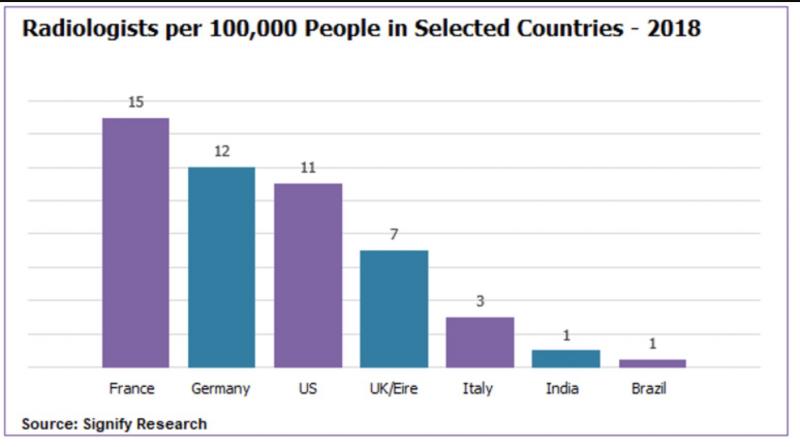

The diagnostic imaging market has suffered from growing pressures on healthcare resources across many countries globally. These shortages are fundamentally due to healthcare services lacking the in-house capacity to read the rising quantity of diagnostic images. Within Europe, the U.K. and Ireland have an exceptionally high shortage of radiologists; in 2019 there were an estimated seven radiologists per 100,000 people in the U.K. and Ireland, which is particularly low compared to the European average of 13 radiologists per 100,000 people, and the U.S. of 11 per 100,000. There were also a relatively low number of radiologists per population in Asia, Africa and Latin America.

Additionally, there is a shortage of radiologists capable of interpreting more specialist and complicated scans, with financial constraints placed on public healthcare service providers limiting their ability to invest in trainee radiologists. The ability to retain and recruit radiologists is proving a significant challenge for the industry.

With the demand for diagnostic imaging growing at a faster rate than the supply of radiologists, radiology groups, imaging centers and hospitals are increasingly becoming reliant on outsourcing their diagnostic reporting workload.

COVID-19 Impact

In addition, hospitals globally are facing an unprecedented constraint on resources due to the impact of COVID-19, which is contributing to a surge in patients requiring diagnostic examinations, such as a chest X-ray or computed tomography (CT). While remote reading of diagnostic images within the hospital network is beyond the scope of Signify’s market report, the knock-on effect of resourcing constraints will result in hospitals increasingly outsourcing their diagnostic reporting workload, outside of the hospital network, to teleradiology reading service providers.

2 Increased Demand for More Specialized Modalities

X-ray was the most popular modality in 2019 and accounted for almost two-thirds of worldwide diagnostic imaging volumes. X-ray demand is forecast to continue to rise steadily through to 2024 although other modalities, including ultrasound, CT and magnetic resonance imaging (MRI), are on course for significantly higher rates of growth. This is due to the advantages of using specialist modalities, including greater detection and visibility of soft tissues, cancers and tumors. As demand for specialized modalities increases, so does the requirement for specialist radiologists capable of interpreting complicated imaging examinations. Where access to subspecialty expertise can be limited in-house (e.g. in smaller hospitals), teleradiologist expertise provides a potential solution.

3 Longer Read Times for More Specialized Modalities

There is a clear relationship between the complexity of a diagnostic examination and the length of read time; the average read time for an X-ray is two minutes, whereas the average read time for CT and MRI is significantly longer — 15 minutes and 20 minutes respectively. While X-rays accounted for most of the diagnostic imaging examinations performed in 2019, it is estimated that they accounted for less than 20 percent of total radiologist reading time, due to faster reading times per scan. The net effect of the changing complexion of scan types forecast over the next five years is, not only are diagnostic procedures increasing, but procedures that take a disproportionately longer time to report are growing fastest, increasing the demand for radiologist resource. With radiology demand (reading hours) rising at a faster pace than the supply of radiologists, the shortfall between supply and demand is set to accelerate.

4 Demand for Out-of-hours Reporting

The primary driver for out-of-hours reporting is for time-critical applications such as neurology, or if there is suspicion of serious injury; these patients will require fast and accurate diagnosis. Emergency diagnostic examinations will be conducted on-site, however, due to the lack of on-site radiologists working out-of-hours, the diagnostic image will be transmitted externally to a teleradiologist for reporting within a short turnaround time, typically less than one hour, depending on the urgency. Additional demand for out-of-hours reporting is being driven by the insufficient capacity of radiologists in-house (in radiology groups, imaging centers and hospitals) during normal working hours. Out-of-hours reporting is estimated to have accounted for approximately 45 percent of the global teleradiology reading service market in 2019. It has been a major historic driver of growth for many reading services companies. For example, U.K. reading service provider Medica Group has seen out-of-hours reading services revenue increase from $16M in 2015 to more than $28M in 2019. While still contributing heavily to overall market growth over the next five years, the share of the market taken by out of hours reporting is projected to fall fractionally as revenues from routine and specialist reporting gain share.

5 Increased Use of Cloud-based Technology

Increased use of cloud-based technology is making implementing information technology (IT) for teleradiology less complex. The benefit for hospitals and imaging centers in using cloud-based technology is that it bypasses the investment required for static IT architecture. It also removes geographical barriers, providing access to teleradiologists globally who simply require an internet connection and access credentials in order to provide a read/report.

In terms of cloud versus on-premise technology, there is a significant level of variation by vendor and region in terms of the architecture of the products that address teleradiology. However, the remote nature of the market means that more solutions are provisioned via cloud-based technology, compared to the broader imaging IT market.

Technology Advances

As highlighted in Signify Research’s recent market insight, “Impact of AI on Teleradiology,” there has been plenty of activity in relation to teleradiology and artificial intelligence (AI), particularly for improving the three key ingredients of a successful teleradiology service — speed, accuracy and workflow/decision support. While it will be beyond the five-year forecast period of our report before we see AI having a major impact on the teleradiology market, particularly in relation to reading speed and accuracy improvements, teleradiologists will increasingly benefit from solutions for workflow optimization in the short-medium term.

Arun Gill joined Signify Research in 2019 as part of the digital health team focusing on telehealth, PHM and EHR/EMR. He brings with him

10 years of experience as a senior market analyst.

February 24, 2026

February 24, 2026