Breast imaging technology has experienced major growth over the last decade or so, and a new report suggests the market will not be slowing anytime soon — particularly in the U.S. The “Market Estimates and Trend Analysis: Breast Imaging Market” report by Grand View Research projects the global breast imaging market will reach a value of $7.3 billion by 2024. Rising prevalence of breast cancer and other chronic breast diseases, as well as more new technological innovations, will be the most likely drivers for the coming boom, though challenges still loom on the horizon.

Rising Cancer Rates Fueling Innovation

As with any medical technology, innovation in breast imaging is largely a product of necessity. Global breast cancer rates have been on the rise in recent years, with worldwide breast cancer incidence going up by more than 20 percent since 2008.1 In the U.S., 266,120 new breast cancer cases were projected for 2018 along with 40,920 deaths.2 At the same time, the five-year survival rate from 2008-2014 was an encouraging 89.7 percent overall, and 98.7 percent for breast cancers that are still localized.2 These numbers would suggest that improved early detection through enhanced technology is having an impact on survival rates.

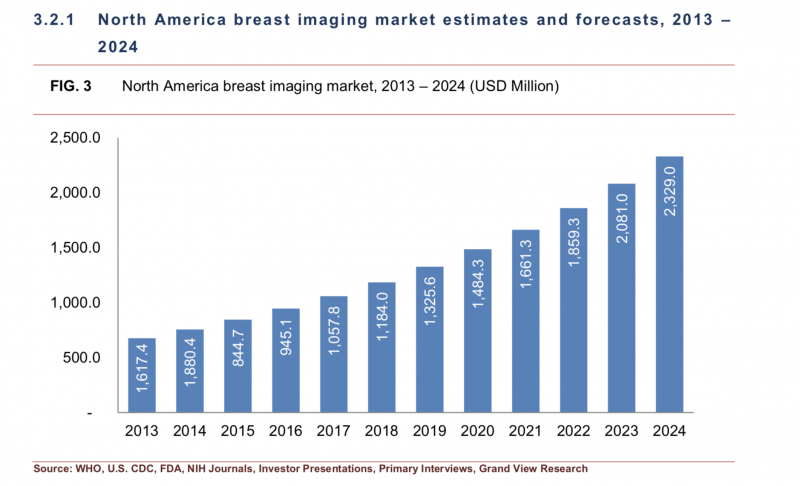

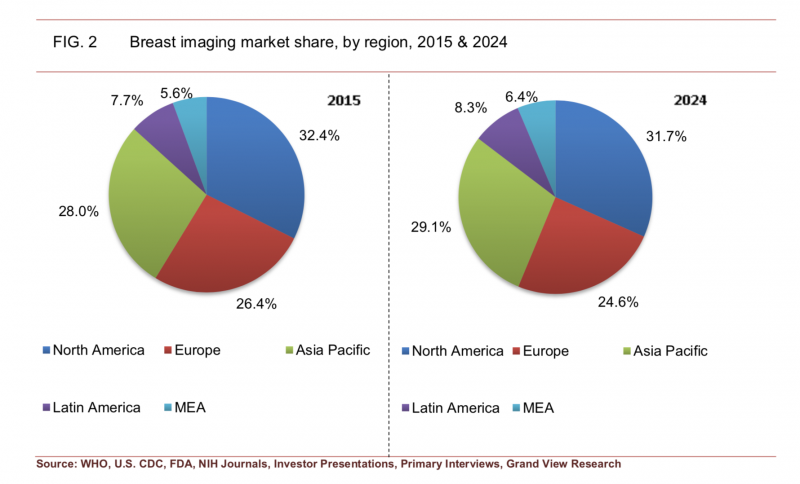

U.S. Driving Largest Market Share

The North American market (split between the U.S. and Canada) has traditionally held the largest market share for breast imaging technology, accounting for 32.4 percent in 2015. While that percentage is expected to drop to 31.7 percent by 2024, it will still occupy the largest share of the market.

The Grand View Research analysis notes perhaps the single greatest factor backing this demand, at least since 2010, has been the Affordable Care Act (ACA). One of the key portions of the comprehensive healthcare reform law requires coverage of certain preventive services for all adults, women and children at no cost to the consumer. Breast cancer screening falls under these provisions, and so private group and individual insurance plans, as well as state Medicaid expansion programs, must cover screening mammography every two years for women between the ages of 50 and 74. The covered frequency of mammography screening is based on recommendations from the United States Preventive Services Task Force (USPSTF), an independent group of volunteer experts in evidence-based medicine.

The USPSTF released its most recent breast cancer screening recommendations in 2016. Its findings stated that screening mammography is effective in reducing deaths due to breast cancer among women ages 40 to 74 years. The greatest benefit of screening mammography occurs in women ages 50 to 74 years, according to the task force, and these women get the best balance of benefits to harms when screening is done every two years.

Mammography, Ionizing Technologies Still Popular

The Grand View Research analysis divides breast imaging technologies into two categories — ionizing and nonionizing. Ionizing modalities emit electromagnetic radiation and include:

• Mammography;

• Tomosynthesis;

• Computed tomography (CT); and

• Molecular imaging, including positron emission tomography (PET).

The nonionizing category includes:

• Breast magnetic resonance imaging (MRI);

• Thermography;

• Ultrasound;

• Optical imaging; and

• Automated breast ultrasound (ABUS).

While there are some safety concerns around the radiation they generate, ionizing technologies are poised for greater market growth than their radiation-free companions, according to Grand View Research. Mammography continues to be the gold standard for breast cancer screening and detection, generating more than $820.4 million worldwide in 2015 and projecting the largest growth rate of any modality (14.6 percent). Furthermore, 3-D mammography has emerged as an important alternative to 2-D mammography, particularly for women with dense fibroglandular breast tissue.

Cost Remains Key Constraint on Growth

While there are many reasons to be bullish on the future of breast imaging technology, the Grand View Research analysis acknowledges there are still several factors that could limit growth moving forward — the most prominent of which is cost. For example, the report notes that, depending on the number of slices desired, CT scanners can come with a price tag of $1 million (64-slice) to $2.5 million (320-slice). It further notes that the average cost of mammography and ultrasound systems is around $400,000.

While the imaging systems themselves can carry a large price tag, the associated downstream costs can be just as burdensome for patients and providers. A study published in ClinicoEconomics and Outcomes Research found that the annual cost of false-positive breast biopsies exceeds $2 billion. The research team — a collaboration between IBM Watson Health and A. Thomas Stavros, M.D., FACR, chief medical officer for Seno Medical — analyzed recent data focusing on procedures performed as follow-up to a screening mammogram or breast exam. Real-world encounters from a total of 875,000 women between 2011 and 2015 found:

• More than half (53.3 percent) of women received a second, diagnostic mammogram;

• Forty-two-point-four (42.4) percent received diagnostic breast ultrasounds; and

• Just over 10 percent (10.3 percent) received biopsies after their initial procedures.

In all, $3.05 billion was spent on diagnostic mammograms ($349 average), $0.92 billion on diagnostic breast ultrasound ($132 average) and $3.07 billion on biopsies ($1,938 average).3

“The costs to the healthcare system are secondary to the psychological impact on women who are told that their mammogram and ultrasound were inconclusive, and that a biopsy is required to rule out cancer,” said Stavros, who is also professor specialist, Department of Radiology, University of Texas Health Sciences Center. “Conscientious clinicians rightly want to confirm that a mass is not malignant, so the guidelines and clinical practice aren’t at fault. It’s simply that technology — as advanced as it has become — still needs further refinement to provide better specificity without sacrificing sensitivity and to engender increased diagnostic confidence for the clinician. There are significant volumes and costs of procedures required to reach a definitive, ‘yes,’ that breast cancer does or does not exist.”

Innovating New Solutions

The analysis concludes that continuing to innovate cost-effective technological solutions is the key to offsetting the high costs of breast cancer screening technologies. Examples include molecular breast imaging (MBI) systems, which Grand View Research notes are one-third the price of a typical MRI system. Molecular imaging systems show cellular function by tracing the activity of an injected radiopharmaceutical in the body. This can be employed as a cost-effective follow-up to a screening mammogram to try to reduce the number of false-positive findings requiring biopsies.

References

1. Bray F., Ren J.S., Masuyer E., Ferlay J. Global estimates of cancer prevalence for 27 sites in the adult population in 2008. International Journal of Cancer, July 3, 2012. https://doi.org/10.1002/ijc.27711

2. Cancer Stat Facts: Female Breast Cancer. https://seer.cancer. gov/statfacts/html/breast.html

3. Vlahiotis A., Griffin B., Stavros A.T., Margolis J. Analysis of utilization patterns and associated costs of the breast imaging and diagnostic procedures after screening mammography. ClinicoEconomics and Outcomes Research, March 26, 2018. https://doi.org/10.2147/CEOR.S150260

February 06, 2026

February 06, 2026