Figure 1

Every year in late November tens of thousands of diagnostic imaging professionals from all over the globe descend upon the city of Chicago to learn what’s new in the industry, visit the technical exhibits and network with colleagues — both old and new — at a variety of professional meetings and social gatherings.

2018 has been an interesting year for health innovation. More than $15 billion in investment capital was poured into digital health firms in the first half of the year alone — outperforming every previous year overall for the past decade and amounting to 70 percent more than in the first half of 2017.(1) With new innovations and applications seemingly popping up everywhere, we were curious to learn how this would shape attendees’ hopes and expectations at this year’s RSNA.

We reached out to more than 3,500 diagnostic imaging professionals, including healthcare executives, radiology and IT leaders, radiologists, technologists and clinicians to ask about their top reasons for attending the show, and what new and exciting innovations they are hoping to see and learn about this year. The results are in!

Who’s Coming?

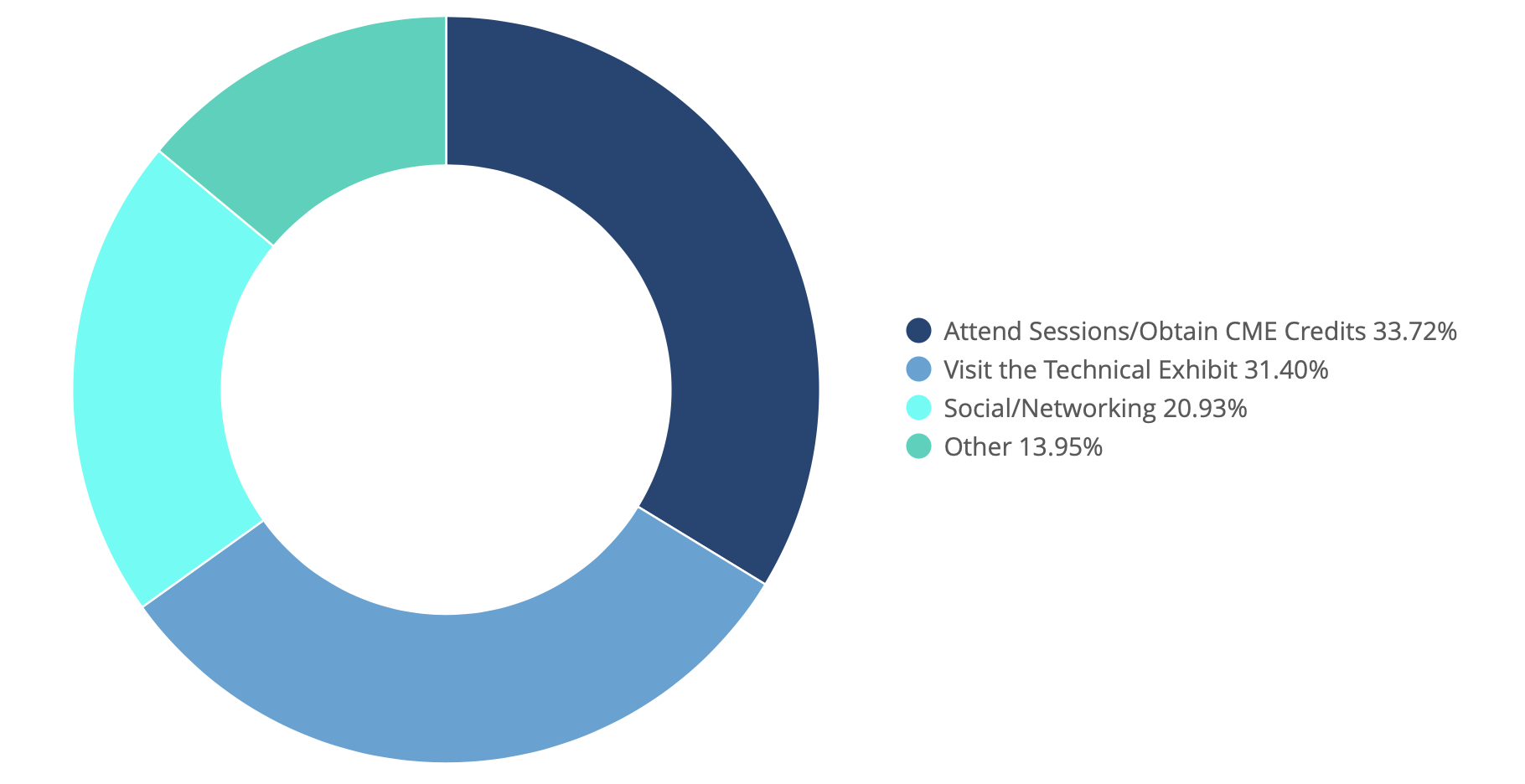

Given the steadily increasing number of mergers and acquisitions between provider organizations in industry it is no surprise that there will be significant representation from integrated health enterprises at this year’s show, followed (not so closely) by independent hospitals, outpatient centers, private practices, and teleradiology providers (see Figure 1).

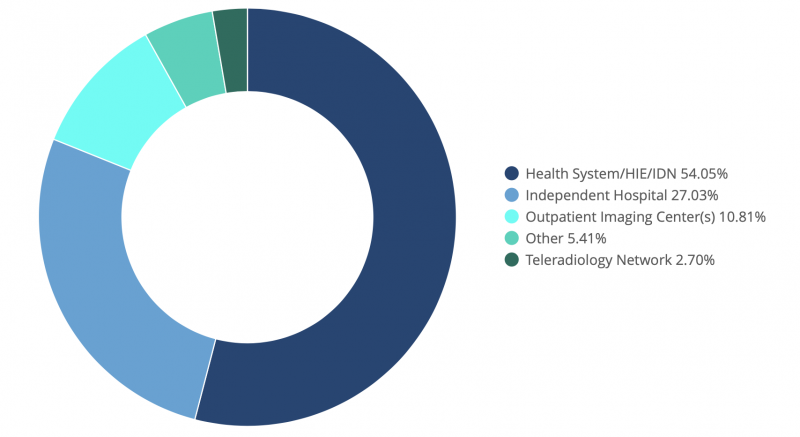

The majority of attendees fall into front-line roles including radiology administrators, practicing radiologists and technologists. There is some representation from clinical and IT leadership, but very little at the executive level. This is indicative of the importance of experience from the ‘trenches’ and the level of influence retained by such stakeholders within their organizations — even in an environment of consolidation, expansion, and change (see Figure 2).

What are Their Top Reasons for Attending?

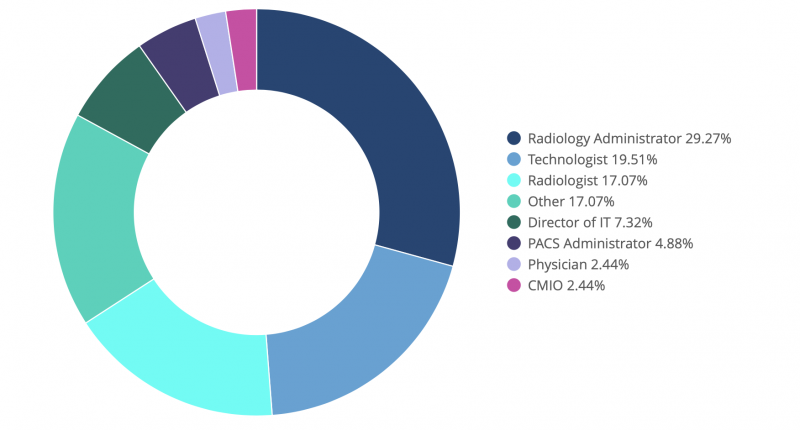

Continuing education (CE) and visiting the technical exhibit were in close contention for the top reason for most respondents attending RSNA this year, once again demonstrating the show as a destination for scientific and technological education, advancement and procurement. Of course, one cannot dismiss the popularity of social and professional networking events — and the many dinners and happy hours that are sure to be well attended (see Figure 3).

What are the Top Trends for RSNA 2018

By aggregating the responses to questions related to continuing education (CE) topics of interest, active shopping plans for the technical exhibit, and what new innovations/ technologies and associated applications respondents were most excited to see at this year’s show we were able to identify five key trends for RSNA 2018 (which we will expand upon in the following sections):

- Continued shift toward subspecialty practice

- Focus on optimization rather than replacement

- The nebulous potential of artificial intelligence (AI)

- Cloud confusion

- What didn’t make the list?

Trend #1: Continued Shift Toward Subspecialty Practice

Once again imaging modalities are the most popular shopping list item among RSNA attendees this year, with 30 percent of respondents noting that they will be actively shopping for new modalities — in particular magnetic resonance imaging (MRI) and ultrasound systems — at the show this year. Following this trend, advances in modality technologies and best practices lead in terms for CE topics of interest, with 30 percent of respondents planning to attend sessions related to scientific and technological innovation, dose management and imaging workflow optimization across a wide array of specific clinical specialty applications, once again with a heavy emphasis on MRI.

Driven by shifting reimbursements and growing consumer demand for specialized care services, this trend highlights the increased focus on subspecialty practice, and subsequently image acquisition workflow. Consequently, healthcare organizations are seeking to leverage new technologies to enable more accurate diagnosis, improve clinical outcomes and derive increased value from their imaging service lines.

Trend #2: Focus on Optimization Rather Than Replacement

For those who are actively shopping at this year’s show, analytics/business intelligence (BI) and AI were in contention for second place at the top of the list, with 21 percent and 20 percent of respondents, respectively. The top reasons cited for adopting these technologies include:

- Improve workflow efficiency and reduce manual effort for technologists and radiologists

- Increase patient throughput and modality utilization

- Improve accuracy of interpretation results

- Gain prospective and retrospective insight into quality and organizational performance

Conversely, taking a popularity hit from previous years was enterprise imaging systems and PACS replacements, each appearing on fewer than 9 percent of attendees’ shopping lists. This is a surprising statistic, given the strong focus on both of these topics at previous shows.

Combined, these statistics highlight a strong shift toward optimization of existing systems and workflows and away from large-scale system replacements, and a demand for evidence-based decision making for both clinical and operational roles. This results in a greater-than-ever need for interoperability between vendors — especially up-and-coming BI and AI companies — to support the level of integration required to deliver on the expectations of this year’s shoppers.

Trend #3: The Nebulous Potential of AI

It should come as no surprise that AI was a leading topic for both CE sessions and the technical exhibit. At a high-level most respondents noted that they were looking to AI to optimize workflow, improve efficiency and accuracy, and increase satisfaction scores for providers and patients alike. These are common yet ambiguous answers that continue to reinforce trend #2 above, however very few respondents offered specific examples when asked what specific use cases and benefits respondents are hoping AI could offer. This is highly indicative that AI is still in its healthcare infancy, and that the industry in general continues to be unsure about what the most immediate and impactful applications of this emerging technology could be.

With AI appearing in numerous CE sessions and vendor booths, this year’s show should provide some much-needed education about what AI is, the role of related machine and deep learning technologies, and what they mean for healthcare. However, it remains to be seen whether RSNA 2018 will shed some light into which near-term applications will really take off in the diagnostic imaging realm, and whether vendors will be able to move the needle in terms of adoption in 2019.

Trend #4: Cloud Confusion

Somewhat unexpectedly, cloud-hosted solutions demonstrated a lack of interest among active shoppers, appearing on only 7 percent of respondents’ shopping lists, and not appearing at all on lists related to CE topics of interest or exciting new innovations. This is a surprising result, given the continued pressure on healthcare organizations to operationalize budgets and reduce cost, and eludes to lingering uncertainty regarding the technical, operational, or economic feasibility of vendor-managed infrastructure, systems and data within the industry at large.

Cloud technology has become a standard data model in many other industries, and offers several advantages including reduced operational complexity and capital expense and improved redundancy and security. The lack of adoption to-date reinforces healthcare’s slow movement to new technologies in general, which is further exacerbated by the confusion resulting from differing capabilities, pricing models, and business cases across vendors in the industry. Ultimately, spurring adoption of this new(er) technology in healthcare will begin with education regarding the capabilities and benefits of cloud-hosted environments so that IT leaders can become informed consumers and gain the confidence and trust required to move forward.

Trend #5: What Didn’t Make the List?

Equally telling to what respondents identified as ‘hot topics’ is what didn’t make the cut. A couple of the technologies that have been leading headlines and water-cooler conversations in 2018 include blockchain and consumer wearables, however they failed to emerge as top-of-mind for respondents when asked what new and exciting innovations they were hoping to see at the show.

Blockchain

Most popular for its applications in the financial industry, blockchain has been lauded for its potential in managing patient identities and sharing information and images between unaffiliated domains, as well as for the role it could play in supporting population health, AI and machine learning by aggregating data and making it accessible for research and algorithm training purposes. However, very few within the healthcare industry truly understand what blockchain is and how it works, and more questions than answers exist when it comes to the feasibility of deploying this resource-intensive technology, which is likely why it failed to make an appearance.

Consumer Wearables

Innovations like the Apple Watch with the ability to take ‘anytime, anywhere’ ECG readings continues to be a popular topic of discussion. While a good idea in theory, care providers have challenged whether the industry is ready for this type of innovation — citing questions such as how the resulting information can be meaningfully shared with and used by care providers, what to do when there is an inevitable influx of false positives to manage, and how will this fit into existing reimbursement models? These are not trivial concerns, which is why it is likely too soon for this type of technology to make a meaningful appearance on the RSNA 2018 agenda.

Conclusion

The trends identified for RSNA 2018 reinforce that the industry’s top priorities continue to be measurably improving the quality, scalability and cost of care. Imaging leaders and practitioners alike are cautiously looking to technology to provide transparency into clinical and business operations, optimize workflow and resource utilization, and improve interpretation accuracy.

While the rate of adoption typically lags behind the pace of innovation in healthcare, it will be interesting to see if this year’s show will provide the knowledge and confidence needed to diffuse some of the industry’s newer technologies into clinical practice in 2019.

Jef Williams is Managing Partner at Paragon Consulting Partners LLC. With decades of Healthcare IT experience, he has a diverse and creative approach to problem-solving and solution design. He specializes in assisting organizations with organizational strategy, operational improvement, software design and selection, and enterprise imaging deployment initiatives. Williams contributes to the industry at-large as a member of the AHRA, IHE and by participating in the HIMSS-SIIM working group.

Laurie Lafleur is a senior imaging consultant at Paragon Consulting Partners, providing consultative and advisory services for healthcare and technology organizations. Having worked with care providers and vendors across Canada, the United States and Europe, she brings over 18 years of relevant experience in software engineering, product marketing, and business strategy within the Healthcare IT and imaging informatics industries. She is a member the IHE Radiology Planning Committee, and serves as a technical advisor on an academic Software & Electronics Engineering advisory board.

Reference

1. 2018 Forbes, ‘Theranos? Whatever. Healthcare startups have raised $15 billion so far this year’, https://www.forbes.com/sites/matthewherper/2018/07/09/theranos-whatever-healthcare-startups

For additional information on RSNA 2018, read the BLOG 2018 - Year of the Patient

Listen to the PODCAST Hear and Now: Artificial Intelligence in Radiology

Watch the VIDEO RSNA President Says Artificial Intelligence is Hottest Tech Advancement in Radiology

February 06, 2026

February 06, 2026