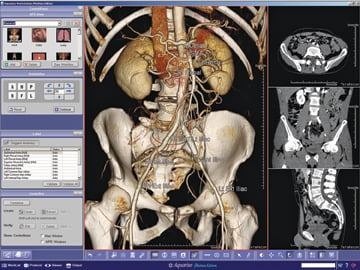

TeraRecon, the only independent major vendor in the advanced visualization marketplace, offers iNtuition.

Once an emerging technology confined to early adopters, server-based advanced visualization has gradually become a more popular solution in the medical imaging informatics marketplace in the last few years. This has carried on to the point that it can today be deemed the de facto standard for advanced visualization in medical imaging enterprises. Now carried over by virtually every vendor in the industry, including picture archiving and communications systems (PACS) vendors and independent software vendors (ISVs), the market’s adoption of server-client advanced visualization (started by companies such as TeraRecon and Emageon more than 10 years ago) has finally reached the critical mass required to be considered ”standard.”

That’s not to say that the stand-alone workstation model is no longer a viable solution for today’s market. But it is reasonable to say that its addressable market opportunity has shrunk considerably and is now limited to a few niche segments. One customer segment that still favors the workstation model over the enterprise model lies at the very large-scale end of the imaging provider market, where many larger academic facilities still prefer to concentrate their image post-processing power in a “superlab.” In these superlabs, dedicated “3-D techs” perform the 3-D functions for the entire enterprise, typically by using stand-alone workstations from multiple vendors.

The other customer segment lies at the opposite end of the provider spectrum, where many smaller hospitals still rely on a few, dedicated workstations to conduct a limited volume of advanced studies. Most of the facilities in between, however, have already implemented, or are at least seriously considering, deploying server-based advanced visualization. For the mid-sized and large hospitals and distributed networks, it has become an evident choice.

Equipment OEMs Back in the Game

Up until a couple of years ago, the major imaging original equipment manufacturers (OEMs) had very limited capability to offer their customers real enterprise-wide advanced visualization. They were mainly selling modality-specific, dedicated, stand-alone scanner workstations, which undoubtedly provided some of the most advanced clinical applications for each individual imaging modality.

However, in order to embed these applications into their PACS offering to allow enterprise access, the “Big Three” needed first to overcome conflicts of interest between the various business units involved internally. Then, in some cases, the vendors had to re-design each application so it could work as a thin client. These obstacles provide the OEMs with justification for late entry into enterprise advanced visualization and for not staying ahead of the curve as this paradigm emerged as an industry best practice.

Nevertheless, by now the OEMs have considerably ramped up their solutions for enterprise advanced visualization. They have spent the last year or two marketing their new-generation solutions.

Such is the case with Philips Healthcare, which was probably the first among the OEM vendors to provide advanced visualization and computed tomography (CT) clinical applications integrated with its iSite PACS, with a multimodality suite called Volume Vision. Similarly, GE Healthcare last year launched the AW server, a scalable version of its popular AW workstation that was updated to offer advanced remote-viewing capabilities and full radiology information system (RIS)/PACS integration.

Siemens Healthcare opted for a broader product overhaul by launching a brand-new enterprise advanced visualization platform, syngo.via, along with a new RIS/PACS platform, syngo.plaza, at the 2009 Radiological Society of North America (RSNA) annual meeting. These two complementary solutions work in a centralized server-client environment.

Toshiba Enters by Means of M&A

Toshiba, the fourth-largest imaging OEM, joined the “Big Three” as an active market player in advanced visualization by means of merger and acquisition when a subsidiary, Merger Sub, announced it would acquire Vital Images in April 2011. This acquisition came as a surprise only because it came less than two years after Toshiba bought the advanced vis business of Barco, formerly independent and known as Voxar.

It was quite predictable otherwise in that the two acquisitions are not at all redundant, but complementary. In fact, Toshiba already had an OEM license to use Voxar technology, which served as the engine of Toshiba’s CT scanners, and this partnership was in place for several years before Toshiba acquired Voxar.

Much in the same way, Toshiba had a reseller agreement in place with Vital Images for many years before it initially stepped up its collaboration and joint research and development (R&D) before finally acquiring it. All these years, Toshiba has been the single largest customer of Vital Images — accounting for almost a third of revenues. For Toshiba, the acquisition is merely a way of bringing its advanced visualization business entirely in-house.

The Vital Images acquisition certainly spiced up the competitive dynamics in the market. Toshiba was the only large equipment vendor to voice the benefits of a best-of-breed approach and was equally selling the third-party solutions from Vital Images and TeraRecon. Now it has a comprehensive solution of its own. This acquisition also makes TeraRecon the only major advanced visualization vendor to remain an independent company today, since its next largest competitors are much smaller companies. Vital Images’ acquisition might well strengthen TeraRecon’s position, but could also challenge the company.

Ironically, it is likely that Toshiba’s latest acquisition came out as good news for the “Big Three,” because Vital Images was in an ideal position to come in independently, armed with its strong product portfolio and displace any OEMs’ dedicated workstations. Vital Images’ ability to continue do so as a part of Toshiba is still a question, as only time can tell if Vital Images’ acquisition by Toshiba has essentially eliminated a strong ISV contender or only made it stronger.

PACS Vendors Figured It Out

During the past few years, different PACS vendors have taken different routes to meet increasing customer demand for enterprise access to advanced visualization — and have done so without committing excessive R&D bandwidth to this one particular PACS feature. To reach the point today where virtually every PACS vendor has secured at least basic 3-D PACS features, some vendors have worked more and more closely with their ISV partners to enhance the integration of their respective products.

Other vendors have developed these capabilities in-house, and yet other smaller PACS vendors have taken advantage of the value proposition of a burgeoning OEM industry. They have forged OEM business deals allowing them to make use of the software development kits (SDK) of various OEM providers to incorporate basic 3-D and 4-D imaging functionality into their PACS. In most instances, since the technology is re-branded, it is transparent to end-users and offered as a PACS upgrade. These PACS upgrades have happened gradually during the past three years, such that the majority of the market now has at least basic PACS-based advanced visualization capabilities.

However, it does seem, now that PACS-based 3-D has gone mainstream, that the OEM advanced visualization industry has been trying to raise the bar. Visage Imaging, for example, is an advanced visualization vendor that found its roots as an OEM business unit of Mercury Computer Systems before it became a wholly owned subsidiary of that company in August 2007 and then was sold to Australian-based healthcare IT firm Pro Medicus in January 2009. Since then, Visage seems to have moved on from operating merely as an OEM 3-D vendor, as it is now selling a full-fledged RIS/PACS/3-D system direct to market.

Calgary Scientific is another interesting example, as the entrepreneurial company once focused on OEMing advanced clinical applications is now marketing a full suite of Web enablement and mobility enhancement OEM technology for data-intensive applications in the medical imaging industry and beyond. Fovia Inc. is yet another 3-D OEM provider that started out in medical imaging to then make strides in various other vertical markets, as its CPU-based rendering engine gains recognition by various leading companies providing 3-D intensive applications to their respective fields.

The combination of these industry trends and dynamics bodes well for the future of advanced visualization, as its evolution may act as a driving force toward greater enterprise access and collaboration in and around medical imaging.

Frost & Sullivan enables clients to accelerate growth and achieve best-in-class positions in growth, innovation and leadership. It leverages 50 years of experience in partnering with Global 1,000 companies. For more information: www.frost.com

February 16, 2026

February 16, 2026