As molecular imaging transitions from undercard modality to mainstream tool in diagnostic imaging, the reality of personalized healthcare appears to be on the horizon. An increasing limelight placed on the modality has attracted both investors and new companies, leading to significant milestones in R&D and thus fulfilling the promise of “true” personalized medicine.

Within the imaging industry, shifts in end-user preferences have manufacturers redirecting their R&D focus away from traditional product lines to more scalable technology platforms that offer more flexibility in clinical workflow. SPECT/CT continues to gain clinical acceptance as novel quantitative tools and improved imaging technology are introduced. As a result, the market has slowly recovered from its recent stagnancy over the last several years and is expected to witness steady growth over the next few years.

Challenging this growth is the lack of standardization protocols for certain imaging procedures and new quantitative applications as well as the downturn in businesses in the post-DRA era. These factors, along with the continued absence of novel agents being introduced to market, remain key areas of focus that manufacturers are addressing to establish molecular imaging’s place in the diagnostic industry.

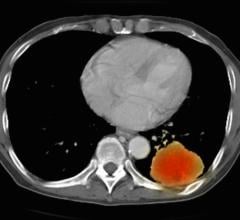

New Strides in Cancer Diagnosis and Treatment

Shifts in end-user trends in terms of how, and when, molecular imaging is being utilized within the continuum of care for cancer are slowly coming forth as new data emerges. Data released by the National Oncology PET Registry (NOPR) in March 2008 revealed that FDG-PET scan results had a 36.5 percent change in the decision of whether, or how to, treat a patient’s cancer in approximately 23,000 patients. More surprising was the impact of FDG-PET had on the rate of lesion biopsy – approximately 75 percent of cases were avoided after a performed FDG-PET scan. As more studies clearly demonstrate the positive clinical impact of molecular imaging, advocates of the modality again question whether the CMS’ requirement for “Coverage with Evidence Development” is the best strategy for coverage expansion. A lack of coverage for FDG-PET in non-oncology applications has placed a cap on near-term market growth and left it susceptible to disruptive technologies from competing modalities in the long-term future.

One such example is the challenge FDG faces from SPECT universal oncology diagnostic agents currently being developed, such as 99mTc-EC-G (CellPoint) and CLR1404 (Cellectar). CellPoint’s 99mTc-EC-G is entering a combined Phase II/III trial in 2008 with an estimated market entry in 2012. As a SPECT-based agent, 99mTc-EC-G holds several key advantages over FDG including: being technetium-based, the agent has a six hour half-life and can be made available in a “shake and shoot” cold kit, which simplifies production and preparation of the agent; 99mTc-EC-G yields 73 percent less radioactive exposure than 18F, reducing both physician and patient fears of radiation exposure; and on average, patient costs for SPECT procedures are considerably less than its FDG-PET counterpart.

The impact of this technology would be substantial given the affordability of SPECT as well as the much larger installed base of SPECT and SPECT/CT versus PET/CT. However, it remains to be seen whether the road to approval will parallel FDG’s past experience. The approval process for SPECT universal oncology agents can only be speculated at the time leaving many guessing that FDG has potentially paved the way for SPECT universal oncology agents to gain market approval and thus has sealed its own fate. Under this assumption, both market approval and the following reimbursement coverage will be much easier for SPECT universal oncology agents and ultimately result in patients benefiting from improved accessibility and affordability of molecular imaging.

MI for Breast Imaging

On the imaging equipment side, the advent of digital technology has molecular imaging manufacturers directing their focus on the lucrative breast cancer screening and diagnosis market. Adoption of full-field digital mammography (FFDM) remains lower than expected, with July 2008 data from MQSA National Statistics showing that only 38.1 percent of certified mammography facilities within the U.S. and its territories currently operate a FFDM unit. In addition, growing rates of obesity and age-related complications has led to an increase in the dense breast patient population – an area in which FFDM historically performs poorly.

As such, gamma camera manufacturers see an opportunity for molecular breast imaging (MBI) in breast cancer screening. The technology provides superior image resolution (and thus higher diagnostic accuracy) than FFDM while costing less than breast MRI. Mayo Clinic researchers have already demonstrated Gamma-Medica Ideas’ LumaGEM, a dual-head solid-state detector system, to be able to detect tumors smaller than 10 mm with 88 percent accuracy. More importantly, patients scored the system at a much higher comfort level over traditional mammography units – a key factor in why women neglect to receive mammography screening. Further inroads of this technology are expected as more studies demonstrate the benefits of MBI.

Cardiac Imaging Goes Quantitative

As the myocardial perfusion imaging (MPI) market shifts from traditional SPECT to hybrid SPECT/CT imaging, manufacturers have steadily introduced quantitative tools that add clinical value to the nuclear cardiology community. Equipped with SPECT/CT, imaging providers are now able to provide a more comprehensive cardio workup including calcium scoring and perfusion imaging with CT attenuation correction. With the latest addition of quantitative tools introduced at the 2008 Society of Nuclear Medicine (SNM), the medical community will surely benefit from significant improvements in the quality and diagnostic accuracy of MPI.

GE Healthcare looks to smooth the end-user transition from SPECT to SPECT/CT with its Volumetrix Suite, a set of quantitative tools designed to expand capabilities of a hybrid system. With these tools, automatic registration and 3D image rendering is integrated into the NM workflow, leading to a more streamlined workflow and thus higher patient throughput. In addition, GE Healthcare reports that with improved controls over advanced image rendering tools, image acquisition times can be reduced in half, resulting in better diagnostic accuracy as well as patient experience.

In its newest gamma camera, IQ·SPECT, Siemens offers the latest technology in dedicated-cardiac cameras that accelerates workflow through a redesigned collimator. The SMARTZOOM collimator design breaks away from the traditional fixed-90 degree dual-head design and instead employs what Siemens refers to as a cardio-centric orbit such that the heart is maintained within the collimator’s magnification area throughout the entire study. As a result, the camera is capable of performing true organ-specific imaging, resulting in significant reductions in image acquisition times. Additionally, calcium scoring with SPECT/CT cameras can be performed under one minute, completing the most comprehensive perfusion study available today.

Also easing the upgrade from SPECT to SPECT/CT is Philips Healthcare’s new Brightview XCT system. One benefit about the system is that the camera is the first, and only scalable hybrid camera to fit into a 12 x 15.5-foot room. As such, the system requires little to no room renovation, reducing the cost of ownership as well. In addition, consumers have the upgrade-to-CT option so that they can scale the system as their business needs evolve over time.

PET Perfusion: Ready to Penetrate the MPI Market

PET perfusion imaging continues to generate an increasing amount of buzz due to its superior image resolution and PET MPI radiotracer characteristics. The clinical benefits of PET MPI have been established, with PET MPI showing superiority in detecting coronary artery disease (CAD) over SPECT MPI, CT angiography (CTA) or MR angiography (MRA). In addition, the perfusion agent used in PET MPI, Rubidium-82, has a half-life of 75 seconds, allowing end-users to complete both rest and stress imaging tests in less than 30 minutes. This is highly advantageous, as SPECT MPI typically requires at least a few hours between technetium dose administration for its rest and stress stages. As such, advocates of PET perfusion argue that the benefits of the modality easily justify its costs. The medical community, however, continues to disagree, which is evident by the wide consideration of PET MPI to be a “nice-to-have” technology instead of a “need-to-have” like its SPECT counterpart.

Positron Corp. looks to strengthen PET perfusion’s position with its recent introduction of a PET-only dedicated cardiac camera. Currently under development, this “economically priced” PET system is speculated to cost approximately $600,000 – considerably less than an average PET/CT system that can cost around $1.6 – $2.1 million. With a small footprint and lower costs, the PET camera is expected to directly compete with the mobile dedicated-cardiac SPECT cameras within the primary-care physician and cardiologist office setting, which represents the largest (and most lucrative) untapped market segment within the MPI industry. If PET perfusion is able to successfully penetrate this market segment, the modality may finally be able to shake off its misconception of being an “oncology-only” modality.

Feature | September 02, 2008 | Travis Chong, research analyst, Healthca

MI to grow with new SPECT/CT agents, breast applications and PET/CT for MPI.

© Copyright Wainscot Media. All Rights Reserved.

Subscribe Now

February 15, 2024

February 15, 2024