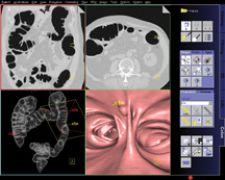

Voxar 3D ColonMetrix incorporates multiple reading paradigms, including 3D review, 3D endoluminal flythrough and a dissected view.

The future is looking bright for virtual colonoscopy (CTC) after encouraging news came out that the Centers for Medicare and Medicaid Services (CMS) had initiated a national coverage analysis (NCA) for the use of screening CTC for colorectal cancer, granting the public 30 days to submit comments on the topic. The NCA will evaluate the available evidence for screening CTC and determine if a national coverage determination is warranted.

The Next Big Thing?

As the prospects for higher, more consistent CTC coverage, and for subsidizing it as a screening tool, continue to good, CTC will soon be considered the ‘next big thing’ in the medical imaging industry. The last such push to the industry has come from cardiovascular imaging, thanks to CT angiography (CTA) in particular, during 2005 and 2006. However, it is important to place into context the effect that mainstream CTC adoption could have on an industry whose revenues have been slowing down dramatically throughout 2007. Indeed, wider CTC adoption does not warrant the adoption of the new, multimillion dollar CT scanners – their improved dynamic imaging capabilities are relevant mostly to cardiovascular applications. It does, however, warrant the adoption of the newer CTC software packages – and possibly CT imaging equipment among the (very) late adopters.

The impulse created by global CTC coverage would therefore benefit primarily the markets for advanced visualization and CAR, which stands for computer-aided reading, a concept related to but distinct from CAD solutions. These providers include equipment manufacturers GE Healthcare, Siemens Medical Solutions and Philips Healthcare and the major vendors of advanced visualization solutions such as Vital Images, TeraRecon and Barco-Voxar, in addition to smaller vendors, some of which have been focusing on CTC since the early stages, most notably Viatronix and Rendoscopy. What’s most interesting about the CTC industry, however, is the collaboration that is strengthening recently between these vendors and the CAD companies such as Medicsight, R2 Technology, iCAD or im3D Medical Imaging Lab. Many believe the integration of CTC reconstruction software with polyp-detection CAR systems is precisely the key to mainstream CTC, and to CTC outcomes that are more consistent across providers. The recent industry activity, including technology and marketing partnerships and reseller agreements, reflects well on this fact.

Time is of the Essence

The importance of CTC coverage for the patient and the clinical communities is undeniable. The procedure spares the discomfort – and reticence - associated with optical colonoscopy, the current gold standard, by offering a much less invasive, yet equally reliable alternative to one of the more unpleasant procedures. CTC therefore holds the promise of achieving higher rates of screening compliance among Americans age 50 and older, which demonstrably translates into more effective treatments and lower death rates from colorectal cancer. As for its business model, if the procedure is granted reimbursement levels similar to or higher than the current level of coverage for optical colonoscopy, it could easily be profitable and present an attractive return on investment (ROI) model for the imaging enterprise, especially over the long term.

ROI, however, is directly dependent on procedure time. Typically, an optical colonoscopy examination requires about 20 to 30 minutes for completion. In the case of CTC, the total procedure turnaround time is the sum of three components, namely patient preparation, CT scanning and CTC reading. All three components can improve with more experience and higher volumes. CTC reading in particular depends highly on the clinician’s comfort level. Today, enhanced workflow tools, coupled with higher levels of training, have led to a reduction in turnaround times for CTC reading to about the same timeframe as for optical colonoscopy, which is in the 20-minute range.

Faster, Further with a CAR

Initially, four-slice CT scanners were considered to be the minimum suitable image acquisition technology to perform CTC, suggesting that the technical aspect of the procedure had become secured shortly after these systems were introduced in 1999-2000. Nevertheless, the subsequent generations of CT scanners – 8, 16, 32 and 64-slice CT – have had a positive impact on CTC. Aside from reducing scanning times – and thereby improving the overall patient experience – these systems generate image datasets of higher resolution, which translates into increased robustness for the application. The state of virtual colonoscopy has been, for years, akin to a vicious circle, whereby the lack of robustness of the application and its workflow inefficiencies were reinforcing its low clinical acceptance, the low levels of reimbursement for the procedure and the lack of training among radiologists and gastroenterologists. Today, the robustness of CTC applications is one less factor holding the application back.

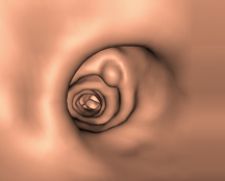

More so than the majority of multislice CT (MSCT) procedures, virtual colonoscopy generates extremely large image datasets that are then post-processed into a fly-through voyage inside the colon, in the case of 3D CTC or a multitude of tomographic 2D images in the 2D version of CTC. Analyzing this tremendous amount of imaging data without assistance from polyp-detection CAR systems is far too time-consuming and requires too much concentration and expertise from the clinician, which threatens both their comfort level and the profitability of the procedure. CAR helps locate lesions and polyps, which are difficult to discern from the surrounding tissue, as a preliminary step to scrutinizing each one. Therefore, the newer advanced application algorithms can improve reliability and shorten the review time to more acceptable levels.

The Focus Turns to Prep

The recent studies have shown that 3D reading requires a few more minutes on average than 2D reading and yields similar outcomes. The latest clinical trials also suggest that interobserver variability is low, but not entirely nonexistent. These are also some issues surrounding CTC that can be addressed through higher levels of training. The various multivendor trials from ACRIN and other organizations yield contradictory conclusions, however, as to intervendor variability. Some analysis concludes that the different packages in use in the trials were at par, while others highlighted the superior outcomes of specific vendor solutions. With the first CTC packages hitting the market over five years ago, and given the attention industry participants are giving to CTC, it is safe to assume that the industry will soon reach higher levels of consistency.

CTC is considered a less invasive alternative to optical colonoscopy, not a noninvasive one. The reason is that patient prep is still required before undergoing CT scanning. This aspect of CTC still has room for improvement, as it remains a time-consuming process that does not always optimize CT imaging. The work of companies such as EZ-EM is commendable in this area.

Disruptive Technology Calls for Enterprise Reorganization

Recent imaging-based cardiovascular procedures that have emerged as serious contenders to the more invasive, traditional gold standards – most notably cardiovascular computed tomography angiography (CCTA), which is establishing itself as a first-line procedure ahead of invasive cardiac catheterization – have revived the ‘turf battles’ in the enterprise. With both groups presenting a solid argument, radiologists and cardiologists have been claiming ownership of the procedure. Similarly, CTC may be disruptive at first to the enterprise organization, as it stands at the crossroads of radiology and gastroenterology. At early adopter sites, these two groups have often entered into mild competition over the ownership of the procedure and are encouraged to gain certification early on. However, healthcare enterprises usually adjust rapidly to such challenges, and it is often the collaborative model that proves best at minimizing enterprise disruption, while improving patient outcomes.

February 09, 2026

February 09, 2026