June 26, 2018 —GE announced the results of its strategic review, and plans to separate GE Healthcare into a standalone company and pursue an orderly separation from BHGE over the next two to three years to make its corporate structure leaner and substantially reduce debt. GE will focus on aviation, power and renewable energy, creating a simpler, stronger, leading high-tech Industrial company. GE’s Board of Directors unanimously approved the plans.

John Flannery, chairman and CEO of GE, said, “Today marks an important milestone in GE’s history. We are aggressively driving forward as an aviation, power and renewable energy company — three highly complementary businesses poised for future growth. We will continue to improve our operations and balance sheet as we make GE simpler and stronger.”

Flannery continued, “GE Healthcare and BHGE are excellent examples of GE at its best — anticipating customer needs, breaking barriers through innovation and delivering life-changing products and services. Today’s actions unlock both a pure-play healthcare company and a tier-one oil and gas servicing and equipment player. We are confident that positioning GE Healthcare and BHGE outside of GE’s current structure is best not only for GE and its owners, but also for these businesses, which will strengthen their market-leading positions and enhance their ability to invest for the future, while carrying the spirit of GE forward.”

GE is making fundamental changes to how it will run the company. The new GE Operating System will result in a smaller corporate headquarters focused primarily on strategy, capital allocation, talent and governance. It will result in better execution, increased speed and is expected to generate at least $500 million in corporate savings by the end of 2020. Under the new GE Operating System, most resources and services traditionally held at the headquarters level will be realigned to the businesses.

GE is targeting an Industrial net debt-to-EBITDA ratio of less than 2.5 times and a long-term A credit rating. GE also plans to reduce Industrial net debt by approximately $25 billion by 2020 and maintain more than $15 billion of cash on the balance sheet.

GE expects to maintain its current quarterly dividend, subject to Board approval, until GE Healthcare is established as an independent entity. At that time, the new GE Healthcare Board of Directors will determine GE Healthcare’s dividend policy, which GE expects to reflect healthcare industry practices. Also at that time, the GE Board expects to adjust the GE dividend with a target dividend policy in line with industrial peers.

Creating GE Healthcare as a Standalone, Pure-Play Company

Kieran Murphy, president and CEO of GE Healthcare, will continue to lead GE Healthcare as a standalone company, maintaining the GE brand.

“GE Healthcare’s vision is to drive more individualized, precise and effective patient outcomes. As an independent global healthcare business, we will have greater flexibility to pursue future growth opportunities, react quickly to changes in the industry and invest in innovation. We will build on strong customer demand for integrated precision health solutions and great technology with digital and analytics capabilities as we enter our next chapter,” said Murphy.

Flannery added, “GE Healthcare is an industry leader with financial strength, global scale and cutting-edge technology. Our talented Healthcare team will continue delivering precision health solutions, building on our heritage of technology innovation that delivers patient outcomes.”

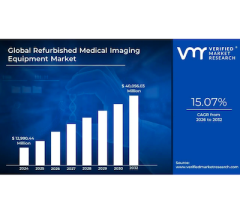

GE Healthcare recorded over $19 billion in revenues in 2017 and posted five percent revenue growth and nine percent segment profit growth in the same year. The business provides medical imaging (including contrast agents), monitoring, biomanufacturing and cell therapy technology, leveraging deep digital, artificial intelligence and data analytics capabilities. Its products and services are valued by customers in 140 countries around the world.

GE expects to generate cash from the disposition of approximately 20 percent of its interest in the healthcare business and to distribute the remaining 80% to GE shareholders through a tax-free distribution. The structure, sequence and timing of these transactions will be determined and announced at a later date, but are expected to be completed over the next 12 to 18 months. GE Healthcare will conduct business as usual throughout this process, continuing to serve its partners and customers.

Lead Director Transition

GE also announced that the Board’s independent directors have completed the previously announced lead director transition, electing Larry Culp, former CEO of Danaher, to succeed Jack Brennan, who is completing his last term on the Board. The change is effective today. Mr. Culp will also chair the Board’s Management Development and Compensation Committee. He joined the GE Board as an independent director earlier this year.

Flannery said, “As lead director, Jack has been an incredibly valuable partner and advisor to GE through economic cycles, changes to our business and our most recent leadership transition. I would like to thank him for his advice and stewardship through a period of significant change for GE. He has been especially helpful over the last year as we have conducted our review of the company and developed our plan to position GE for the future.”

Flannery added, “Larry’s track record on strategy development and execution, capital allocation and talent make him well suited to take on this role. I appreciate his clarity, transparency and business-first philosophy, and I believe his leadership will be invaluable to GE as we enter our next chapter.”

Simpler, Stronger GE

Today’s announcements follow a series of changes GE has made in the past year. With the announced sales of Distributed Power, Industrial Solutions, and Value-Based Care, and pending combination of its Transportation business with Wabtec, GE’s $20 billion divestiture target is substantially complete.

Flannery concluded, “GE’s mission and technology change the lives of billions of people around the world. We will now move forward with purpose to make our company simpler and stronger and accelerate growth across our businesses. I’m confident that today’s actions, in conjunction with other changes we have already made, will produce improved operating results and increased shareholder value going forward. We are focused on executing the strategy and implementing the structure we’ve laid out today to position our businesses for future growth.”

For more information: www.ge.com

February 04, 2026

February 04, 2026