Steven R. Renard

It is no surprise that during the past several years, the number of magnetic resonance imaging (MRI) and computed tomography (CT) scans performed in the U.S. has dramatically escalated. An aging population and technological advances are driving these testing modalities and also forming the basis for extended offerings. In 2004 alone, the U.S. market for diagnostic imaging systems reached about $7 billion. It is expected to exceed $8 billion by 2009, according to findings by Millennium Research Group.

This increase has propelled the industry to new levels, creating higher demand for revolutionary technologies, more accurate results and enhanced service. The shift in the quality of services offered at outpatient imaging centers is primarily attributed to increased competition.

The density of centers across every market has grown drastically, while hospitals are seeking to reclaim outpatient business that has trickled to smaller centers. Consequently, this upsurge is forcing outpatient imaging centers to change their ways to better compete with each other in this burgeoning marketplace.

The boutique body-scanning niche created a business model geared toward self-referring consumers. Many centers have closed because of tough economic and political issues. These centers produced results in as little as two hours and offered a spa-like atmosphere. This level of catering has been adopted in many mainstream imaging centers. Lastly, physician-owned centers are growing, contributing to market erosion.

Today, payers are placing increased pressure on centers, also contributing to the changing face of the industry. They are driving the range of services centers typically offered by requiring them to offer multimodalities as opposed to single testing capabilities. In turn, providers are rated based on the number of modalities and services offered, along with quality of care. By meeting such requirements, they may be entitled to receive preferred provider status.

Payers are more apt to award contracts to those companies offering a one-stop-shop for all imaging needs. Payers are searching for high levels of patient and referring physician satisfaction and conduct surveys to assure centers are meeting their internal requirements.

Essentially, increased market pressure and competition is forcing centers to find ways to stand out in the crowd. Independent centers are constantly trying to outperform. The smaller centers that cater exclusively to the patient, payers and physicians with whom they work are gaining popularity.

Smaller centers can offer greater flexibility and a true personal touch. The sheer nature of their size, coupled with an emphasis on technology and dedication to customer care, are enabling them to forge stronger relationships with the referring medical community and local radiologists. In turn, they offer significant benefits for the patient, payer and physician.

Differentiating factors employed by centers to successfully compete in this saturated marketplace include:

1. Stress faster turnaround times. Offering better response time for reporting is a high priority when compared with larger centers.

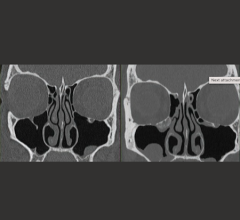

2. Incorporate state-of-the-art-technology. Keep current via continual upgrading of software and installation of top-of-the-line hardware.

3. Design centers to the comfort of the patient. Many centers are designed with women in mind, boasting among other things, calm atmosphere, pastel colors, relaxing music, comfortable furniture and alluring artwork. Many women are the decision makers for their immediate families as well as the extended unit and serve as healthcare director for the entire family. As CEOs of their households (a. k. a. chief everything officers), “she” must be catered to.

4. Emphasize convenience, ease and privacy. These are key to distinguishing a smaller center from a larger, more complex institutional setting.

5. Choose the right employees. Employ highly trained technical/professional staff and continually train in the area of customer service.

6. Partner with a good radiologist. Selecting the right radiologist sets the stage for an entire imaging operation. For example, Liberty Pacific Medical Imaging, an Encino, CA-based outpatient center owner/operator, establishes strategic alliances with well-respected radiologists, encouraging them to establish ownership without assuming personal guarantees. This business paradigm has enabled Liberty to attract and recruit exceptional physicians and practice groups as partners in new and existing centers.

7. Deliver quality images and timely reports. A center that offers high-quality images and customized reporting from local or onsite radiologists brings the community a broader offering.

8. Allow physicians easy access to films. Teleradiology gives physicians secure access to online reports and patient images. Software programs enable referring physicians to view and archive images rather than store films.

9. Contract with prominent payers. This allows the center to increase volume and build its reputation.

10. Partner with radiology groups, hospitals and specialists. This helps prevent isolation and create protection in a center’s market.

11. Employ fast, easy and accommodating schedules processes. Scheduling can be managed expeditiously while incorporating insurance verification capacities into the system.

12. Offer outstanding patient care and service. The outpatient center that incorporates these key elements will most likely succeed. As the population continues to age and modern technology progresses, the pressures to excel in a crowded and saturated market will surmount. But the upside is that patients, payers and physicians will be the beneficiaries as outpatient centers strive to enhance their offerings to keep pace with the changing times.

February 20, 2026

February 20, 2026