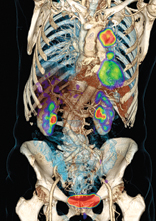

Photo courtesy of Siemens

The medical advanced visualization software market was recently examined in a report created by KLAS Research, based on surveys from end-users around the country. Two key trends were that mobile devices will play a growing role in advanced visualization and dedicated workstations will continue to play a role for the foreseeable future.

Of respondents, 46 percent believe mobile devices will impact 3-D imaging by offering more widespread adoption of 3-D imaging and allowing physicians greater accessibility and more connectivity with the electronic medical record (EMR). Depending on the volume of 3-D images, department workflow and physician demand, dedicated workstations will continue to make sense in some facilities.

Budget constraints may hinder others from updating their systems. KLAS reported most providers agree that enterprise-wide advanced 3-D imaging is great technology, but it does not make sense for everyone.

Of the physicians using advanced visualization software, large hospitals with more than 200 beds currently make up 80% of the advanced 3-D solution market. Respondents said they use the software in the following departments: 99% radiology, 49% cardiology, 28% molecular imaging, 21% orthopedics, 17% interventional procedures, 13% operating room, 12% oncology and 9% emergency department.

Market Evolution

The 3-D imaging software market has evolved from applications found on the modality workstations to 3-D-specific workstations and now to enterprise-wide systems. The enterprise solutions offer advanced 3-D imaging software that can be accessed from anywhere.

The two biggest players in the advanced visualization arena are third-party software providers TeraRecon and Vital Images. Both have been in a race to introduce new technology, the KLAS report states.

TeraRecon was the first to take the step toward an enterprise solution with NetServer, but functionality was missing from that first attempt. Following in TeraRecon’s footsteps and upping the ante, Vital Images was the first to introduce true Web-based functionality to a full-blown enterprise advanced 3-D imaging solution with Vitrea Enterprise Suite. TeraRecon then came out with iNtuition, offering full functionality.

Modality vendors have always offered some 3-D functionality and they are stepping up their game to compete with the third-party enterprise solutions. GE has seen some success and adoption with the introduction of its GE AW Server. Siemens and Philips both offer a 3-D solution. Siemens’ syngo via and Philips’ Intellispace Portal have seen some adoption since coming to the table, but the jury is still out on whether they will catch up to the levels of Vital Images and TeraRecon.

Market Leaders

The KLAS report found Vital Images maintains its lead of the market, but GE Healthcare and TeraRecon are gaining ground. Both GE and TeraRecon trended up over the last year, while Vital Images remained stable. But in new deals, TeraRecon is ahead, now being considered in 70 percent of the decisions KLAS heard about, while Vital Images was considered in 65 percent of the deals.

GE Healthcare is fairly new to the enterprise 3-D imaging arena, but is relying on a strong existing network to help provide service coverage for customers. Some respondents mentioned that AW Server is sluggish at times and does not handle large datasets well. Others said they would like to see more advanced functionality from GE.

Providers have noticed positive changes with the functionality of TeraRecon’s intuition system. Though the product is improving, some providers said they would like to see more focus on improving communication and making service more proactive.

Consistent performance over the last year has helped Vital Images maintain a slight edge over TeraRecon and GE. Providers liked the advanced CT post-processing functionality, especially for cardiac and vascular scans. Some respondents said Vital Images is expensive and not easy to work with during the contracting process; however, service and support are able get things back on track, the KLAS report stated.

Nice vs. Necessary

Radiology directors told KLAS they have not found a way to work 3-D imaging into the workflow of the radiology department effectively. Those who only send a small portion of scans to be post-processed did not see as much ROI from the enterprise solutions.

To overcome the issue of time spent to post-process images, vendors are adding increasingly sophisticated automation to immediately show specific, commonly used views for specific reads, auto bone removal and segmentation for specific anatomy and automated quantification of various anatomical measures, such as the degree of stenosis in coronary vessels or the amount of left ventricular wall motion.

What the Future Holds

KLAS said enterprise imaging’s future is pegged on adoption. Wider adoption will only happen when more clinical evidence validates the technology. Reimbursement for the clinicians will also remain an issue. However, the technology does provide clinical benefits, including quicker and more accurate surgical planning, enabling guidance for minimally invasive procedures and easier patient education in the physician’s office.

Editor’s note: For more information about KLAS and its research reports, visit www.klasresearch.com.

To see the latest comparison chart on advanced visualization systems, click here.

March 06, 2026

March 06, 2026