Over the past decade the medical imaging industry has slowly but surely moved toward the all-digital era. Storage rooms for film archives near the radiology department are giving way to temperature-controlled IT rooms with servers and storage hardware running on a fast data network. Having been trained to read on films hung from light boxes, radiologists have had to adapt to softcopy viewing, reading off of medical-grade display monitors instead. Beyond the savings incurred in film-related expenses, digital imaging has opened the door to new possibilities for viewing, manipulating, distributing and archiving radiology images through the use of IT and picture archiving and communications systems (PACS). In the wake of this digitization process, advanced visualization is emerging as the logical next step.

CT Data Overload

Recent advances in medical imaging technologies are allowing scanners to image anatomy and function with unprecedented scope, detail and speed. The benefits to patients are considerable. Volumetric imaging based on anticipated 256-slice CT technology will allow emergency departments to complete a brain perfusion study in less than one second. CT angiography (CTA) and virtual colonoscopy (VC) are two imaging procedures that were made possible by 16-slice CT in 2001 and were then made more robust with 64-slice CT in 2004. These procedures are potentially less-invasive substitutes for otherwise risky, unpleasant and cumbersome screening procedures, namely coronary angiography by cardiac catheterization and traditional colonoscopy.

As for radiologists and other specialists such as cardiologists who have become major users of medical imaging equipment, these new technologies provide a considerable amount of additional information. More information, however, leads to more time-consuming diagnoses, as well as long postprocessing times of as much as 60 minutes for a large study, hence acting as a limiting factor for patient throughput, and motivating the use of outsourced services.

Apart from being somewhat disruptive to the long established patterns of enterprise organization and clinical workflow, these advances come at the price of an explosion of image data, with the associated challenges of managing these large data sets, in addition to the challenge of viewing them in a meaningful way. Today, a single CT or MR exam can generate over 2,000 images. Key images are traditionally presented side-by-side, however with thousands of tomographic image sequences, 3D postprocessing is needed to provide an intuitive depiction of anatomy, with the ability to scrutinize images down to the voxels (the 3D version of pixels).

Advanced Visualization Specializes

The utilization of advanced visualization is expanding beyond diagnosis in the imaging departments. Specialists such as neurosurgeons, oncologists, orthopedists, and ED physicians are becoming savvy users of 3D technology, calling for the enterprisewide availability of 3D imaging capabilities. For referring physicians, 3D rendering often provides images that are more intuitive and easier to understand to the untrained eye than their 2D counterparts. They can, as such, help establish a deeper communication between the patient and his physician. These trends contribute to making 3D imaging truly ubiquitous in the enterprise.

Direct-to-Consumer 3D Imaging

Rarely have new medical imaging technologies made an appearance in the mainstream media, but on Oct. 20, 2005, when Oprah Winfrey underwent a heart scan on live television, 64-slice CT illustrated the appeal of 3D imaging to a health-conscious U.S. society. Despite the uncertain reimbursement levels for 3D procedures during their initial introduction, the new $2 million scanners that unlocked these 3D procedures had a good return on investment thanks to out-of-pocket expenditures from the public.

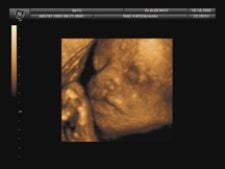

A similar phenomenon characterized the early adoption of 3D ultrasound. Initially, a common perception of 3D ultrasound is that it is of greater aesthetic than clinical value. One can easily gauge the appeal of the images obtainable of fetuses through obstetric imaging with 3D ultrasound. The fact that 3D ultrasound has been the object of such massive advertising efforts in general-public literature, in particular for its fetal imaging applications, corroborates the notion that the early demand was driven primarily by patients, and not by physicians whose evaluation relies strictly upon diagnostic value.

Since then, however, with a broadening of its clinical applications and its increasing sophistication, such as the ability to perform 4D scans, and with positive prospects in the key area of cardiac imaging, 3D ultrasound has been gaining more widespread clinical acceptance. With 3D ultrasound now available in convenient laptop and hand-held platforms, researchers predict that doctors will eventually have ultrasound stethoscopes to perform quick routine examinations. Primary physicians would use ultrasound to see the heart and check other vital signs; obstetricians to analyze a baby’s heartbeat, and first responders could use in emergency situations.

Gaining Acceptance

Following the wide adoption of CT scanners in the early 2000’s, the use of 2D and 3D image post-processing has increased dramatically in the U.S. Until the end of 2005, 3D post-processing was covered under Current Procedural Terminology (CPT) code 76375, which also included standard 2D post-processing. The number of claims for this now-expired code rose dramatically. Claims submitted to Medicare alone more than doubled between 2002 and 2004, climbing from approximately 300,000 claims in 2002 to more than 700,000 in 2004. As a result, two new CPT codes for reimbursement by the CMS were introduced that address 3D post-processing specifically.

The adoption of these codes in times of continued reimbursement cuts is testament to the diagnostic utility of 3D imaging. To date, there remain disparities in reimbursement and in the way the codes are used at every site. Nevertheless, some key procedures such as cardiac and cardiovascular CTA seem to have exploded in the last two years.

Creating a Dynamic Niche Market

The rapid rate of technological change and emerging new standards of care are creating a dynamic niche market. While the demand for advanced postprocessing is driven primarily by the deployment of new CT scanners, it is also growing within other modalities such as MRI, X-ray angiography and positron emission tomography (PET). The result is a rapidly growing market with growth rates of over 25 percent during recent years, according to the 2007 Market Engineering Research Service report (F792) North American Advanced 3D/4D Visualization for Medical Imaging Markets. High growth is expected to persist in coming years. What’s more, the market opportunity for 3D imaging systems encompasses the entire spectrum of healthcare providers. Indeed, one notable fact about the latest 64-slice CT scanners is that these systems did not follow the traditional diffusion model whereby they remain the privilege of the largest and wealthiest facilities before gradually moving down the market chain. On the contrary, early adopters were numerous and very heterogeneous, including small hospitals as well as freestanding diagnostic imaging centers. As a result, the use of advanced visualization technology was quickly established among a wide variety of user segments.

Single-Vendor or Best-of-Breed?

As things stand today, the competitive landscape for advanced visualization consists of two major vendor groups. On one hand, independent software vendors (ISVs) sell specialized 3D software and advanced clinical applications directly to end-users or through OEM partners in the PACS or the imaging equipment industry. The major modality vendors, on the other hand, provide diagnostic workstations mostly as a heavily discounted add-on to the sale of imaging equipment and are beginning to offer 3D functionality through their PACS systems, as done by several other PACS vendors.

Single-vendor integrated systems offer the obvious benefit of providing a single point of contact for support and tighter integration, creating an optimal point-of-care solution. Several facts comfort ISVs in their position within this competitive structure, however, they face the immense competitive advantage of large OEMs who benefit from large sales organizations, an extensive customer base and generous marketing budgets. As companies focused on the advanced visualization component of the larger imaging infrastructure, the end users often comment that ISV solutions are generally of higher quality and easier to use than their OEM counterparts. Also, in their role as a third party, ISVs are generally more flexible in the multivendor ecosystem, considering that the imaging equipment in place can be from multiple vendors and that the 3D solution must not be confined to a single modality. To date, only ISVs are truly capable of offering an enterprisewide approach to 3D imaging both through PACS integration and server-client technology, hence allowing access to advanced visualization to the growing number of end users across the enterprise.

3D, PACS Become Equals

In a few years’ time, 3D functionality could become an intrinsic part of the imaging solution. There is no rationale, indeed, for PACS systems to remain confined to the realm of 2D imaging, while specialized add-on software handles 3D imaging. Most PACS vendors today offer basic 3D imaging (MIP, MPR, etc.) as a native functionality or as an add-on, but not at the same level of functionality as specialized software vendors. 3D imaging places a strain on PACS systems that could call for redesigning the system around 3D. Specialized vendors of advanced visualization solutions are increasingly partnering with PACS vendors to sell their solution suites integrated with PACS. Moving forward, these partnerships are expected to evolve and strengthen, leading to PACS-embedded 3D, rather than mere integration at the application level. As a consequence, commercial agreements would give way to OEM sales of software and hardware solutions aimed at enabling PACS solutions with more complete advanced visualization capabilities.

Some also believe there is also an opportunity for current 3D solutions to evolve into a complete image management solution. Indeed, with years of experience providing modality-independent enterprisewide 3D solutions, independent software vendors could start providing the image-management component as well.

The move of advanced visualization away from the modality and into the image management system is shaping a new competitive landscape in the market. This paradigm change is already visible within the internal organization of the large OEMs. The physical gap between scanner workstations and enterprisewide systems (PACS) is a reflection of internal politics between the imaging equipment and the imaging IT divisions within OEMs. It is true that the 3D component of the imaging solution is a relatively small revenue opportunity for OEMs, considering the much larger average value of PACS and major imaging equipment deals. For this reason, OEM’s are often willing to outsource or subcontract the 3D imaging component to a third-party vendor in order to gain a more satisfied customer.

Due to the growing technological sophistication of advanced visualization systems, however, in conjunction with the expertise and technological competence of ISVs, one can expect to see more partnerships and M&A activity in the medical imaging industry in the near- to mid-term.

November 29, 2025

November 29, 2025