Navigating coverage decisions can be overwhelming and confusing, especially for high-end imaging equipment, where service contracts depend heavily on a combination of several different factors. This uncertainty has only been magnified as the Centers for Medicare & Medicaid Services (CMS) began enforcing strict compliance for equipment manufacturers’ maintenance protocols and schedules in 2010. While this increases hospital accountability and patient safety, it also requires significant upfront costs. In addition to CMS compliance, there is potential for lost revenue if equipment experiences downtime, and also liability consequences when equipment malfunctions occur due to improper preventive maintenance (PM).

Service contracts for ultrasound, like any equipment, will depend on the specific model, equipment age and hours of coverage desired. Five factors that influence ultrasound coverage include:

• Number and type of transducers

• System type (premium/high/mid/low), configuration and software

• Total number of systems and patient volume

• Peripheral devices

• Hours of coverage and PM

Ultrasound Market

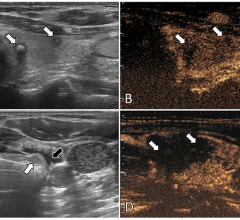

The U.S. ultrasound market is one of the more competitive medical technology markets and in contrast to other modalities in medical imaging, continues to show growth. Ultrasound platforms generally fall into four main categories and are differentiated based on the level of the technology, application software and imaging quality.

The four main categories for ultrasound include:

•

General — Equipment configured for multiple applications.

•

Vascular — Configured with software and transducers specifically for carotid artery, deep vein thrombosis evaluations and peripheral vascular studies.

•

Women’s Healthcare (OB/GYN) — Software and transducers offered specifically for women’s health applications.

•

Cardiac (echocardiography) — Involves the use of ultrasound to assess the size and function of the heart and surrounding vessels.

Within each category, price performance differentiations are premium, high, mid, low and compact/point-of-care. Premium systems are the most commonly purchased price performance level, although the point-of-care market is growing steadily.

Service Contract Price by Category

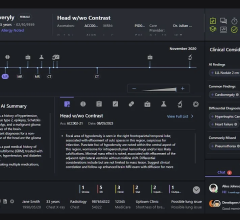

Examples of annual cost of service for major vendors and key ultrasound market segments or categories are shown in Figure 1. There is a wide variation in cost based on equipment cost and the options and applications of the system configuration. The higher service cost includes options such as 3-D software and transducers, specialty transducers and in the case of cardiac ultrasound, transesophageal echo (TEE). (See Figure 1.)

Choosing Service Coverage

Ultrasound is a heavily utilized modality and plays a critical part in the diagnosis and treatment of patients. Facilities cannot afford to have ultrasound systems out of service for any significant amount of time. Today’s technology is also software driven which makes for faster and easier access but adds to the need for more robust service coverage. Most ultrasound programs operate the equipment in 10-12 hour blocks with some operating 24/7. The number of systems, transducers, specialty transducers and the daily volume all factor into the amount of coverage required.

Most hospitals opt to purchase a full service level of coverage. While having remote and on-site support helps avoid any significant downtime, it can be costly. For hospitals looking to lower their service costs other options exist, but require assuming more risk. MD Buyline recommends to only assume as much risk as you are comfortable with, and determining this upfront.

Determining the level of risk. When accessing the appropriate level of risk for your hospital, consider the following:

Determine the utilization of the equipment: Will it be used for a high volume of patients? Does the patient volume include high risk, critical patients? Use historical data on transducer replacement rates to determine the minimal number of accidental transducer replacements to include. Use this information to determine hours of maintenance and the overall level of coverage necessary.

Factor in downtime and repair costs: Evaluate the potential for lost revenue from downtime as well as the cost for repairing the equipment.

Assess in-house support: This includes the training level of biomedical engineering (BME) staff and availability of back-up systems and duplicate transducers. If backup devices are available, the demand for immediate service is less, but these backup systems require maintenance too.

Determine the service maintenance history: Reviewing these reports can help hospitals determine if the current coverage is sufficient or if more is needed. They can also detect consistent issues with the system that the field service engineer may be unable to diagnose the first time.

Considerations for transducers and probes. Transducers are fragile and expensive to replace so regardless of the level of coverage, it is wise to carry some form of transducer coverage. Even when opting for in-house BME service, we advise keeping a transducer contract since they typically cannot be repaired on-site.

The number of probes covered can significantly affect the cost of service. Cost savings can be found by assuming some of the risk and limiting the number of probe replacements over the term. Most hospitals select one accidental probe replacement per year and find significant savings.

Approaches for lowering service costs. MD Buyline suggests limiting the number of visits during the term, limiting probe coverage and probe replacement, excluding peripheral devices such as printers and limiting preventative maintenance visits during the term. In some instances where there are multiple ultrasound systems in use, and if losing one for a period of time is not critical, time and materials are a realistic option.

Facilities with strong BME departments and multiple systems installed should consider a BME Screening or First Call level of coverage. All major vendors have training programs in place for BMEs. Although there is a significant cost associated with these types of contracts, the savings over time pay for the initial upfront investment.

Service Cost by Contract Type

Full service contracts for premium level equipment typically include business day coverage, all parts and labor, two PMs, remote coverage and unlimited accidental probe replacement. The BME screening includes first call BME with parts included and field engineer hours from 8 a.m.-5 p.m. if required. It also includes probe replacement. Limited coverage includes parts and labor, one general probe replacement and one accidental probe replacement. Limited service contracts include three remedial calls per year with field engineering hours Monday through Friday from 8 a.m.-5 p.m. TEE probe coverage includes standard hours of coverage, two PMs, probe replacement due to failure and accidental probe protection. (See Figure 2.)

Negotiating Service Contracts

In addition to selecting the optimal level of coverage to meet your needs and requirements, there are a few factors to consider in your negotiations. First, the best pricing for service post-warranty is obtained at the point of purchase and you should request, if not provided, a quote at this time for 3-5 years coverage at the level of your choice. Also, negotiate to pay for the service annually and not all upfront. Bundle all of the ultrasound equipment together to obtain multisystem discounting. In addition, consider the bundling of multimodality equipment for additional savings.

It is also important that all contracts include language that protects your facility. Below are some of the best clauses:

• Multi-Year Service Contracts: These contracts are typically priced lower. You should negotiate paying on a yearly basis and at a fixed rate over the contract term. The option to change contract levels depending on system performance, or renegotiate price depending on the service quality, should be included.

• Performance Guarantee Clause: This ensures that the equipment is performing to the agreed upon performance specification, and will eliminate any finger-pointing if a service issue arises.

• Response Time Guarantee: Response time to service problems is vital in choosing a service contract, especially with systems that can’t afford downtime. These must be provided in writing and be acceptable to the hospital before the purchase order is issued.

• Uptime Guarantee: Many vendors will provide a 95-98 percent uptime guarantee on their equipment. Vendors typically calculate uptime guarantee on a 24/7 basis but uptime guarantee should be calculated during your specific hours of operation.

• Termination Clause: All contracts should have a termination clause that allows your facility to terminate the entire agreement or terminate coverage of specific items within that contract. Clauses that impose a penalty for termination should be deleted.

Key Points

When negotiating a capital equipment purchase or maintenance contract, it is important to understand that the vendor’s goals and objectives differ from those of a hospital. Unless otherwise instructed, most vendors will automatically quote hospitals a full service contract. Keep in mind that 40-60 percent of vendors’ revenue comes from service contracts and they will typically negotiate the highest level of service at the highest price. It is up to the hospital to determine the appropriate amount of coverage, taking into consideration costs and risk. Service costs are a vital part of any purchasing discussion, and for some technologies they can be the difference of breaking even — or not — over the lifetime of the purchase.

Jon Brubaker’s background includes more than 30 years in the medical field. At MD Buyline, he covers noninvasive cardiology technologies and all ultrasound technologies.

Katie Regan joined MD Buyline in 2013, bringing with her seven years of clinical and laboratory research experience. At MD Buyline, she is responsible for all clinical, financial and general healthcare publishing projects.

April 25, 2024

April 25, 2024