The true impact that COVID-19 has had on the medical imaging industry still remains to be seen, as hospitals and imaging facilities strive to figure out this “new normal,” and the world slowly starts to open back up from the past four months of isolation, as nonessential imaging exams and procedures were postponed. Medical professionals are still unsure what the new business model looks like, but have been dedicating much of their time to figure this out, according to a new survey.

In new QuickPoLL survey on imaging during the pandemic, responses were tallied from around 170 radiology administrators and business managers, who are part of an imagePRO panel created by The MarkeTech Group (TMTG), regarding the effects of COVID-19 on their business. TMTG is a research firm specializing in the medical device, healthcare and pharmaceutical industries. Participants were selected as a representative cross-section of the imaging industry. The panel was asked nine questions about their current business to gauge the imaging impact by COVID-19, and the work that lies on the road ahead.

Some facilities opted to keep their doors open, when possible, to continue serving those who needed scans for various medical reasons, such as cancer patients. Others were able to transfer some of the workload over to off-site imaging companies to help those not allowed to perform imaging procedures during the pandemic. Off-site imaging companies did help prepare for the potential surge in patients by keeping imaging processes moving forward. But not every facility had this option, and imaging procedures fell short of expectations and in performance compared to one year ago.

Now that the COVID-19 pandemic has peaked in most states, hospitals are starting to reopen general imaging services and have seen a surge in the number of patients needing scans. So, where does the industry currently stand on imaging procedures, as compared to 2019 figures for the same time period?

The Pandemic’s Impact on Radiology

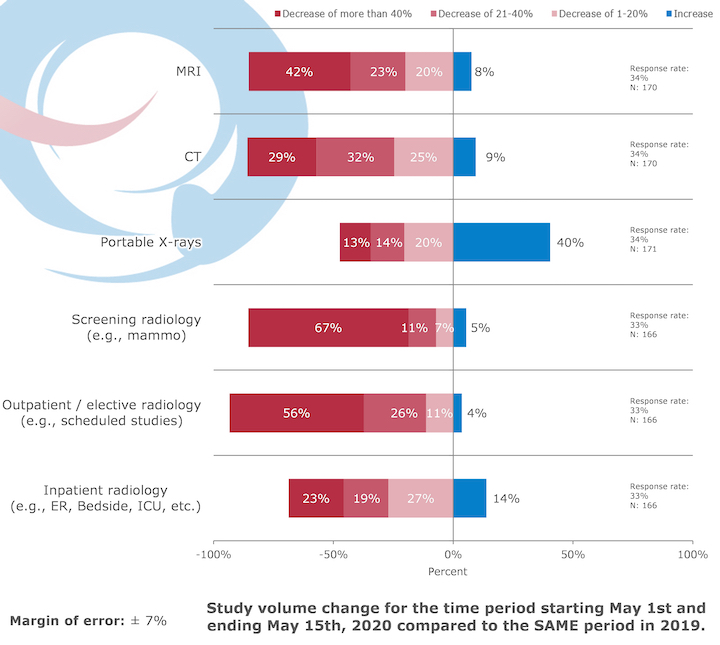

Not surprisingly, the majority of those surveyed said the number of portable X-rays conducted over the time period of May 1-15, 2020, in comparison to that same timeframe in 2019, had increased by 40 percent. Ramping up the availability of mobile and portable imaging systems during the peak of the pandemic helped increase options to image patients inside and outside of healthcare facilities. This was done to help to reduce the spread of COVID-19 and also to diagnose it sooner and easier in remote locations that were set up nationwide. Most hospitals found it was easier to sterilize a mobile DR or ultrasound system than to move a COVID-positive patient through halls, elevators and into a CT room that then needed a deep cleaning for 30-50 minutes.

In April, the U.S. Food and Drug Administration (FDA) issued guidance to provide a policy to help expand the availability and capability of medical X-ray, ultrasound and magnetic resonance imaging (MRI) systems, and image analysis software used to diagnose and monitor medical conditions, while mitigating circumstances that could lead to patient, healthcare provider and healthcare technology management (HTM) exposure to COVID-19. This remains in effect for the duration of the public health emergency declared by the secretary of Health and Human Services (HHS) on Jan. 31, 2020, effective Jan. 27, 2020, and renewed for 90 days on April 21, 2020, effective April 26, 2020. This policy is intended to remain in effect only for the duration of the public health emergency related to COVID-19 declared by the HHS, including any renewals made by the HHS secretary in accordance with section 319(a)(2) of the Public Health Services Act (42 U.S.C. 247d(a)(2)).

The biggest service decrease was in screening radiology (e.g., mammography), which took a huge hit when all elective surgeries and procedures were put on hold. Of the panelists surveyed, 67 percent saw a decrease of more than 40 percent in this area. This was closely followed by outpatient/elective radiology (e.g., scheduled studies), in which 56 percent of those surveyed saw a decrease of 56 percent. For a complete comparison of screening volume change for this period, see Table 1.

Table 1: This table shows the study volume change for the time period May 1-15, 2020, as compared to the same time period in 2019.

Anticipation of a Surge in Medical Imaging After Reopening Hospitals

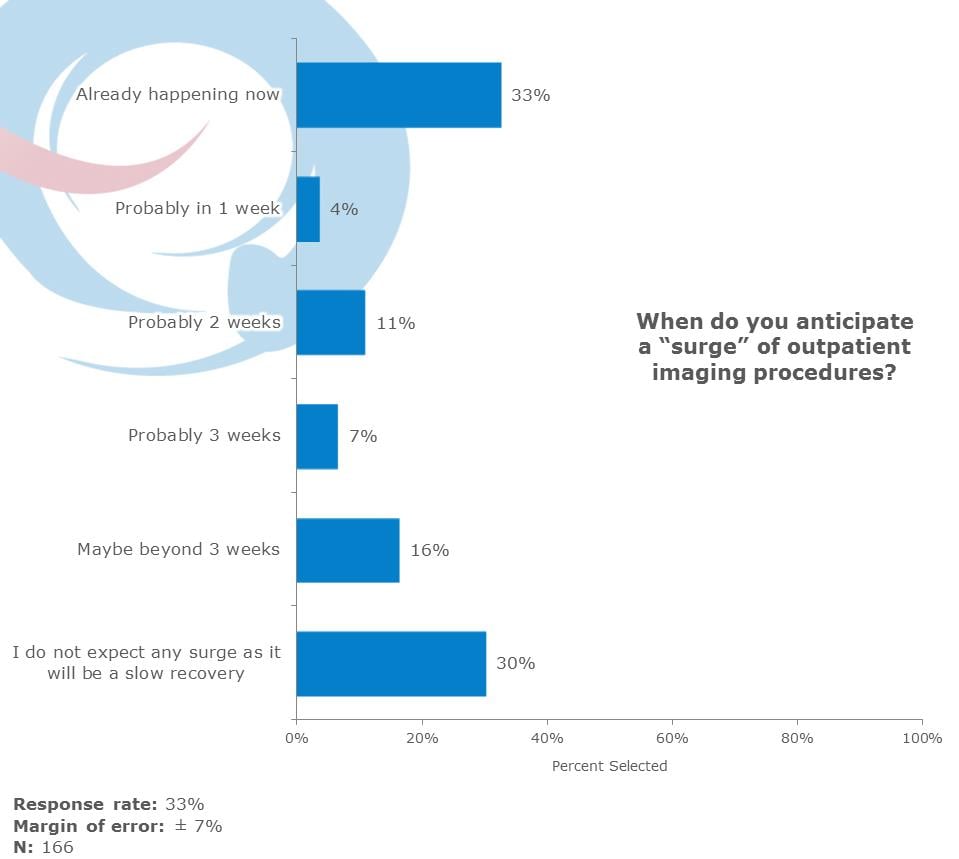

Survey participants anticipate a surge of outpatient imaging procedures — with some currently experiencing these surges — due to reopening hospitals for elective exams following COVID-19 closures, according to the QuickPoLL results. TMTG defined “surge” as a much larger volume of studies per day than what was experienced before COVID-19. Thirty-three percent of respondents said that the surge is already happening now, while 11 percent say in two weeks; 7 percent in three weeks; 16 percent beyond three weeks; and 30 percent saying they expect no surge due to a slow recovery process. See Table 2.

Table 2: This table shows the survey results of when survey respondents expect to see a surge in imaging services.

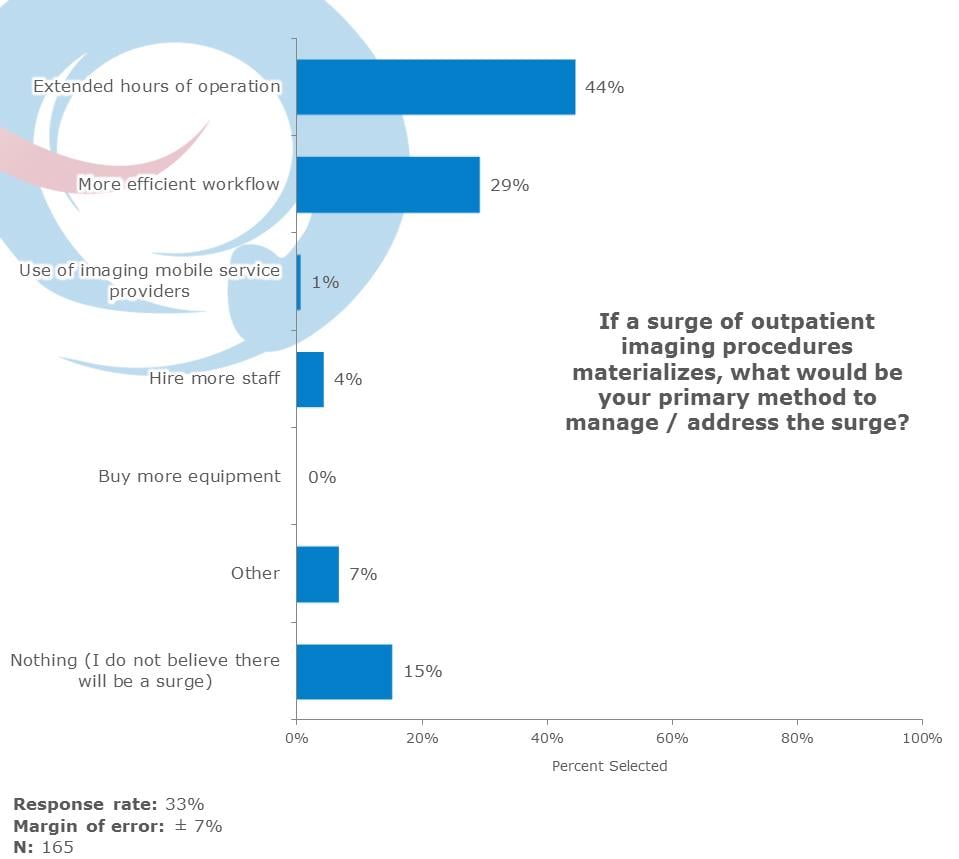

When asked if a surge of outpatient imaging procedures materializes, what would be the primary method to manage/address the surge, 44 percent of respondents said they would extend hours of operation. Twenty-nine percent would create a more efficient workflow; 1 percent would utilize an imaging mobile service provider; 4 percent would hire more staff; and 15 percent would do nothing, believing that there will be no surge of outpatient imaging procedures. See Table 3.

Table 3: Survey results on how respondents plan to manage and address the surge in imaging services.

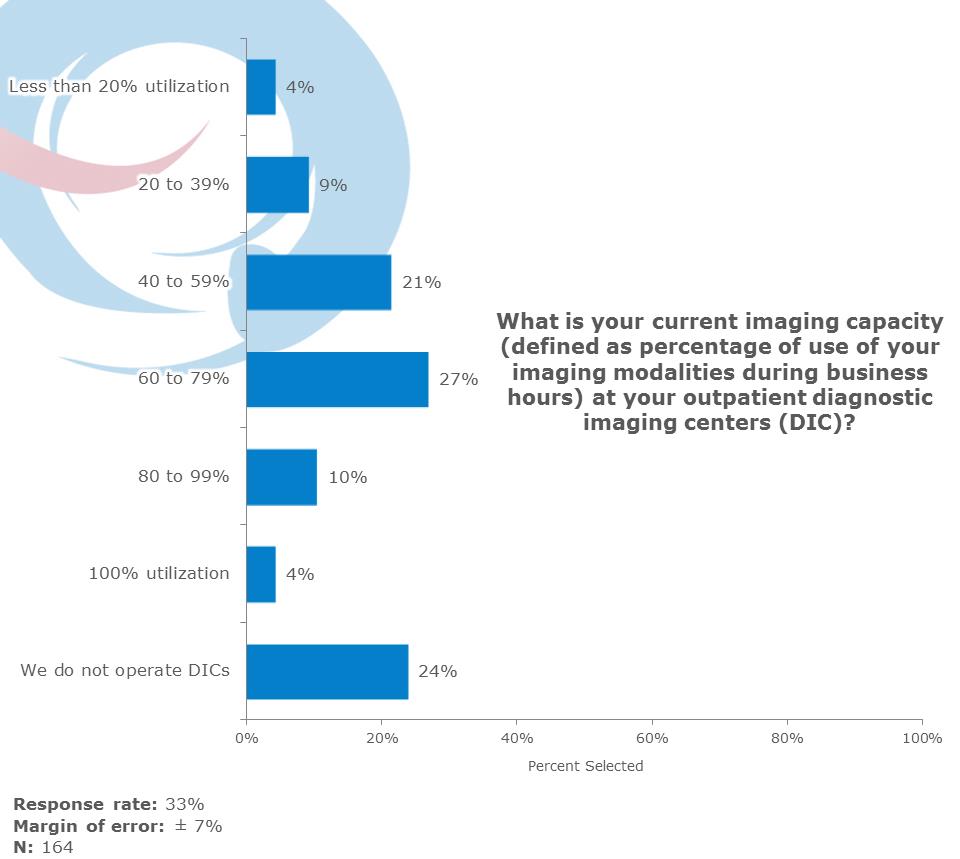

Poll participants were also asked about the current imaging capacity, defined as percentage of use of imaging modalities during business hours, at their outpatient diagnostic imaging centers (DIC). Four percent said less than 20 percent utilization; 9 percent said 20-39 percent; 21 percent at 40-59 percent; and 27 percent of the respondents said 60-79 percent. In addition, 10 percent reported 80-99 percent and 4 percent at 100 percent current imaging capacity. Twenty-four percent of those surveyed did not operate DICs. See Table 4.

Table 4: Responses on current imaging capacity at outpatient diagnostic imaging centers.

COVID-19’s Long-lasting Impact on Radiology

It can be seen from these QuickPoLL results that the coronavirus pandemic has impacted the volume of most centers surveyed. The numbers are split between whether a surge is happening now versus will never happen. Many facilities will extend hours of operation and create a more efficient workflow to manage this increase of volume. Imaging Technology News, in partnership with The MarkeTech Group, will continue to keep you periodically updated on these pandemic imaging trends throughout July.

You can find more information on The MarkeTech Group and services offered at www.themarketechgroup.com/en/solutions/imagepro-products.

April 22, 2024

April 22, 2024