Since 2016, KLAS Research has been gathering data from vendors and providers about their picture archiving and communication system (PACS) solutions. The resulting PACS 2018 report paints a picture of the current PACS market.

Standardization is driving many PACS purchases, and provider organizations have multiple factors to consider before making their choices. The purpose behind KLAS’ report is to help provider organizations decide which vendors will best fit their needs and how to achieve success with those vendors.

Good purchasing decisions require good data. Here, KLAS shares some key learnings from the PACS 2018 report about current purchasing energy, trends in vendor performance and provider-approved keys to success.

Purchasing Energy

Most U.S.-based PACS vendors have gained customers since January of 2016. Several vendors contracted with many provider organizations, making significant progress in the market. For several other organizations, net new contracts (not including wins due to consolidation) were few in number, but large in scale.

Intelerad and Sectra had the most validated net new contracts (28 and 22, respectively). In the past, IntelePACS was seen most often at outpatient facilities and Sectra PACS in clinics, but both have notably increased their hospital presence over the past three years.

Change Healthcare, Carestream, Fujifilm and Philips also did relatively well. The 2017 Change Healthcare-McKesson merger hasn’t stunted the growth of McKesson Radiology, which is still the PACS most likely to be chosen by large, high-volume organizations. Carestream Vue PACS’ impressive functionality and price point make it a continued favorite of small organizations. Several integrated delivery networks (IDN) have recently picked Synapse and IntelliSpace PACS. Fujifilm customers appreciate Synapse’s breadth, and Philips customers have their eyes trained on the vendor’s road map.

Merge was among the vendors with a handful of large wins. Despite the hype surrounding IBM Watson’s offerings, no customers have told KLAS about any tangible outcomes of the technology thus far. However, curiosity about the technology and Merge’s reputation for strong partnerships continue to attract providers’ attention.

A few new net customers went to Agfa HealthCare, Infinitt and Novarad. Customer misgivings are leading to slow transitions from Impax to Enterprise Imaging for Radiology. Infinitt’s strengths in cardiology and service have earned them a small number of new deals, but a terrific reputation. While Novarad’s recent gains have been modest, the improvements in their relationships and support have stabilized the vendor’s current customer base. GE Healthcare still boasts a very large footprint and many provider considerations, and did achieve some wins with providers who were consolidating, but they have won very few net new customers since 2016.

Many outpatient organizations have turned to the less familiar Konica Minolta and PaxeraHealth. These small vendors are not yet measured by KLAS, but are gaining traction in the market because of their low cost.

Vendor Performance

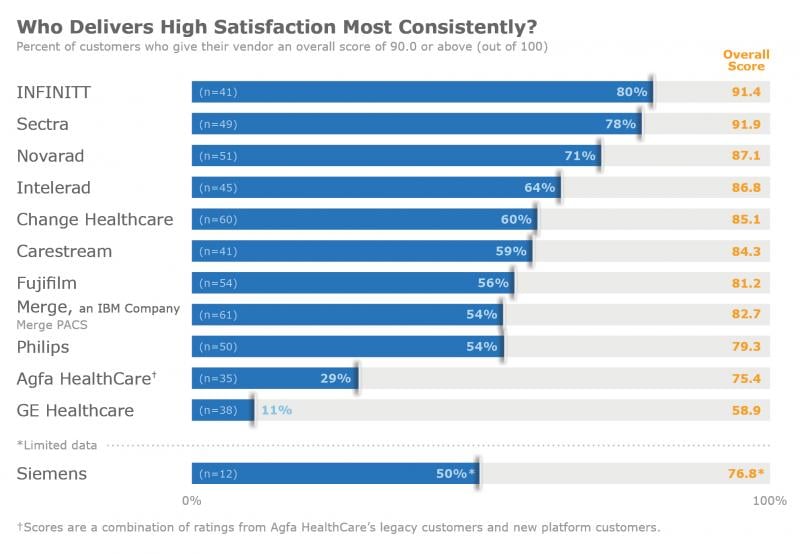

No matter how carefully a provider organization chooses its PACS and vendor, unplanned challenges always arrive at some point. That is why excellent tools and ongoing support are essential. Some vendors do better than others at providing both products and relationships that live up to customer expectations. (See Figure 1.)

The most highly satisfied PACS customers are with Sectra and Infinitt. Sectra’s commitment to pro-active customer service, continual product improvements and superb training helps users achieve quick wins. Infinitt holds a similar position. While some customers would like quicker follow-up on tickets, most are exceptionally happy with the vendor’s product development and fair treatment.

In the past year, Novarad and Intelerad have each made improvements that show in 2018 scores. Novarad’s sometimes buggy upgrades gleaned mixed reviews, but their outpatient customers rated their vendor about 10 points higher this year because of improved customer service. Similarly, improved executive involvement has impressed Intelerad customers. Some dislike the newly introduced tiered support structure, but others talk up the support staff.

While most Change Healthcare and Carestream customers are relatively pleased, they still described a few problems. The smaller Change Healthcare customers are the most satisfied. Larger customers feel that they receive insufficient support and functionality. While they receive reliable software, too many Carestream customers experience implementation and training problems, and the recovery is often slow.

Merge, Fujifilm and Philips make up the middle of the pack. Seen as strategic and strong in several areas, Merge nevertheless disappoints some customers with merely average technology and service. Fujifilm’s v.5 update is a significant improvement, but customers want the vendor to be more pro-active. Many providers eagerly await Philips’ new enterprise imaging technology. (See Figure 2.)

Keys to Success

While choosing the right partner is very important, many of KLAS’ provider friends have shown that it is possible to achieve success with any vendor. The most satisfied customers — as well as the least satisfied — have offered advice on how organizations can make the best of their PACS.

Some best practices begin long before a product’s go-live. For instance, every healthcare organization should make sure their contract incorporates everything the end users will need. Providers should do all they can to make sure that support and upgrades are covered in their contracts, even if they have to pay a higher price.

Organizations lacking experience in data migration may benefit from hiring a third-party firm to help with the process. But this approach isn’t best for all groups. Those with limited cash may prefer to do the work themselves and keep communication simple.

Collaboration is crucial to a smooth implementation process. Healthcare leaders ought to confirm that their vendor has positive methodologies, resources and communication habits so that they can work well with the provider organization. Internally, healthcare leaders should encourage the IT and clinical stakeholders to participate in every stage of the project.

Because KLAS’ research shows that training quality is the second-strongest predictor of long-term customer satisfaction, healthcare organizations should make training required for all users. Choosing great trainers and incentivizing participation will maximize training’s positive effects.

Customers also supplied specific tips for succeeding with their respective vendors. For example, providers with PACS solutions from Carestream, Change Healthcare and GE Healthcare encourage new customers to actively choose how training will be done.

Using account representatives to channel support is a recommended tactic for Cerner, Intelerad and Philips customers. On a similar note, Fujifilm and Infinitt organizations may need to be internally pro-active in the support process if they want to see positive outcomes.

Some provider organizations may need to arrange for something extra in their contract. For instance, the standard Agfa HealthCare package doesn’t necessarily include functionality for 3-D construction. Merge customers may also need to plan on (and pay for) more support than they think they will need.

Customers of Novarad, Sectra and Siemens could gain from managing expectations of their vendor. Novarad customers should know that the support staff turns over frequently. Every financial stakeholder in a Sectra deal must understand the pricing model before a contract is signed. And finally, providers working with Siemens should meet with the vendor often in order to keep tabs on the vendor’s road map.

Many Options

The PACS market may be well established, but provider organizations still have many options and elements to consider while making decisions about their PACS solutions. By following the advice of fellow providers and determining which vendors will satisfy expectations, healthcare IT leaders can set their organizations up for success.

Monique Rasband is a vice president of KLAS Research. Katie Brooks is a research editor at KLAS Research.

April 11, 2024

April 11, 2024