November 21. 2013 — Exponential growth in vendor neutral archive (VNA) study volumes is forecast to drive strong demand for VNA solutions in the next five years, according to a report titled “Medical Enterprise Data Storage — World — 2013” from IHS, a global source of critical information and insight.

The migration of picture archiving and communication system (PACS) images to VNA will largely drive the growth. In addition, other imaging departments are also adopting the concept of VNA interoperability.

Asia-Pacific has been identified as a high-growth region, with the annual VNA study volume growth estimated at 83.3 percent. This is predominantly due to legislation and increasing support for interoperable care between departments and healthcare provider sites in Asia during the next five years.

“The migration to VNA has been the biggest trend in the healthcare IT market for the past 18 months,” said Shane Walker, senior manager for consumer and digital health research, IHS. “VNA is set to be at the forefront of how all hospitals manage their patient images during the next decade. The technology is moving beyond its initial goal of simply managing PACS images. Instead, migration of PACS to VNA also is leading to the establishment of solutions for non-PACS departmental information, thereby shaping the future of how all information is shared and stored in healthcare.”

The management of images is becoming more important. The key objective is to share images between physicians in multiple regions, and even countries, irrespective of vendor or location.

Australia provides an example of this: with its six states and multiple territories, vendors seek to provide state-level solutions in order to improve the interoperability of care. A similar approach is being taken in countries such as China at a provincial level, albeit at a slower rate compared to Australia’s VNA adoption.

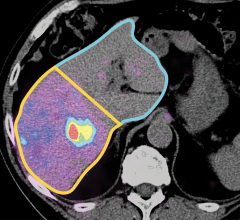

At a healthcare provider level, all hospital departments using image archives have a growing need for VNA software that accommodates their imaging needs, which include both image sharing and providing business continuity. Although VNAs have served these needs so far, demand for improved interoperability is growing at a departmental level for image sharing. Radiology and cardiology are well ahead in this area, with PACS images increasingly migrating into VNAs.

Dermatology images, endoscopy videos and sleep and gait analysis studies are touted as the next types of departmental image information suitable for migration. To date, non-DICOM (digital imaging and communications in medicine) files such as JPEGs, TIFFs, PDFs, MPEG videos and WAV audio — although falling within the VNA definition by HIS — have had little influence in the VNA market. However, with ever-increasing requirements for interoperable patient care within hospitals, the non-DICOM world is set to propagate beyond PACS, offering a wealth of new migration opportunities for VNA and healthcare information technology vendors.

Pathology, dermatology and ophthalmology departments are making significant attempts to follow in the footsteps of the PACS world. Changes at a departmental level in these areas to adopt VNA platforms will be a major factor for growth of study volumes in the VNA market.

The major challenges for image sharing between healthcare providers vary by region. In the United States for example, the prospect of a patient’s image being used and followed up on by another healthcare professional in another institution is unlikely due to the inherent complexity of the U.S. healthcare system and insurance providers. On the other hand, Western Europe has an opposing view in that interoperable care will drastically improve clinical workflow efficiency not only between departments, but also between healthcare providers.

VNA is set for significant growth and new market opportunity. Radiology and cardiology have led the way for integration of VNA into departmental and site level interoperability, with other departments set to follow during the next five years.

Moreover, regional and even international sharing of healthcare image data is increasingly likely with wider VNA adoption. This is highlighted by the strong prediction for VNA study growth, with the five-year growth forecast at 990 percent, 220 percent and 1,960 percent for Europe, Middle East and Africa (EMEA), the Americas and the Asia Pacific regions respectively.

For more information: www.ihs.com, www.imsresearch.com

© Copyright Wainscot Media. All Rights Reserved.

Subscribe Now

April 11, 2024

April 11, 2024