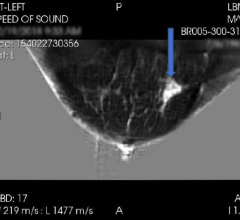

Stroke is the leading cause of long-term disability in the U.S. Siemens SOMATOM CT and CT Neuro Engine offer a solution for many aspects of neuroradiology.

With the combined impact of the Deficit Reduction Act (DRA), the credit crisis, the economic slowdown, and the uncertainty of pending healthcare reform legislation, we have created the perfect storm.

These market conditions have all greatly undermined non-profit institutions in their ability to raise capital and has placed downward pressure on patient’s ability to pay for procedures, resulting in postponed purchases of capital equipment costing more than $200,000, whether it is CT, MRI or any investments.

But since there is plenty of imaging service capacity in the market in every modality, utilization will continue to increase gradually because of demographic pressures over the next five years. By postponing purchasing of capital equipment, hospitals are pushing the envelope on capacity and must improve scheduling, workflow, throughput and the utilization of the current install base. But that will only last for so long. At some point, CFOs will have to re-open budgets for new investments.

To gain better insight on what to expect in the diagnostic imaging market for 2010, Imaging Technology News spoke with Christian Renaudin, D.V.M., Ph.D., MBA, managing partner and CEO of The MarkeTech Group LLC, a leading medical-technology market research firm, along with other industry experts.

CT (Computed Tomography)

CT has become clinically positioned as a key triage tool in many care areas, whether in the ER, MSK, workup involving abdominal pain and even some cardiac pathways. It will continue to be a central modality in both inpatient and outpatient care, and you can’t deliver care unless you have equipment that functions. You can stretch the lifecycle of your equipment, but at some point you will have to replace it.

There are two vectors – one is obsolescence and the other is capacity. What drives purchase of new equipment in a non-replacement mode is additional need for capacity. In the past, purchasers were overly sensitive to capacity. Typically, one week’s backlog warranted investment in another unit for CT because stakeholders don’t want their clients to go to the competition. That is a key metric for outpatient imaging centers and also hospitals. I think that this has been relaxed this year because of economical reasons, but it still is a factor.

The other factor is obsolescence. Doctors can still get good clinical diagnostic accuracy with existing equipment. But in absence of clear guidelines, you will see a lot of disparity in the market as to what constitutes an obsolete piece of equipment. Some clinicians will still use a one-slice CT and do just fine. Some think that if you do not have a 16-slice CT, you can’t do a good job. That is up to the institutions’ perception of obsolescence, and there is a segmentation effect that drives the notion of obsolescence beyond simple accounting rules. If you are a well-known high-end tertiary care facility, then you will not have a one-slice CT, as opposed to a general purpose for profit outpatient, which could do fine with a one-slice CT because their case mix may not warrant the need for more up-to-date technology.

There is also the cost of maintenance factor. Older equipment is more expensive to maintain than new equipment. This is an important economic decision to be considered because even if the equipment is fully amortized you still have the high-cost of running older equipment.

Radiation reduction concern is becoming more important and has been catching up with the European community for at least six or seven years. As to whether radiation reduction is a key driver for choosing a CT system – I think it is still a secondary factor. If you look at pure economics when considering a purchase, throughput, speed of the exam, and access to higher-end applications is most crucial. Unless a manufacturer can offer lower radiation with the same performance, radiation will remain a secondary driver.

MR (Magnetic Resonance)

Will 3.0T MR systems experience increased growth, and how will it compare to sales of 1.5T systems?

If the need is motivated by more signal to noise, then yes, MR 3T will grow. The reason 3T was not growing by as much as it should have grown beyond the inner circle of academic early adopters was that there were some limitations with artifacts; the application package was limited (versatility of use issue); there was an issue of patient comfort (3T MRI gradients are very noisy); and finally the cost of those systems. If you have a higher field, you are buying more “currency” that you can use for speed and/or spatial resolution. But magnetic field strength is not the only consideration. Gradient performance, channel count and coil technology are also very important for high throughput. There is a potential for 3T MRI to become the next standard, but I don’t see that happening immediately. 1.5T still has good years to live because it is very versatile, it is patient friendly (wider bore design) and very robust. There are technical challenges with 3T’s, and 1.5T delivers very good imaging for most applications (brain, MSK), if you focus on spatial resolution with good coils as opposed to speed. From a macro trend analysis, signal-to-noise ratio is the driving force in MRI, and with 3T you have more.

Other trends in MRI, according to Hiroyuki Fujita, Ph.D., president and CEO of Quality Electrodynamics (QED) are wider bore apertures and making an MRI scan time much shorter so that the patient feels more comfortable and the patient throughput can be much improved. Miniaturization of MRI coil components such as a preamplifier plays a major role for that purpose. In order for the MRI scan time to become shorter, one strategy is to increase the channel count of MRI RF coil receivers. Since the MRI coil enclosure is rather fixed in its shape and size depending upon the anatomy of interest to be imaged, the components that are enclosed/housed in the coil have to be made smaller if the number of receiver channels needs to be increased. QED has developed the ultra-compact MRI preamplifier so that the RF coil channel count can be increased for improved signal-to-noise ratio. With this higher channel count RF coils, we can achieve the increased ability to detect smaller abnormalities.

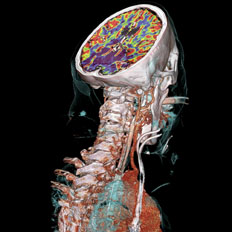

A unique application that is increasingly used involves MRI integration of diffusion tensor imaging, which creates 2D and 3D color images of the fiber pathways in the brain. This technique is providing neuroscientists information about fiber pathways in the brain and is especially useful for treatment planning by neurosurgeons prior to surgery.

PET (Positron Emission Tomography)

Oncology applications continue to drive PET/CT (PET) adoption, not neurology. PET for cardiac imaging is not yet very economical and clinically is not driving adoption. Cardiac will not be the driver of PET unless there is an agent that is cheaper to produce than FDG. But that would kill SPECT as the bread and butter modality, and therefore the OEMs would probably offer a less expensive PET before killing their cash cow in SPECT. If you offered a PET scanner that was less expensive along with a new agent that would not require a cyclotron, then you’re talking about something very interesting. Dr. Daniel Berman, a cardiologist at Cedars-Sinai Medical Center in Los Angeles, is very excited about some new agents in the pipeline, which could totally disrupt the current model of office-based cardiac nuclear imaging, which is SPECT. There might be some disruptive agents on the camera side for cardiac PET as well that may surface in the next five years.

SPECT (Single-Photon Emission Computed Tomography)

The focus in single-photon emission computed tomography (SPECT) is on the improvement on the camera side with CZT for cardiac SPECT. Digirad was the first to use CZT for cardiac SPECT, but the challenge was the economic model with the high cost of CZT, and there were field of view issues. This past June, GE introduced the Discovery NM530c, with a new detector based on CZT, which is better than crystal.

Today, innovation in SPECT is on the detector, not on the isotope. The speed of acquisition is the most disruptive change, and improvement in image quality. They are still using the same agents where the spectral profile is inferior, and there is a lot of spectral overlap. You could have the best camera in the world, but if your room is lit by a candle, there is not much you can do.

Hybrid Modalities

There are two different categories of hybrid modalities. The first category is where one modality acts as an enhancement to the main modality’s image – almost like a contrast media. The second category is where both modalities equally contribute to diagnosis, and could be used independently from one another and bill for it.

The most relevant example of that is SPECT/CT. In SPECT/CT today SPECT is the primary modality and CT is the secondary modality because usually it’s a non-diagnostic CT. The vendors have been trying to offer both diagnostic CT with SPECT or non-diagnostic CT with SPECT. The first vendor to do non-diagnostic CT with SPECT was GE with the Hawkeye. The CT is used as a projection map to perform attenuation correction for the SPECT. The CT is there to grossly define the anatomy, and guide the reader, but you could not use the CT independently; it’s non-diagnostic. Those products have been extremely successful; they have sold hundreds and hundreds of units around the world.

Now an example of a balanced and clinically useful modality is PET/CT. PET/CT has become the standard for oncology imaging. I don’t think the future of dedicated PET is guaranteed anymore. The reason for this is there is tremendous value in getting both the PET and the CT image together, and here the CT is diagnostic. Oncology applications drive the clinical need, either for diagnosis or treatment planning for radiation therapy. You need the CT. You could argue that PET is considered the “functional” contrast agent for CT, in other words, PET provides the hot spots on a CT image, and that is why a lot of radiologists read them. In contrast, if you are a nuclear clinician, your focus is PET, and CT is just there to guide you for the anatomy. You will get a different story depending on the reader. This is a good indication that the hybrid is very balanced.

Other examples of clinically useful hybrids are PET/MRI, but it is a long shot in this economy because it is very expensive. There are different PET/MR models: the Siemens model where a PET insert goes into the MRI bore. The Philips model where both modalities are in line and the patient can be moved on a table from one scanner to the other. Both have merit and both address different clinical needs. The adopters are the high-academic sites, whether it is the PET insert or the in-line solutions, however, the economic value of the PET/MRI is not yet certain. Clinically there are reasons to do both PET and MR because there are shortcomings in MRI, although MRI technology will probably catch up in 20 years. The area where the two modalities compete the most is in cardiac imaging because both can offer great perfusion imaging. PET is more the gold standard for absolute myocardial perfusion. MRI is getting more traction in cardiology and provides more information than PET alone.

The areas of need are in the brain for Alzheimer’s disease and other chronic degenerative diseases where you have to do fusion imaging. There is also a need for PET/MRI in the abdominal areas for tumors because now they use soft fusion and the idea of the hybrid is to avoid the soft fusion step. The hybrid model also offers clinical workflow advantages and image fusion is not workflow friendly.

Another combined modality is cath lab/MR for interventional procedures, with the challenges being the cost of the infrastructure and the different types of techs required.

There has been a lot of talk about optical and MR, ultrasound and MR, but I think both are still in the lab today. There isn’t any clinical validation for those yet.

Ultrasound could be looked at as a tomographic modality. There is potential for ultrasound tomographic imaging to be combined with other tomographic modalities such as MR or CT.

Multipurpose detectors represents another hybrid modality area. Bruce H. Hasegawa, Ph.D., of University of California San Francisco, was working on a detector that would receive both gamma rays and X-rays. The clinical indications would fall under the area of SPECT/CT.

For hybrid modalities to work and be accepted, you need to have a justified clinical need, and secondly you need workflow economics. The big OEMS had a lot of projects involving the hybrid modalities that are on the back burner because of the economy. U.S. sales of high-end modalities fell by 20 percent this year. Right now we must wait and see what will happen with the Obama healthcare reform.

Ultrasound

The low cost of ultrasound is driving adoption. What is deceiving is that this is a modality that requires the user to be sono-anatomy trained and not all physicians understand that. Plus, the miniaturization of ultrasound creates the impression that the ultrasound is a less expensive system. So those two factors disrupt the economic model of the ultrasound, which is forcing down the pricing on higher-end systems.

As compact ultrasound systems that can be carried, instead of using a cart, do Doppler and have other advanced features, the higher-end systems seek to retain their additional value. The high-end system can offer more probes than a compact system, it offers harmony imaging, and software such as 3D/4D. However, there is a not a huge demand for 3D/4D imaging — it is a differentiation strategy to justify the price for the high-end equipment.

There is a role for both, and the market is in the process of redefining the product categories in ultrasound. There are two important dimensions that define ultrasound. One is the versatility of use and the quality of the machine. The other dimension is how you will use it in the clinical setting. Is it for radiology or medical specialties or primary care? It depends on the application. For radiology, the application is diagnostic. It is the diagnostic lab approach where you bring the patient to the lab, and therefore you want to maintain image quality, high throughput and sonographers want more software and sophistication.

Women’s Health

Will breast MRI continue to have a strong impact as a breast-screening tool in 2010?

Breast MRI is a growth application for MRI. The model is what I call conditional screening. You can’t use MR for screening from an economic standpoint, but you could use it in conditional screening. If you are an at-risk patient, let’s say you are HER-2 positive, then instead of sending you to a mammogram, there are good clinical reasons to send you directly to an MR. It is a very sensitive modality, and it is better at picking up diseases for a high-risk group. But if you’re not at high risk, then you would go to mammography first, since MRI is typically a second or third line diagnostic test.

Once the FDA clears tomosynthesis for breast cancer screening, even if tomosynthesis is very promising and has good results, a lack of inertia in healthcare means it will be a long time before it becomes the standard of care.

Another technology that is experiencing incremental but steady adoption is breast-specific gamma imaging (BSGI), or molecular breast imaging. BSGI evolved from a related nuclear medicine imaging procedure of the breast, scintimammography, and both are based on the enhanced uptake of sestamibi in tumors within the breast. For years, scintimammography showed considerable promise to be a strong diagnostic tool in the early detection of breast cancer. Limitations with reliable detection of sub-centimeter lesions or direct correlation to mammograms, have been overcome and the technology is now commercially available.

DR / CR

The digital radiography (DR) and computed radiography (CR) is a very mature market. In the studies we have done, we find that the overriding issue is workflow environment. If you have a need for point-of-care impact, then CR is more applicable because of its mobility. Over the last five years, DR has maintained the same price point. So, CR versus DR is a workflow and volume decision. Improvement in imaging quality alone is not the debate as much as a workflow and patient mix.

IGRT (Image-Guided Radiation Therapy)

According to vendors that ITN spoke with, the emergence of (intensity-modulated arc therapy) IMAT and VMAT (volumetric modulated arc therapy) treatment delivery techniques, on-board imaging and treatment planning has become increasingly important. Expansion of radiation treatment departments over multiple locations, and a growing need for remote, enterprisewide access to all radiation treatment capabilities, will include imaging systems for planning, review and approval. There will be more elaborate decision support based on multi-modality imaging. There will be greater use of biological markers to direct therapy decisions, new imaging agents for PET and SPECT imaging, and greater use of functional MR.

Image-Guided Technology

High-intensity focused ultrasound (HIFU) or MR imaging-guided focused ultrasound surgery is a therapeutic modality that burns uterine fibroids and prostate cancer. Outside of the radiology-imaging world, in the surgeon’s office, there is a lot of growth potential in outpatient therapeutics using non-invasive or semi-invasive tools, such as RF ablation and cryoablation. All of them are either guided by fluoroscopy or ultrasound because it’s done at the point of care. Because MR or CT-guided procedures are expensive; if you have an MR used to guide a biopsy procedure, you are losing income on diagnostic throughput, because you are taking away the MR for an hour from diagnostic imaging, and the procedure may not be as well reimbursed as the diagnostic test. Using MR just for guidance is a very difficult economic model to prove, unless the facility only uses it for therapeutic purposes. But if you look at the whole OR environment, where fluoroscopy is king, as well as ultrasound, you get real-time navigation, whether for spine, brain or orthopedic applications, which is growing. The main players in virtual navigation are Medtronic, BrainLab, Stryker and GE Healthcare.

The largest market for image-guided procedures is the office-based outpatient centers. There are many players unrelated to imaging in that sector and the king modality for guidance is fluoroscopy and to some extent ultrasound.

The second big area is OR with fluoroscopy as the main imaging modality along with pre-acquired CT or MR datasets. The third big area is the diagnostic centers that are attempting to become therapeutic centers (with solutions like MRI-guided HIFU), but that economic model is not proven yet.

Cardiac Imaging

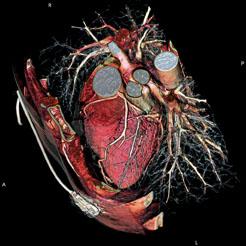

In cardiac CT, Dr. Renaudin indicates there will be an increase in 128- and 256-slice scanners to help decrease procedure times and increase resolution. However, he said so far there are no good clinical studies showing these high-slice systems are any better at diagnostics than a typical 64-slice system. He expects sales will do better when these studies begin to surface.

One set back in CT is in overall sales, which Dr. Renaudin said dropped by 20-30 percent in the United States over the past year due to the recession initially and now with the uncertainty of the pending healthcare reform.

He said the U.S. market is widely seen as the engine for purchases in the worldwide imaging market. Until the U.S. sales pickup he expects the CT market to remain flat worldwide. The lack of cardiac CT reimbursement has been a major issue holding back the modality, Dr. Renaudin said. “Some modalities are not well valued by payers,” he said, including cardiac CT and MRI.

However, the American Medical Association announced in October it created four new Category 1 CPT codes for CT artery calcium scoring and coronary CT angiography (CTA), effective Jan. 1, 2010. The new codes offer a universal insurance billing code for cardiac CT, which previously did not exist and opens the door to reimbursements in 2010. This move will likely change the attitudes toward CT and open the likelihood of its expanded use in cardiology.

The growing awareness of the risks of radiation exposure, said Dr. Renaudin, is driving manufacturers to find ways to reduce radiation, including faster, higher-slice CT scanners. Faster scanners will result in the need for new, faster contrast media injectors that can keep up with the pace. He said these new injectors will be designed in ways to help reduce the amount of contrast agent that is used and will better integrate with EMRs. This evolution will include more dual-chamber injectors, because single chamber injectors cannot keep up with the faster speeds and require bolus and saline flush protocols.

CT Angiography

Will the utilization of CT angiography (CTA) for diagnosing patients for cardiovascular disease outpace the use of angiographic X-ray in the cath lab for the same purpose?

Dr. Renaudin notes that CT angiography imaging service providers are at the mercy of reimbursement. In theory it makes sense to consider CT before you consider an invasive diagnostic procedure. If you can see a coronary artery affected by atherosclerosis nearly as well as you could on an angio system, you would want to do the noninvasive test first. In terms of guidelines, you should consider CT a rule out of coronary artery disease before sending a patient to cath lab table. Depending on the work up, some patients are sent directly to the cath lab because there are findings that warrant a potential intervention. Why do a CT if you can get the patient on the table directly, get a diagnostic image in the cath lab and intervene on the spot? There is no reimbursement for an asymptomatic patient for a screening test with a CT.

Just like angiography, the data is just topographic or anatomic in clinical terms; there is no functional information in CT. So during a CT exam you might see a lesion that may or may not impact the patient’s mortality risk. CT will not show you the unstable plaque and will only tell you morphologically whether the lesion warrants the placement of a stent. That doesn’t address potential ischemic risks, which are better assessed with stress nuclear imaging or stress echo.

Yet, it might be inappropriate to send borderline patients to the cath lab because there is a potential risk and it is expensive. So there is good reason to consider CTA.

As Stephanie LaBelle, senior analyst, Millennium Research Group, indicated, CTA will grow in importance as a tool for diagnosing coronary heart disease (CHD). Use of CTA will increase due to its ability to rule out adverse cardiac events in patients deemed to be at a low risk of developing significant blood flow-restricting CHD. In a recent study published in the American Journal of Cardiology, researchers found that CTA was able to correctly identify all non-negative cases at a fraction of the cost of a nuclear medicine and invasive angiography procedures. In addition to the speed with which patients can be scanned and the high availability of computed tomography (CT) scanners in emergency departments and catheterization labs, these new results will lead to widespread adoption of CTA over the next year.

Nuclear Medicine

Nuclear medicine, which has been buffeted by a shortage of radioisotopes, will continue to be the most popular choice for myocardial perfusion imaging, said LaBelle. The use of nuclear medicine systems in cardiac imaging has, however, been negatively affected by the erratic supply of technetium-based radioisotopes. With the continuing shutdown of the Chalk River reactor in Canada disrupting isotope supply to many North American facilities, nuclear medicine procedures have been limited. In the face of this crisis, physicians have been forced to resort to dual-isotope studies, which use thallium for images at rest and technetium for stress imaging to eke out more studies from their current supply of technetium-based isotopes. Facilities have also had to resort to using CTA, echocardiography, and traditional angiography to cope with erratic technetium supplies. With the Canadian reactor not expected to be back in production until the first quarter of 2010, the current outage will continue to hinder nuclear medicine cardiac scans. Once the reactor resumes production, market conditions will be alleviated to some extent; however, the planned maintenance of the Petten reactor in 2010 will ensure that the supply chain will continue to remain fragile.

MRI vs. SPECT

“For years we have been predicting cardiac SPECT would die and cardiac MRI would take off,” Dr. Renaudin said. “I think the predicted death of SPECT is going to be delayed for another 10 years.”

He describes MRI as a one-stop shop for cardiac imaging because it can provide the same anatomical imaging as CT, the same information as echo, and the same perfusion imaging as SPECT nuclear scans. MRI also does not expose the patient to any radiation. However, he admits MRI is expensive and is not easily accessible. He said the economics for dedicated cardiac MRI are just not there, so for now SPECT imaging will likely remain the dominant perfusion imaging system. He said SPECT gamma cameras are also cheap compared to MRI systems and are available for in-office use, while MRI sitting cost is too expensive to serve as an office-based machine.

He said the quality of SPECT imaging is also improving. In June 2009 GE Healthcare released its Alcyone Technology, a nuclear cardiology SPECT platform combining cadmium zinc telluride (CZT) detectors, focused pin-hole collimation, 3D reconstruction and stationary data acquisition. GE said the technology is designed to improve workflow, dose management and overall image quality. GE claims that Discovery NM/CT 570c will cut scanning times from 20 minutes to three minutes. Other equivalent technologies already exist in the market (Digirad, Spectrum Dynamics), and it is still early to be able to compare the different products. Dr. Renaudin said the new technology could hurt echo and MRI because it is faster and has better throughput.

SPECT/CT and PET/CT

The manufacturers of the new combined SPECT/CT and PET/CT imaging systems say these systems offer better attenuation correction and hybrid images with better anatomical landmarks to increase diagnostic accuracy. However, Dr. Renaudin said many radiologists say new software can correct attenuation without the large, extra cost of a built-in CT scanner. In addition, many say they do not need CT’s anatomical landmarks because they already know what part of the heart they are looking at. CT guidance is more valued with oncology applications.

For these reasons, Dr. Renaudin said SPECT/CT and PET/CT systems have been a hard sell for use in the cardiac imaging market. He said they are better suited for imaging cancer, which is reflected in the fact that 95 percent of the imaging studies performed by these scanners are oncology exams.

Echocardiography

The biggest advancement in the past couple years for echocardiography has been the introduction of 3D and 4D imaging, primarily for evaluating heart structure, such as valve function. Dr. Renaudin said 3D echo is still a top-tier hospital modality because of its expense. But, he said the prices are falling with increased competition in the market.

He said ultrasound is not just about the machine, it’s also about the user and their skill in interpreting the images. He sees a trend where vendors are attempting to create analytical software to help interpret the images.

“There is a greater effort to bring in artificial intelligence and take the guesswork out of the analysis,” Dr. Renaudin said.

He said progress in this area is much further along in CT imaging, but is not there yet with echo. One of the things the analytical systems need to do before they will be able to match CT interpretive systems is take an image and convert it into standardized indexes of numbers and measurements for things like ejection fractions.

OCT (Optical Coherence Tomography)

Optical coherence tomography (OCT) enables micron-scale, cross-sectional and three-dimensional (3D) imaging of biological tissues in situ and in real time.1 The technique measures the echo time delay and intensity of backscattered light using interferometry with broadband light sources or with frequency swept lasers.2 The approach is analogous to ultrasound, except that imaging is performed by measuring light rather than sound. The imaging depths are on average 2 mm.3

“OCT is a new technology that has an opportunity to show a higher resolution of structure in the vasculature that can be used to help to differentiate between different types of tissue components in the vessels as well as differentiate types of plaque, and also it is going to be very useful in guiding and evaluating the efficacy of some of the new interventional devices, in particular drug-eluting stents made of bioabsorable and biodegradable materials,” explained Mark Low, managing director, Global Cardiovascular Innovation Center (GCIC).4 Case Western Reserve University along with University Hospitals in Cleveland, Ohio, is a leader in developing the technology, in collaboration with LightLabs (based in Mass.), which has one of the first commercialized products to do OCT in cardiovascular and imaging applications. Volcano Corp., an imaging company that is a market leader in intravascular ultrasound, is expanding into OCT, says Low.

Angiography

Among the big advances in digital angiography X-ray systems is a move to create CT-like images in the cath lab. The major angiography system manufacturers have each created their own versions of CT-like imaging where the C-arm does a rotation around the patient on the table and creates a 3D image. The image can be used for overlays on angiography for better navigation, anatomical reference, and can help visualize stent positioning.

Dr. Renaudin points out one of the shortcomings of angiography is it does not show the true lumen wall in vessels with stenosis. However, the CT-like images can help reveal the true anatomy. He said the biggest advantage of these new tools will likely be in better mapping vessels in the brain. This road-mapping solution already exists in the neuro interventional lab.

Health IT

Hospitals and radiology practices have to invest in relationships with their referring physicians in order to retain and grow them. Nancy Koenig, president of Merge Healthcare’s Fusion Division, identified some of the biggest challenges and advances in imaging will confront in information technology (IT) in 2010. According to Koenig, RIS and PACS have streamlined workflow operations in imaging organizations, and making this process easier and more efficient among referrers will be an important variable for strategic differentiation, especially among imaging centers. Koenig identifies the following areas where technology will improve relationships with referring physicians:

• Interoperability: Referring physicians should be able to place orders within their own EMRs or practice management systems and send it to PACS. However, interfaces are often broken when one or more of the parties upgrades their systems. Interoperability can be achieved using the following strategies:

1. Hosted solutions and cloud computing, vendors can now offer on-demand HL7 solutions, whereby the interfaces are managed and maintained under a service contract with no capital outlay by the radiology services provider. Running these transactions through cloud computing is technically efficient, secure and extremely cost effective.

2. Technology that maintains the specialized file format of the images, manages movement without dealing with the large file sizes, and associates images with reports. There is no software loaded on the referring physicians’ computers or computer environment. There is no need for large, expansive telecom networking to referring physicians. This level of interoperability is available today.

• Patient Health Records (PHR): This same technology can be used to make full studies – reports, key images, full image sets and priors – available to the patient’s personal health (PHR) record. All of this information may be accessed from the radiologist’s system or from the patient’s PHR. The technology exists today. The industry has an opportunity to come together to make this a reality.

• Diagnostic Grade Images: Delivering diagnostic grade images securely via the Web browser without the use of java applet technology is called “zero-client imaging.” Through this technology, radiology service providers can now give referring physicians ready access to images simply by embedding a URL into the referring physician’s EMR system. This gives referring practices access to the full study, not just the report or key images. Merge aims to provide this with its FusionWeb platform.

Koenig added that this is especially important to specialists like neurosurgeons or orthopedic surgeons.

• e-Ordering: Radiology will embrace electronic ordering and electronic appropriateness checking as a reality. Nuance, Medicalis and MedCurrent are delivering solutions to market today. States like Minnesota are endorsing these solutions today.

• Appropriateness checking: Radiology must engage with the Office of the National Coordinator (ONC) to help construct the definition of meaningful use beyond what has already been drafted, which merely challenges the industry to reduce inappropriate or redundant studies to reduce overall healthcare costs. The e-Ordering Coalition, formed by industry leaders such as CDI, Nuance, Merge, GE and Medicalis, is working to promote electronic order entry and appropriateness checking as a more effective and transparent alternative to the RBM process. In addition, the e-Ordering Coalition’s provider roundtable has partnered with the American College of Radiology (ACR) to provide input to the ONC on the meaningful use matrix. The roundtable’s objective is to be a representative voice in the national dialogue pertaining to the adoption of HIT and meaningful use.

• Comparative Clinical Effectiveness: Another growth area in IT will be in technology that supports comparative clinical effectiveness. According to Gregory R. Wise, M.D., FACP, FACHE CPE, CPHQ, vice president, Medical Affairs, Kettering Medical Center, Dayton, Ohio, applying clinical effectiveness models in healthcare institutions will reduce deaths, dollars and days.

• Advanced visualization has mirrored the evolution of CT and MR solutions within the cardiology segment, owing the main part of its growth to the cardiovascular imaging markets such as CTA. Although Medicare’s decision not to reimburse for virtual colonoscopy was a set back for new solutions, a Frost & Sullivan report predicts the segment will have a projected compound annual growth rate (CAGR) from 2009-2015 will be 4-6 percent. <

References:

1. Freebody, M. New growth for optical coherence tomography

May 16, 2008. http://optics.org/cws/article/research/34127

2. Ibid.

3. Ibid.

4. The Global Cardiovascular Innovation Center (GCIC) is a multi-institutional product development and commercialization consortium made possible through a $60 million grant from the State of Ohio’s Third Frontier Project. Founded in 2007, the consortium is led by the Cleveland Clinic and is comprised of Case Western Reserve University, The Ohio State University, The University of Cincinnati, The University of Toledo and University Hospitals of Cleveland along with leading industry and economic development partners.

*Reference: Healthcare IT Market: Insights and Opportunities study in September of 2009.

April 24, 2024

April 24, 2024