The first thing you should know about remarketed or used equipment is that it’s not about picking up someone else’s junk or problems. At least for the educated buyer.

By filtering out the vendor stereotypes and marketplace stigmas and doing your homework you can locate a gem in the rough that not only will suit your needs, but deliver the performance, bolster the volume and generate the revenue you seek.

Once you decide that a second-hand piece of equipment is an acceptable option, however, barely half the battle is won. You also have to determine what type of equipment to choose, where it should be placed and from which reputable company to acquire the technology, be it an original equipment manufacturer (OEM), independent third-party refurbisher or used equipment dealer.

Measuring Tech Changes

Educated buyers may tap the secondary market for some good deals on selected equipment, but they generally won’t find it a panacea. That’s because some things are best bought new, unless you stumble on a short lease, a quick trade-in or a recent buyer with second thoughts courtesy of business challenges or market condition changes.

John Marquez, president and CEO, Therapy Remarketing Group LLC, Long Beach, CA, offered a general rule of thumb that makes sense as the initial go/no-go point.

“Some types of equipment lend themselves better to used acquisition than others,” Marquez told Outpatient Care Technology. “Typically, anything computer-based that requires the latest in processing power, or software revision, is best bought new. The same thing goes for diagnostic modalities where the technology is critical in diagnosing or staging disease.” Therapy Remarketing Group (TRG) specializes in radiation oncology equipment. In many cases, dramatic changes in computer technology can emerge every two to three years, he added. Plus, reselling software requires re-licensing fees for legal transfers.

Marquez stressed that prospective buyers should think in terms of application. “In general, any time you require cutting-edge features for diagnostic purposes you’re better off going with new,” he said.

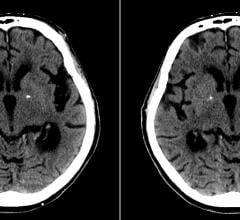

“For imaging, not much has changed in X-ray for many years. The same goes for C-arms, and arguably in ultrasound. The improvements are incremental, if at all,” he continued. “In diagnostic imaging, CT technology renders older generations relatively obsolete [about] every 36 months, so for diagnostic CT in areas requiring the greatest speed or the most advanced techniques, new is the best choice. In radiation oncology, which is TRG’s specialty, we have found that used actually makes a lot of sense for simulation, as well as for most accelerator applications, as in the simulation instance [when] no diagnosis is taking place [but clinicians are] just characterizing the tumor. Accelerator technology hasn’t really taken any quantum leaps in the last decade.”

Neither has much of the basic equipment used in general practice and surgery, in which World Medical Equipment, Maryville, WA, specializes. “Our company focuses on selling operating room tables, lights and autoclaves for a reason,” said Bob Mighell, World Medical co-founder and president. “These pieces of equipment don’t really have the leapfrogs in technology that monitoring or imaging equipment does. Operating room tables have not basically changed in function for the last 50 years. The tables are now easier to use and have a lot more bells and whistles, but that is something the customer can chose how much they would like to have. Autoclaves still get hot and lights still get bright. It used to be that every generation of lights was brighter than the next but they have finally maxed out how bright you can be and the new models have only minor improvements.”

Outpatient care facilities should decide what technology they need first and then determine if they can pay for it before looking at all the options, according to Martin Zimmerman, president and CEO, LFC Equipment and sister company LFC Capital Inc., Chicago. “The [cost] difference between a refurbished 16-slice CT and a new quad [four-slice CT] could be pretty close,” he said. “The 16s and 4s are coming down because everybody is migrating to larger and more complex systems. There’s a lot of equipment around that’s good stuff – particularly if you’re just getting started or need a backup unit.”

Because a patient’s disease has been diagnosed and characterized by the time he or she arrives in radiation oncology, clinicians there do not necessarily have to rely on the latest and greatest technology for effective treatment, according to Marquez. “A 64-slice speed in a CT isn’t going to help a doctor get the outline of the tumor any better than a single slice,” he said. “In fact, the key advantage that multislice affords is in respiratory gating. Even there, gating can be accomplished with a four-slice CT, so buying cutting-edge technology has little or no benefit in this environment.

“As far as accelerator technology goes, the basic idea behind all accelerators hasn’t changed in 40 years,” he continued. “So a 10-year-old accelerator can treat most cancer as effectively as a one-year-old in real-world cases. Accelerators, which are big delivery systems for radiation, are somewhat akin to microwave ovens. They all use radiation to heat the food, all in the same way. The latest models have new and advanced features, but your food will get just as hot in a five-year-old unit as it does in a brand new one.” Furthermore, most advances remain in the collimation of the beam and in the dose levels, he added.

Determining the Need

Every facility faces the same primary considerations for equipment buying, according to Mighell. “What do we need? What does our budget allow? What will give us the best value for our money?” he said. “When a facility’s needs outweigh their budget, refurbished equipment becomes an attractive option, provided that the refurbishing has been thoroughly done by a quality organization. At World Medical, we strip down every piece of equipment to its component parts and rebuild to OEM specifications. However, the buyer must be aware of companies that claim to refurbish equipment, but only do a surface level of repair. Suspiciously low prices may be an indication of inferior workmanship, and the original savings may quickly disappear in the costs to repair and service this equipment.”

Knut Fenner, vice president, Proven Excellence Refurbished Systems Division, Siemens Medical Solutions USA Inc., Hoffman Estates, IL, concurred about the basic decisions that have to be made about equipment buying. Budget tops the list. “Especially for outpatient care facilities facing stringent budget restrictions, OEM-refurbished equipment might be the best possible solution to obtain high-quality equipment while staying within a given budget,” he said. “Outpatient care facilities might find themselves in a situation where the decision to buy refurbished equipment allows them to purchase two systems while still staying within their budget, therefore being able to handle increased patient volumes. The purchase of new equipment, however, might have only allowed them to facilitate one system given their budget restraints.”

Identifying the types of procedures to be performed with the equipment and comparing that to the required technology level for those procedures should be next in line. “If the types of procedures to be performed with the equipment require the latest and most advanced technology the market has to offer, [such as] dual-source CT technology, the only possible solution is the purchase of new equipment,” he said. “However, purchasing OEM-refurbished equipment does not automatically mean having to forgo latest system types and technology levels. Nearly 60 percent of the refurbished products in the Siemens Medical Proven Excellence program, for example, are still available as new systems as well.”

Finally, investment risk should be taken into account. “Looking at the planned rate of growth, the purchase of refurbished equipment might offer a start-up solution for an outpatient care facility and therefore represent the best strategic buying decision,” he noted. “OEM refurbished equipment is always an option which should be looked at, no matter what equipment type.” The Siemens Proven Excellence refurbishing program, for example, offers “like new” quality at reduced purchasing costs, including upgrading pre-owned systems to the latest software version, enabling future upgrades, he added.

Weighing the risk versus the reward is a big decision that depends on whether the used equipment will support a new service or expansion of an existing service, Zimmerman acknowledged. “If it’s a new service then you have a new decision to make because you don’t necessarily have an established volume,” he said. “Generally, new equipment across the board will allow you to build a referral base more quickly from a marketing point of view.”

But the decision also comes down to an economic challenge, balancing the cost of new technology with that of second-hand technology, according to Zimmerman. Do you want to pay $600,000 for a new 16-slice CT, for example, or $1.5 million for a new 64-slice model? Or do you go with a refurbished 16-slice for $450,000 to $500,000, based on the unit’s age, its software package and financing arrangements? “You have to ask yourself how much difference is there between a new and a refurbished unit,” he noted. “Fundamentally, you have to make a tech decision, a marketing decision, a volume decision and a risk decision.”

Be Site Specific

Experts agree that second-hand equipment can be an option for any facility – primary or satellite. But then again, it depends on the type of equipment.

“The latest/newest tech option should be chosen if it can be shown to improve the outcome of the patient,” Mighell said. “Latest technology imaging equipment, for example, can do more than older technology equipment. Better monitoring equipment can benefit the patient. On the other hand, latest technology autoclaves may offer a few more cycle options but still sterilize the same as an older refurbished unit. Does the facility really need an OR table that can lift 1,100 pounds when they don’t have a bariatric program?”

From a marketing standpoint, the question of technology and price supersedes the question of whether equipment is used or new, Fenner stressed. “Patients and insurance companies are looking for the best healthcare at the lowest possible price point,” he said. “The purchase of OEM-refurbished equipment allows facilities to acquire state-of-the-art technology at a reasonable cost, therefore being able to provide good patient care at a competitive price.”

But location and market conditions do matter. “If they’re a leading institution and they need to have the latest and best because of competition they’ll go with new,” Zimmerman insisted. “They’ll want to be on the bleeding or leading edge. They don’t want to lose referrals. They want volume. If it’s a backup unit or [handles] overload, then it’s a completely different story. You don’t need the latest and greatest for a secondary purpose.” He also noted that smaller institutions may be more open to used equipment, as well as any facility using the equipment for less complex diagnoses, such as simple screening for fractures or radiation therapy.

Marquez admitted that “it makes more sense with a start-up or in rural areas with low patient volumes to go with used. Once the practice is more established you can always upgrade to new.” That progressive pathway endears TRG to OEMs, forging “a very symbiotic relationship,” he added. How? When TRG sells a refurbished piece of equipment from a particular OEM, that OEM may not view it as losing a new system sale but gaining a footprint with a customer. “We’ve found customers are far more likely to install the same brand of equipment down the road once they’ve designed a site around equipment from a specific manufacturer,” Marquez indicated.

Run the Numbers

Not surprisingly, economics drives used equipment decisions. Cost is a key reason, specifically price, experts noted.

“If one runs the numbers on a startup stand-alone cancer center, you will quickly find that paying off a $400,000 machine and reaching breakeven significantly alters the financial dynamics versus paying off a $2.2 million machine,” Marquez said. “In the first instance, one is at breakeven in 18 months or so, and in the second, it could be five years or longer. A lot of things have to go right for five-plus years in reimbursements and the competitive/referral landscape for a center to be profitable. Many seasoned operators choose to put used equipment in their satellite or stand-alone centers for that reason, along with making the used choice when considering a second or third system for their hospital. They might choose a system with the latest greatest on it for their flagship technology claims, and then buy used for the second machine, for which that technology isn’t key.”

Don’t overlook parts availability as a factor either. “At a practical level, a five-to-10-year-old CT or accelerator is going to have significantly greater parts availability in the secondary market than a new system, as well as a much larger pool of talent to draw from for third-party service,” Marquez added. “And the technology is generally far more stable and proved, with all the bugs worked out.”

Believe it or not, physician preference may be another attraction, according to Mighell. “We have also been contacted by facilities to locate equipment that certain doctors prefer that is no longer being offered new,” he said. “Some facilities have one operating room set up in a certain way and they want to replicate that equipment in another new room. Having the same equipment in multiple rooms makes for easier training, allows the sharing of disposable components and maintenance is easier.”

Highlighting the Drawbacks

While used equipment may be a viable alternative that offers tangible benefits in terms of operational performance and return-on-investment, it has some drawbacks, experts admitted. They range from the quality of the refurbishing job to the availability of certain types.

“Oftentimes used equipment has not undergone a detailed refurbishing process, and therefore there are certain concerns, for example, regarding the performance and reliability of the system,” Fenner noted. “The system has not been tested, broken parts have not been replaced, etc. There is an increased risk of future system downtime. Due to these concerns, the purchase of OEM-refurbished equipment presents the best alternative: The equipment has undergone a detailed refurbishing process, has been tested and has been approved by the OEM.”

But first, you have to get past the used equipment market’s stereotype and the OEM market’s marketing hype to avoid risk by buying new, not used, according to Marquez.

“Often, the biggest drawback is the feared stigma of buying ‘used’ equipment,” he said. “This trend is also evident in competitive areas, where the OEM has convinced all the players that they all must have the newest new thing to be competitive. The physician who is defining the technology they want often isn’t the one responsible for [profit and loss], so the equipment decision is divorced from the economic decision. The physician wants the latest [and] greatest, and the equipment vendors do their best to encourage this.

“The notion that one needs a 64-slice CT and a $2-million accelerator to ‘compete’ is a reality in many areas, regardless of whether existing equipment is more than adequate,” he continued. “This can result in a center that gets used gear to be marketed against as using ‘inferior’ gear, which ignores that the patient outcomes are identical. We work closely with the original manufacturers to assure our customers that the equipment performs at original manufacturer specifications. All used equipment has to meet the same operating specifications as new.”

Marquez also cited availability as a concern. “If a facility has very specific needs or restrictions, like vault shielding, there may be a limited pool of used equipment to choose from at any given time,” he added.

Mighell delineated between the terms “used” and “refurbished,” emphasizing that facilities seek the latter because semantics matter. “I would advise a facility to not purchase ‘used’ equipment and strictly focus on purchasing ‘refurbished’ equipment,” he said. “A used piece of equipment is one you would probably buy directly from a facility, off the Internet or from a wholesaler and will probably be offered as-is. The price may be attractive at the time but may end up costing you more in the long run than if you have purchased it from a reputable refurbisher. Another issue to ask before you buy a piece of equipment is whether the original manufacturer still supports the product with parts.”

Zimmerman turned a popular phrase on its ear. “You don’t always get what you pay for,” he said. “You may pay more in the long run. But if you ask the right questions you can get a good value.”

Remarketed/Used Equipment Vendors

A Imaging Solutions Birmingham, AL www.aimagingsolutions.com

Adam Medical Sales Brooklyn, NY www.adammedical.com

American Healthcare Technologies Inc. New York, NY www.ahtiny.com

Ardus Medical Inc. Cincinnati, OH www.ardusmedical.com

Associates Imaging Inc. St Petersburg FL www.associatesimaging.com

Atlas Medical Technologies Ontario, CA www.atlasmedtec.com

Barrington Medical Imaging LLC Cary, IL www.bmimed.com

Bay Shore Medical Ronkonkoma, NY www.bayshore-medical.com

Blue Ridge Medical Imaging Inc. Salem, VA www.brmi.net

C & G Technologies Inc. Jeffersonville, IN www.cgtscan.com

Capital Medical Equipment Matawan, NJ www.capmedonline.com

Conquest Imaging Stockton, CA www.conquestimaging.com

CTronics Inc. Stockton, CA www.ctronics.com

D B International Corp. Staten Island, NY www.dbicorp.com

Diagnostic Parts Exchange Inc. Quincy, FL N/A

Diagnostix Plus Inc. Rockville Center, NY www.diagplus.com

Digitec Medical Service Corp. Lawrenceville, GA www.digitecmedical.com

Dunlee Aurora, IL www.dunlee.com

Eastern Diagnostic Imaging Taunton, MA www.easterndiagnostic.com

Efore USA Inc. Irving, TX www.eforeusa.com

Equipment Placement Services Inc. Streetman, TX www.equipmentplacement.com

Expert Medical Systems Inc. Port Charlotte, FL expertmedicalsystems.com

Foremost Equipment Rochester , NY www.foremostequipment.com

GE Healthcare GoldSeal Brookfield, WI www.gehealthcare.com/usen/mr/s_excite3/products/goldseal.html

Genesis Medical Imaging Inc. Huntley, IL www.genesismedicalimaging.com

Health Care Exports Inc. Miami, FL www.ahce.com

Huestis Medical Taunton, MA www.huestismedical.com

Imaging Associates Inc. Charlotte, NC www.imaginga.com

Imaging Systems International Ann Arbor, MI N/A

International Imaging Systems Ann Arbor, MI N/A

International Medical Equipment Services Inc. Kings Mountain, NC www.medical-equipment.net

International X-Ray Brokers Brockton, MA N/A

LFC Equipment Chicago, IL www.lfcequipment.com

Lundy Healthcare Ltd. Berkshire UK www.lundyhealthcare.co.uk

MedExchange International Agawam , MA www.medexchangeinc.com

Medical Equipment Refinishing Systems Inc. Sarasota, FL www.medicalequipmentrefinish.com

Medical Equipment Services Inc. La Grange, KY www.melocator.com

MedX Inc. Arlington Heights, IL www.medx-inc.com

Metropolis International LLC Long Island City, NY www.metropolisint.com

Miller Medical Imaging Cincinnati, OH www.millermedicalimaging.com

MRN Resources Inc. East Northport, NY N/A

Mylin Medical Systems Inc. Burr Ridge, IL [email protected]

NCD Medical Corp. Eastlake, OH www.ncdmedical.com

Nakomis Medical Systems Inc. Venice, FL www.nmsinc.com

Northeast Electronics Derry, NH www.northeastelectronics.com

Oncology Services International Alvarado, TX www.thinkosi.com

Prescott's Inc. Sayreville, NJ www.prosvcs.com

ProActive Technology Solutions Inc. Dublin, OH www.ptsi.cc

R D Medical Inc. Crete, IL www.rdmed.com

Radiology One Source Franklin, TN www.radiologyonesource.com

Radon Medical Imaging Gaffney, SC www.radiologyonesource.com

Raynostix Group LLC Louisville, KY www.raynostix.com

ReMedPar Goodletsville, TN remedpar.com

Remedy Medical Systems Phoenix, AZ www.mrirental.com

SFG Imaging Consultants Inc. St Petersburg, FL www.sfgimaging.com

Siemens Medical Solutions USA Inc. Malvern, PA www.siemens.com/refurbished

Sunbelt Medical Corp. Houston, TX www.sunbeltmedical.com

Tandem Medical Equipment Inc. Smithtown, NY www.tandemequipment.com

Teslamed International GmbH Geisenkirchen, NRW www.telamed.info

Therapy Remarketing Group Long Beach, CA www.therapyrg.com

Ticitech S.A. Bedano, Switzerland www.ticitech.ch

Tomovation GmbH Castrop-Rauxel www.tomovation.com

TransPhoton Corp. Miami, FL www.photon2.com

Transtate Equipment Co. Raleigh, NC www.transtateonline.com

United Medical Technologies Fort Myers, FL www.unitedmedicaltech.com

Universal Medical Resources Washington, MO www.unimed.com

V.I.S. Imaging Ltd. Brooklyn, NY www.visimagingltd.com

Venture Medical Requip Tampa, FL www.venturemedical.com

West Valley Imaging Seneca, SC www.westvalleyimaging.com

World Medical Equipment Marysville, WA www.worldmedicalequip.com

Source: Outpatient Care Technology research, March 2007

September 03, 2021

September 03, 2021