The application of cloud-based solutions to medical image management has come a long way in the last few years. Customer perceptions are evolving at a rapid pace, while cloud-hosted applications and managed service offerings are strengthening and diversifying. A “cloud version” (in any of its many flavors, including data center-hosted and/or Web-based zero-footprint clients, or thin clients using server-side processing) exists today for virtually every common image management function. This includes picture archiving and communication system/radiology

information system (PACS/RIS) and reporting, image storage and advanced analytics, vendor-neutral and long-term archiving, as well as teleradiology and image exchange. While the first generation of cloud solutions involved primarily radiologists and their referring physicians, today’s solutions cater to secondary imaging stakeholders, both intra- and inter-enterprise, and, most recently, to patients as well.

These recent dynamics raise a question that is more pressing than ever: Are we headed to an inflection point in the adoption curve?

Constantly Evolving

Today, cloud adoption in imaging remains largely confined to the small-scale and outpatient facilities with limited IT staff on hand. However, as the larger facilities and multisite networks in the United States ramp up their enterprise IT strategy, they all have at least one cloud-based solution under consideration.

In the midst of intense pressures — and immense marketing efforts — exerted at every level of the healthcare ladder, U.S. providers’ perceptions of cloud-based technologies have evolved. Until four years ago, the use of cloud in imaging was limited mainly to disaster recovery and teleradiology, and was just starting for remote 3-D/4-D rendering. These applications sprung directly from the mounting “big data” challenge posed by imaging. The sharp adoption of electronic medical records (EMRs), however, including cloud-based EMR solutions (e.g., success stories such as Athenahealth), has opened the way to further cloud expansion in imaging. Similarly, meaningful use (MU) Stage 2’s provisions for imaging may call for, and will likely promote, cloud-based solutions in certain areas of the imaging workflow.

On the imaging provider front, only four years ago performance issues topped the list of prospective customers’ concerns with cloud-based alternatives to on-premise solutions, at par with security and safety concerns. Cost considerations came next. However, the last few years have seen a reshuffling in the order of these concerns. Thanks to ongoing advances in the availability of high-speed bandwidth and the ensuing speed and reliability gains of network-based technologies, performance issues are now less of a concern. At the same time, the cost model of clouds has become much clearer as has the cost-consciousness of providers.

As for safety and security concerns, vendors are now able to downplay many of these apprehensions by putting forth their experience operating cross-industry as well as healthcare-only clouds, with efforts catered specifically to the medical imaging market. In fact, the marketing language in the industry has evolved to the point that cloud vendors today defend the idea that their proposed cloud solution is not just as safe and secure than the incumbent on-site solution, but actually far safer and more secure.

Strategic Aspects

To illustrate the strides achieved in the last two years, vendors can now tout applications that comply with a wealth of International Standards Organization (ISO) and Health Insurance Portability and Accountability Act (HIPAA) mandates, in addition to numerous new security standards learned in the information and communication technologies (ICT) world. Further, a limited number of vendors are now ready to sign a business associate agreement (BAA) with their customers to better define the lines of responsibility and liability.

This mindset change in both current and prospective cloud users indicates the imaging market has greatly advanced along the learning and adaptation curves for the cloud. Now that the cloud model is much closer to users’ comfort zones with more predictability on future costs, increasingly, providers are willing to take a closer look at the total cost of ownership (TCO) and decide how a low-capital, operational-based financing model will work for them. As such, imaging providers are starting to make less emotional, more business-driven decisions on whether or not to adopt a cloud-based solution.

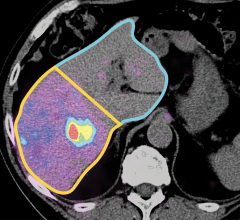

This increasing customer education is starting to take the debate around image management in the cloud to higher levels. Beyond the tactical factors at play, the strategic aspects of cloud solutions are entering the decision process. One such aspect involves imaging data mining, and all the clinical and business intelligence that can derive from analyzing imaging big data over time. Some big questions that then arise are: As an imaging provider, if I hand off or outsource the management of my images, is there a risk this might compromise my future prospects and the value I can expect to derive from image data analytics?

In the End, It’s All About Service

The answer to this type of questioning always revolves around service. Whether service will be provided centrally within a private cloud by an enterprise’s IT department or outsourced to a third-party cloud vendor, it is the key to ensuring providers maintain ownership of the intellectual property the data represents — and a proactive attitude in reaping its value. This might be one reason why the private cloud efforts are taking so long to materialize as part of the large providers’ enterprise imaging IT strategy.

On the managed services front, the last few years are marked by the entry of many giants in the cloud industry into the managed-service medical imaging vertical — notably the large telecommunication firms such as AT&T and Verizon. The success of these cross-industry cloud providers without a healthcare-specific background, and whose data centers usually serve various industries outside of healthcare, has been slow to materialize to say the least.

In fact, the last year is marked not so much by the entry of new market participants, but rather by the (soft) exit of certain industry contenders. Such is the case of Symantec, which seems to have pulled out of this market segment, as well as Peake Healthcare Innovations — a joint venture between Johns Hopkins University and Harris Healthcare — which recently ended. If these negative industry developments reveal one thing about managed service clouds in medical imaging, it is that they require long-term commitment from the vendors and are not the secret sauce for short-term profits.

Value Proposition

The market penetration of some second-generation cloud offerings, such as cloud-hosted PACS-as-a-service, remains marginal in the U.S. today; by certain accounts, these represented less than 2 percent of new system sales in 2012. Every other indicator also suggests that the U.S. medical imaging market is still in its early adopter phase for the cloud. However, given the joint evolution of the technology and the state of mind in the market, we might be approaching an inflection point in two or three years from now, to when the cloud will be set to become “standard.”

Due to the nature of the mostly private U.S. system, where cloud adoption is not dictated from the top-down by a single governing entity as it might be in mostly public healthcare systems, the deployment of cloud imaging networks is more sporadic in the U.S. than in European countries or in China where huge region-wide and nationwide cloud projects are currently underway. However, as cloud offerings evolve from their original radiology-centric realm of digital imaging and communications in medicine (DICOM), they are taking on a broader perspective eyeing other areas of big data, such as genomics. This evolving value proposition is guaranteed to secure a bright future for the cloud as the only realistic long-term solution to big data challenges, and also an enabler for big data analytics. itn

Market Spotlight: Cloud-Based Image Exchange

Image exchange provides a good case in point of the recent evolution of cloud-based applications in imaging. Image exchange is only a small subset of the larger application scope of cloud in image management. In a way, it is a natural evolution of cloud-based image archiving services, which date back to the late 1990s and the early forays of InSite One (now part of Dell). Indeed, the same processes applied to move images from a provider site to a remote data center for archival — and in the opposite direction for retrieval — can be used to exchange images from one provider to another.

At the same time, image exchange can also be considered the younger brother of healthcare information exchange (HIE), a bustling area of the health IT industry that is tied closely to recent advances in the adoption of electronic medical records (EMRs) and the implementation of meaningful use (MU) and accountable care organizations (ACO). The HIE industry is booming with a host of healthcare IT, EMR, telecommunications and specialized vendors. However, with the current focus on MU, HIE vendors are only marginally addressing medical imaging applications of HIE, i.e. image exchange. Only a few HIE vendors, such as eHealth Technologies, are proactively developing their medical imaging HIE offerings.

MU’s Stage 2 menu objective titled “Imaging Results Consisting of the Image Itself and Any Explanation or Other Accompanying Information are Accessible Through CEHRT,” which mandates image viewing through EMRs, may also apply to the intra-enterprise exchange of medical images. However, stage 2 MU requirements do not explicitly sponsor image sharing between institutions or with patients, which might be a provision of MU’s stage 3 starting in 2014 or 2015.

Taking advantage of the MU momentum, PACS vendors are developing cloud-based imaging IT solutions and looking at image exchange as one potential application for this new technology. Some smaller PACS and specialized vendors are already a step ahead of the game, selling market-approved image exchange solutions. Notable market pioneering solutions include lifeIMAGE and itMD’s CD replacement solutions, Merge Healthcare’s HoneyComb, DR Systems’ eMix, Brit Systems’ Brit Cloud, Karos Health, SeeMyRadiology.com and Client Outlook Inc.’s eUnity.

Nadim Michel Daher is a principal analyst with Frost & Sullivan’s advanced medical technologies practice, specializing in medical imaging informatics and modalities. With almost a decade of industry expertise covering U.S., Middle Eastern and Canadian markets, his knowledge base covers radiology, PACS/RIS, advanced visualization, IT middleware and

teleradiology, as well as CT, MRI and ultrasound technologies.

April 11, 2024

April 11, 2024