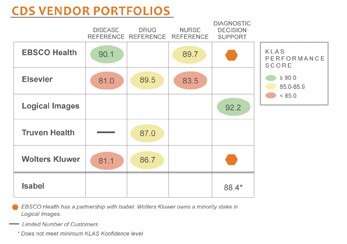

Figure 1: Several companies provide multiple products across the CDS spectrum.

In December 2012 my wife was diagnosed with Stage 1 breast cancer. As the sting of that reality was setting in, we were presented with multiple options regarding her treatment. Chemotherapy was required, but the number of treatments was up for debate. Three different oncologists within the same healthcare system gave three different recommendations: four, six or eight doses of chemo. Even a family member who is a primary care physician told us they were all good options. We were distraught that such a critical decision was left to our own gut feelings. We felt chemo was the right treatment, but the variation of dose options hampered our confidence in the care.

Bert Zimmerli, CFO of Intermountain Healthcare, said, “Variation is the enemy of quality.” Clinical decision support (CDS) tools have the potential to make a significant impact in healthcare and to help reduce variation. While CDS vendors are making progress, providers have shared with KLAS that they need deeper integration with their electronic medical records (EMRs) and more leverage across platforms. KLAS recently published a CDS report, titled “Clinical Decision Support 2013: Sizing Up Point-of-Care Reference Tools.” KLAS spoke with 197 respondents, who shared their perspectives on the status of point-of-care reference tools.

Usage vs. Satisfaction vs. Impact

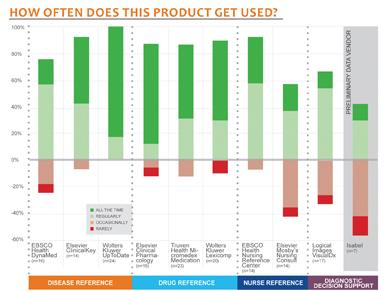

Providers reported different usage for different CDS disease-reference tools, and KLAS found that overall satisfaction and frequency of usage did not correlate. While DynaMed scored high, primarily for service and frequently updated content, 25 percent of DynaMed users reported that the product is used only occasionally or rarely. Physicians said UpToDate is “indispensable,” and 91 percent said that not having the product would have an impact on patient care. One provider claimed, “Because UpToDate is the most frequently used reference solution here, it has the most impact on patient care.”

Elsevier’s ClinicalKey surfaced as the newest rated disease reference product in the report, and respondents reported regular usage but claimed the product still feels a bit unfinished. Most providers interviewed mentioned that ClinicalKey was used mostly as a reference tool.

Several vendors offer multiple products in their portfolios. EBSCO Health, Elsevier, Truven Health Analytics and Wolters Kluwer each provide multiple products across the CDS spectrum. Although the use of multiple solutions from the same vendor might typically lead to enhanced patient impact, only Wolters Kluwer clients mentioned benefits, such as improved workflow, from leveraging multiple products. Others vendors’ products were talked about as standalone products.

As with other CDS segments measured by KLAS (order sets, care plans, surveillance), providers mention high satisfaction with existing point-of-care reference tools but still request deeper partnerships with vendors and deeper content. Additional content was the No. 1 functionality requested that could make these products more impactful on clinical outcomes. Providers mentioned that “the content should be beefed up” and “the product needs more visual content, like charts and illustrations,” further illustrating that while CDS tools provide good support, there is more that can be done.

Wandering Eyes

Providers who have already decided to move away from a solution said budget savings and lack of usage were the main reasons. Thirty-nine percent of respondents using diagnostic decision support tools said not having their current product would have little to no impact on patient care. Both vendors in the study, Logical Images and Isabel, are working to increase usage among their customers. Logical Images has a phenomenal mobile solution, and many users have integrated VisualDx with UpToDate. Isabel is trying to overcome its silo reputation by deploying Active Intelligence, which runs in the background and extracts key words to help clinicians formulate diagnoses.

Is CDS 2.0 Coming?

With high-performing products, the table appears to be set for a healthy discussion on improving the impact of clinical decision support tools on patient outcomes and reducing the variation in healthcare. Providers find value in existing solutions but will need to actively deliver content into provider workflows in order to realize the full potential. Solutions will need to continue to evolve to give clinicians the right answers in the right moment.

Adam Cherrington is a research director at KLAS and heads research on areas such as clinical decision support, pharmacy, labor and delivery, and surgery. He has been in the healthcare industry for nine years, including his time with KLAS since 2012.